Boston Housing Market

Boston is a dynamic housing marketplace with its divergence of towns across the Metro region.

Despite the very high cost of homes and condos in the city, buyers come from across the country to live in what is the top US city with a European flavor. And sellers are ready to sell as many are fleeing to the Southern US for lower taxes and a warmer climate.

Despite slower sales, Boston home prices are rising and pending sales growth shows this summer’s market may be okay.

Boston Economy Strong and Well Supported

Boston is a dynamic economy which will have more to offer as 2025 approaches. From education to tech to military, there is demand against a weaker supply of housing. That might lead to a price bubble.

Boston has so much to offer newcomers with good schools, plenty of recreation, and one of the most successful economies in the US. It’s a city with resourceful entrepreneurs, a sense of competition, and a keen accent on productivity. And as you can imagine, it is one of the richest single-family housing markets in the country.

Boston’s GDP has risen strongly post-pandemic although slipping to annual rate of 1.2% in the fourth quarter of 2023. It’s something to concern buyers, but is far from a crash indicator. The median household income in Massachusetts is $96,505, the third highest in the US. And many believe Boston’s stability and other key demand factors make it less vulnerable to housing market correction or crash.

Yet its population of 4.34 million in the Greater Boston Area and around 700,000 in Boston City is split 65/35 in renters vs owners. Which is understandable given the lofty selling prices as you’ll see below. This generates interest from real estate investors seeking a stable market with high rental income.

Sales have slumped in Boston and across Massachusetts in this post-pandemic high-interest rate period, while sellers are still fetching a great price for their property. Limited supply means little competition for sellers and puts their Realtor in a strong negotiating position. While 2024’s outlook is subdued, 2025 should be the year of big home sales and more record home prices.

This housing market continues to be characterized by high demand against limited inventory, limited land availability for new construction, strict zoning regulations and high cost of construction which limits new home supply into the market. It’s a town of high tech and higher education which draws big demand for rental accommodation for students and young professionals.

Given the high average price of homes in Boston and nearby towns in Eastern Massachusetts, it’s a difficult challenge for first time homebuyers to own a home here. For those interested in moving to Boston, despite its charms, there are drawbacks.

The income taxes are high, traffic is congested, and building regulations can make ownership tricky and costly. Property taxes are comparatively low, but are rising of late.

The city is suffering a tax shortfall of about $1.4 billion over next 5 years due to empty office space since remote work from home has grown in popularity. Experts believe that trend will continue.

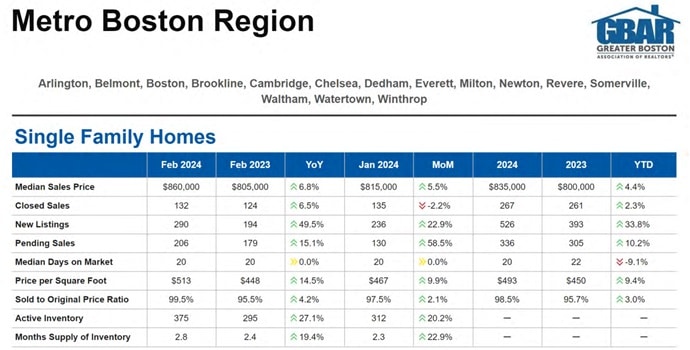

Metro Boston Report from GBAR

For Metro Boston only, closed sales of single family homes dropped 2.2%, while price still rose 5.5% during the month. Active inventory has grown 27.1% year over year and is up 20.2% since January. New listings grew faster, up 49.5% or 22.9% vs January. Are sellers beginning to panic, even though they would face steep mortgage refinancing costs?

The median sales price for a Metro Boston house was up 6.8% in February and is up 4.4% YTD vs 2023. Condo prices rose 7.7% to $770,085, a year-over-year jump of $50,084 for sellers. And pending sales of condos in Metro Boston are up a brisk 34.7% YoY.

