NAR Realtor Survey for April 2020

Realtors Optimistic About Post Corona Virus Period

A new report from the National Association of Realtors suggests most Realtors believe the housing market forecast is for higher prices and fewer listings.

It’s great to see these sentiment reports, yet we may need to read between the lines as there is no regional data.

The latest April Realtor survey found that almost 60% of Realtors believe buyers are delaying home purchases for a few months. 57% believe sellers are delaying home sales for a few months as well. That’s a good sign, however buyers are in for more difficulties than anticipated.

The real estate markets in the US and many other countries were flourishing until the Covid 19 pandemic. It’s obvious now the 2020 economy along with the 2020 housing market will be flattened by the pandemic. While Realtor’s voices are a good signal and we like to be optimistic, there is news that small business people aren’t able to get the loans they expected from the Federal government via the CARES act. There’s turbulence waiting ahead.

Certain Sectors Will See Big Losses

Despite the optimism in the stock markets of late, certain industries are about to see devastating losses. The workers in these industries will be impacted. Whether they own mortgaged houses or are paying rent in rental buildings, they will become displaced workers. Businesses will reorganize and some may become more profitable as a result.

The airline industry (Warren Buffet sold all his airline stock), the hospitality industry (cruise lines, tour operators, airlines, flight services, hotels, service businesses, airbnb, restaurants) will not come back like they did previously. The travel industry itself should produce 100s of thousands of foreclosures or outright home sales.

In energy sector producing sectors in regions such as Dallas, Fort Worth, Denver, Calgary, Edmonton, Oklahoma, and Alaska housing markets face a complete meltdown. Experts believe oil could plummet well below $20 to even $5 a barrel. One OPEC country just announced it is leaving the cartel and Canada was already shutting in oil production. There will be big leaps in sales in these cities and home prices will fall.

So overall, the economy will return, perhaps in 2021, but the lack of seriousness taken by people about the virus, will extend the danger period for sometime. There is no cure for Covid 19. That basic fact means certain industries will be hit harder and the effect on the economy won’t leave.

April’s job losses will be steep but with minimal production, the CARES act can’t possibly replace everyone’s income and generate the kind of capital needed to grow the new post pandemic economy.

It stands to reason that many businesses will not accept the government aid loans because the stipulation that they’ll retain all their employees. That requirement is a significant liability going forward as business slows down over the summer.

Like a heavy train on the tracks, it takes time for an economy to shudder to a stop. Getting that train rolling again won’t happen fast. It’s nice that Realtors are optimistic, and 2021 should be the year things take off again. Hopefully, we’ll have the Covid 19 vaccine distributed by then.

April NAR Flash Survey Sentiment Results

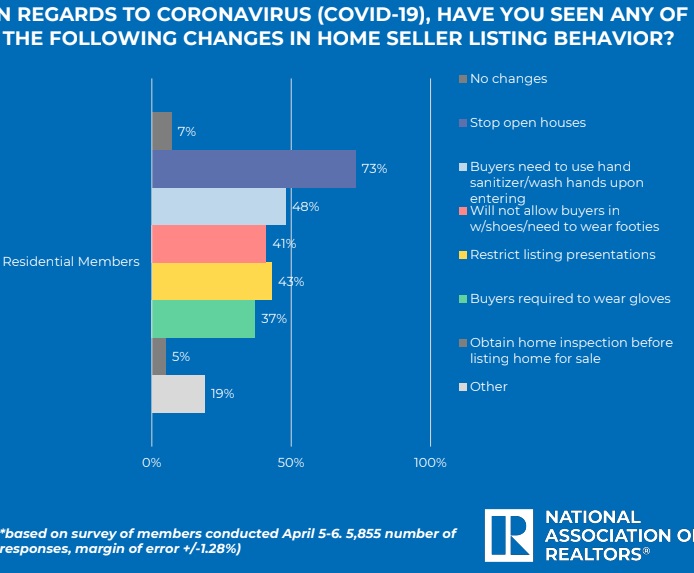

NAR’s most recent Economic Pulse Flash Survey (April 5-6, 2020) asked Realtor members about how the coronavirus outbreak has impacted their residential and commercial housing markets. It didn’t break the survey results down into regional or major cities which would have been very insightful for buyers and sellers. But then, it’s absence might tell you something.

