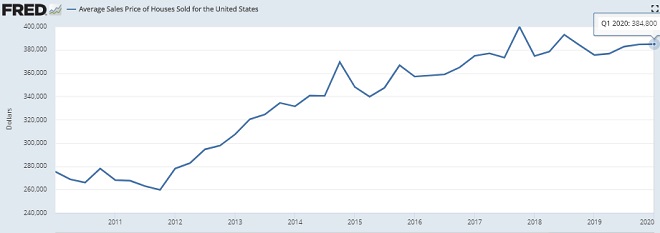

Home Prices will Rise this Fall

The housing market is the darling child of the economy right now as low mortgage rates combined with changes in employment are driving home sales.

Up in Canada (Toronto and Vancouver) July saw record home sales as Realtors are seeing boom times for sales again. And in many regions of the US, sales are rising and prices continue upward. According to Zillow’s latest update, this last week in August, U.S. list price rose 8.35 to $345,255 YoY. New house for sale listings were down 10.6% and overall listing dropped 28.9% compared to last August.

September, October and November will be well above normal in terms of price.

Pending sales growth a good sign:

Redfin’s Homebuyer Index Rose 29% from February

NAR: July Housing Data Strong

The July housing sales report just released by NAR revealed a 24.7% jump in sales nationally, and home prices jumped 8.5.% from last year to $304,100 ($280,400 last July. Home prices rose in every region.

The much sought after single detached home saw its median price rise 8.5% to $307,800 in July, up 8.5% from July 2019. And condo sales jumped 31.8% from June, to a median price of $270,100. Outside of New York and San Francisco, the market is sizzling.

New construction can’t keep up, rates are going lower, and more buyers want to move to another home.

See more on the full US housing market 2020 post.

Some real estate journalists were forecasting plummeting home prices and very soft sales, almost to the point of a market crash. The delay in stimulus money won’t have much impact because most home buyers don’t need the stimulus checks to buy a home, and they’re highly motivated to buy right now.

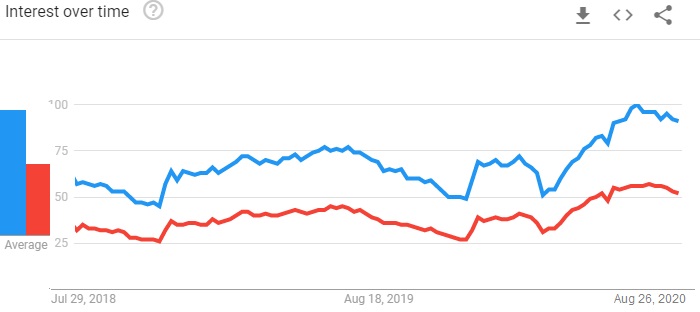

Google Searches for Homes

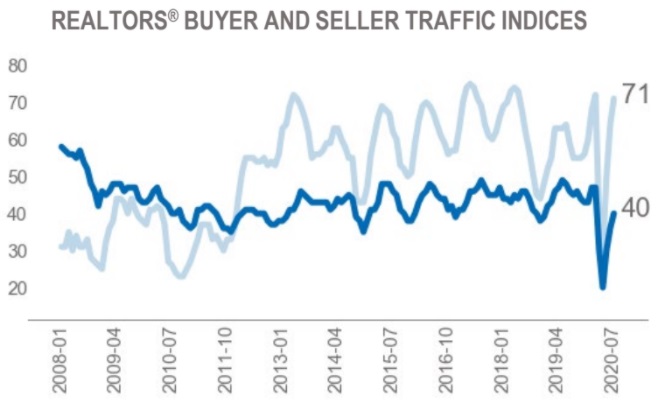

Buyer traffic has rocketed back and seller traffic is growing. As home prices rise and the worries over the Presidential election take hold, more sellers might be willing to unload their properties. A Democrat win could result in a major housing market setback and this could encourage sellers to act faster to sell.

Pending sales are way up and a resurgence of Covid 19 will only stimulate demand for low density, detached homes outside of the cities. Demand has shifted 3 months, so we’ll see continue buyer interest in September and October. This falls weather forecast is for warmth allowing more time for buyers too search for houses for sale.

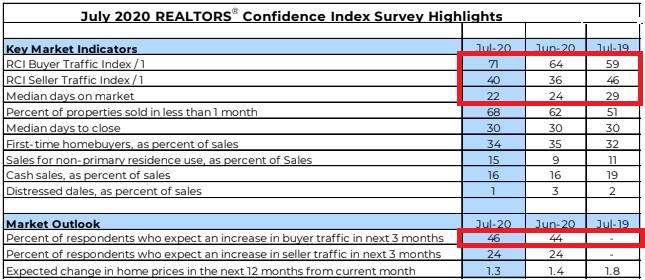

Realtor Confidence Survey

Realtors confidence rose at a faster rate in July to a 71.