City of Boston

In Boston City proper, home prices took a dip of 4.7% (-$21,000) and a drop of 10.4% vs January, while sales slipped 20% from January and down 13.6% YoY. Active inventory is still meager at 105 units, yet median days on market is long at 29.5 days, up 34% from February of 2023. It’s likely affordability, high mortgage rates, lack of choice and remote work that might be eroding the city market.

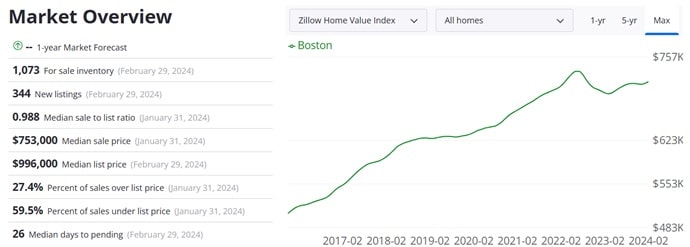

Zillow Housing Market Report for Boston

As the Zillow housing market graphic reveals, home prices did sag as higher interest rates burdened the buyer market, yet last May, prices began to rebound. Last month, house prices rose about $5,000 on average to show some upward pressure heading into this buying season.

Although lower mortgage rates are expected, the economy is strong, thus the FED cuts may not happen. That may dampen this year’s expected sales numbers as we progress through the spring and summer seasons. Zillow’s median price in Boston for single family homes is $762,283, and for condos, the median price hit $689,426.

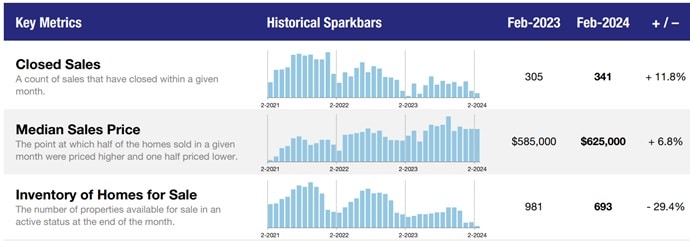

The Massachusetts Association of Realtors reports a rise in house and condo prices across the state in February even though it was the third consecutive decline in closed sales.

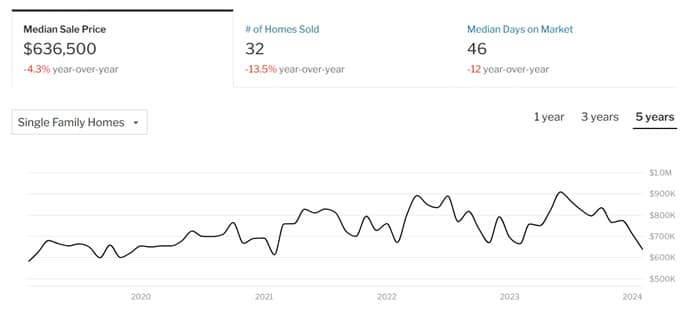

Redfin Boston Housing Market Stats

Redfin’s stats show a steepening decline in home and condo prices as depicted in their latest chart.

From last June’s highest price of $909,000, it has dropped to $636,500 last month, a shocking and significant 30% or $274,000 less. The decline is very similar to that of 2020, yet every year, February marks the bottom of the seasonal sales cycle. And despite the declining sales, homes sold above list price still grew 15.9% vs 12 months ago. Redfin rates Boston as somewhat competitive.

GBAR Housing Market Report

The Greater Boston Association of Realtors includes 64 towns within its jurisdiction.

The February sales report is very positive for both single family houses and condominiums. Their median house price rose $85,000 (12.1%) in the last 12 months to $785,000, while condos jump 7.8% or $50,000 to $689,950. Month over month, home prices dropped 4.3% while condos rose .7% vs January 2024.

Given the usual rise in price in the 2nd quarter of every year, we may see a new record home price in the neighborhood of $920,000 across the GBA.

New listings of houses jumped 35.7% year over year while condo new listings are up 13.3% which is a positive trend for hopeful buyers. Active inventory of houses rose 19% year over year while condo inventory is up 10.6% year over year.