Realtors in the NAR Survey reported:

- 90% thought buyer interest declined and 80% cited a drop in listings (given the stay at home requirement, we could interpret 90% as meaning almost complete disinterest from buyers).

- 72% said sellers have not reduced prices (interest has disappeared so they’re not even responding to their listing, assuming no one is interested or can view it, or get a home inspector in to take a look. As buyer demand disappears, prices will drop in late April, and asking prices will start to nosedive).

There is a big question mark about buyer’s credit positions in June, July and August. Buyer’s too, know they can wait for unemployed number releases to change the market view.

Realtors are looking into online real estate marketing including virtual showings, messaging apps, social media, e-signature, and more high strategies to reach buyers and sellers.

Smart Realtors Rushing into Tech

The smartest realtors will be looking deeply into AI marketing and related artificial intelligence software and platforms. This will be their first foray into real estate AI strategies. When markets change, there is a window of opportunity to capture new market share and build reach. Some brokerages may see tough times and lose many of their best agents (going independent via technology).

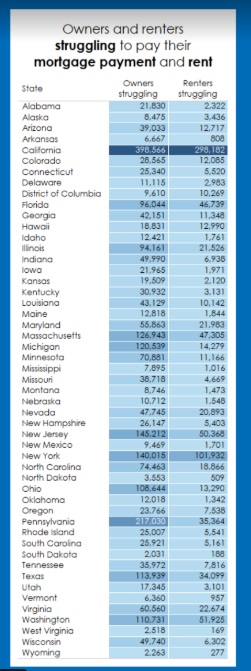

It was reported by NMHC that rent payment defaults have already grown 12% in April, despite the fact we’re only into the pandemic 1 month, and federal aid is being dished out.

By June, the default rates will be significant. This is further work for Realtors to find tenants and perhaps sell highly mortgage rental properties in desperation. That will put downward pressure on residential housing.

Realtors report landlords are accommodating tenants who cannot pay. Not all tenants will be aided by the aid payments from the CARES act. 46% reported that property managers accommodated tenants delay requests (the question is whether many landlords will ever see the delayed payments given looming unemployment?).

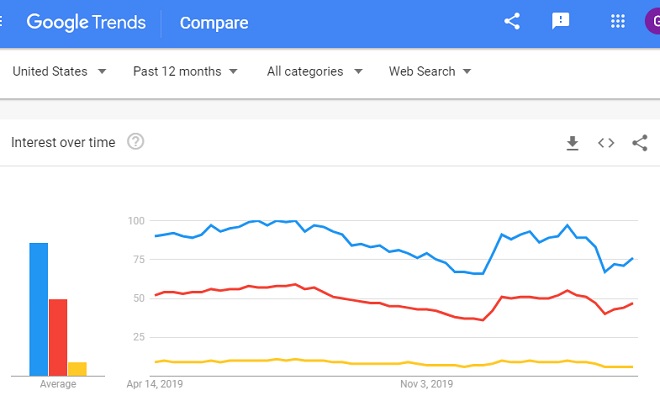

Homes For Sale Searches on Google

A look at Google trends data shows buyer interest is coming back. The stock market is also on its own recovery path, but a few believe it will not be a smooth U shaped recovery. There is a lot of denial of the turbulence and challenges ahead and that means employed buyers and home sellers won’t be prepared for it.

The NAR Realtor survey is useful information to help everyone forecast the housing market demand, estimate home price trends, and whether this summer is actually the best time to buy a house. With prices depressed, you may not get another chance at a cheap home.

The 2021 housing market forecast is much brighter. Past the election, past the epidemic and this stormy period, and everyone will settle down to a more unified view of things.

If President Trump would never have done much for the poor of the nation, the pandemic has actually solved that problem and as the economy heats back up (it always does following a recession) we’ll see the real estate market roar ahead.

Please Bookmark this site to catch up on the latest housing market forecasts, which may include 3 month forecasts, 6 month forecasts, 5 year predictions and 10 Year projections of housing sales and prices.

3 to 6 month Stock Market | Stock Market Tomorrow | Housing Market | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Prediction