Median days on market for houses dropped 15% year over year and was down 19% from January.

Closed sales of houses rose 8.8% vs 12 months previous even the sales price dropped 4.3% vs January.

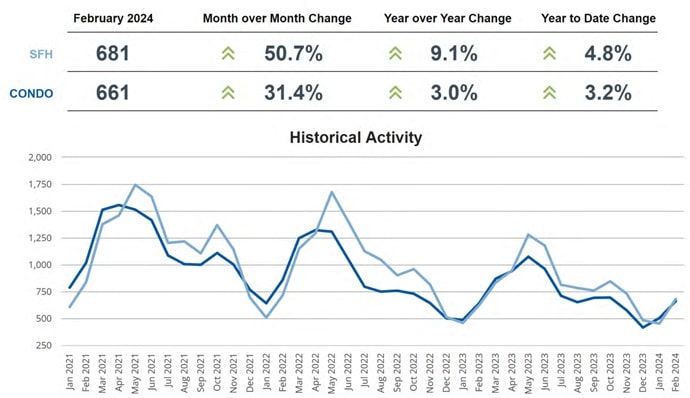

Condo sales rose 8.6% from January and DOM rose 4.8%. Pending sales of condominiums was up 31.4% from January and there is much more inventory, up 17% from January.

Pending home sales are looking strong pointing to a more positive outlook for the spring home-buying season. Pending sales of houses rose 50.7% vs January and pending condo sales rose 31.4% vs last month.

Boston Real Estate Marketing Packages: Boston Realtors, are you looking to successfully launch your digital marketing campaign for the new buying season? SEO, PPC and social media marketing are great ways to establish your brand and stay top of mind. Persistence 24×7 is the best way to collect leads every day. They all add up nicely.

See the real estate marketing packages for comprehensive services to help you excel online.

Boston Housing Market Forecast

Forecasts for the Boston market hinge on macroeconomic factors including stimulus spending, immigration (illegals), continuous high mortgage rates, Presidential election, defense spending, USD index, new construction levels,

Boston Agent Magazine surveyed a number of Boston Realtors about their predictions and outlook for 2022.

They seem to resonate to a moderate forecast of growth this year tempered by continuing high mortgage rates.

Nick Warren: The 2024 housing market is expected to mirror 2023’s trends, characterized by reduced sales volume and generally stable prices

Anthony Lamacchia: I expect more of the same, a very similar year to 2023, but the first couple of months will be even slower than the horribly slow first couple of months than 2022. Reason being, we are going into 2024 with less inventory than we did in 2023.

In 2024, we expect that prices will continue to grow moderately and that inventory will begin to increase.

Boston Home Prices Compare?

Compare prices here to cities such as San Diego, San Francisco, and Los Angeles, Dallas, Denver, Atlanta, New York, Miami and Tampa.

Investors might want to review properties outside of Boston city such as Easton, Lawrence, Worcester, Lynn, Salem, Stoughton, Framingham, Brockton, and Dedham. They’re nice communities and there’s plenty of property to build on and demand is expected to be consistent for single-family homes.

Yes, it looks as though home prices are about to rise in Boston. So the questions: “should I buy a house right now?” or even “should I sell my house” in Boston aren’t easy to answer. To help with a sell decision, see the post on selling tips and best renovation for ROI and where to move to.

What Supports the Boston area Economy?

Boston has a strong regional economy bolstered by transportation, tourism, financial services, and increasingly venture capital. Boston is becoming the Silicon Valley of the north with major influx of funding for startups in FinTech, MedTech and EduTech. Ultimately, all decisions to buy a home in Boston relate back to the US economy, US housing market, and the Massachusetts economy.

Have a good look at the State of Massachusetts and the Boston Housing market. You can find more at GBREB. The outlook is for continuing high prices and limited availability. You’ll need to work closely with your Boston area Realtor to get first dibs on homes for sale.

See more on the full Housing Market Outlook , Housing Market Crash Timeline , and the 5 Year Real Estate Forecast.