The Economy Snaps Back

You can’t really call a pandemic shutdown a crash or a correction. It’s neither. This economic snap back is simply the elastic effect of a V shaped recovery.

The fact monied buyers are returning to hunt for homes was shown in July with strong search volume for houses for sale on Google. People search for things they’re interested in. Housing is a good investment and the jobs outlook is much better.

With work changes, unemployment and the race riots again, more buyers/investors will be checking out the best cities to buy real estate and move to. Why wouldn’t we think the housing market has changed along with everything else?

From a Recent New Zillow Report

- Newly pending sales were up 40.8% from the previous month ago and 4.2% week over week

- Total for-sale listings are down 23.3% year over year in what continues to be an extremely tight market.

- New for-sale listings remain down 17.8% year over year, but more recent numbers show more sellers are putting their homes up for sale. They’re up 37.8% from last month and 7.2% from a week ago.

Of course, Zillow did previously forecast a drop in the real estate markets from April to October, but there’s something flawed in that prediction. Zillow was calling for lower home prices in the summer, but the jobs, economic, interest rates, stimulus, demand to work, and the success of the stock market, just doesn’t support it.

Another round of stimulus is highly likely (okay it’s been delayed).

Most signals predict higher home prices, just like July’s. As the July Realtor.com report suggest, home buyers who were ready to buy in March and April, showed up in June and July to buy a home. Of course with little available stock, they’ll be waiting till September October or November to buy. And Realtors reports suggests bidding wars will be more common. When is the best time to buy a house?

Buyers Aren’t the Same Either

What we see from the BLS jobs report is that people really want to get back to work. Some are scared, others are bored, and other still want to stabilize things for 2021 and beyond. They’re smart people.

If they do regain full employment, they are going to want to buy homes. And as displaced workers in the Covid affected industries (entertainment, restaurants, hotels, personal services and retail) lose their financial last straw, they might be quicker to sell their home in September, October, and November than the housing experts think.

Demand Will Pump Up Home Prices

Demand however, will outstrip supply, which will force prices up in the next 3 months much higher than anticipated. Consider the equities markets and the stock market predictions. NASDAQ hit an all time record. See more about what causes high home prices in general.

With buyers returning quickly looking for bargain properties, they’re finding few on the market for sale. Logic tells us when demand exceeds supply, you’ll have rising prices.

Sales volume was down considerably in April so it’s no surprise it was down in May, another pandemic shutdown month. Residential real estate reports keep citing comparisons to last year’s prices, sales and related stats, but they bear no connection really. This period is unprecedented.

The Covid pandemic and shutdown have altered the housing market seasonal cycle. People aren’t working yet, kids aren’t returning from school, no ones going on vacation, people are only selling because they can’t pay their mortgage, or with no work in sight, there’s no point to stay where they are.

Certain jobs are hot, and some are not. This will tell you where home sales will grow.

Jobs, Jobs, Jobs

The latest US job report was outstanding, and only hints at the numbers for the next few weeks. At the end of it, we’ll still see high jobless numbers as the economy adapts to the new reality. Jobs in hospitality, restaurants, hotels, entertainment, and some services aren’t coming back. Money will shift to those industries that can thrive in the social distancing era.

Some Cities Will Get Hit with an Exodus

However, as the deep freeze on home sales thaws, the summer could see people buying for other reasons. With work at home the rule, there’s not much reason to stay in the city. And with riots, police funding cuts, a lack of income, and municipalities cutting transit and services, people are rethinking living in certain neighborhoods.

Rioters joining with terrorists, with the full support of the media is frightening a lot of Americans. This will add fuel to the home price fire this summer.

Back in the 60’s, after the race riots, home values and incomes in the inner city sunk for decades afterward ( as.vanderbilt.edu/econ/wparchive/workpaper/vu04-w10.pdf)

Zillow’s Home Price Recovery

President Trump and the Fed are both eager to ensure the economy gets back on track. Sort of like an unemployed person with lots of credit card debt, who gets a new job. Only US federal and state governments are desperate for money, so they’ve got to stimulate to get whatever industry is working in the economy, to work well.

Tech, manufacturing, vaccines, and housing construction are good targets. This might be a great time to renew America’s national infrastructure.

Let’s not forget the US economy was booming in February before that pandemic recession. With super low interest rates, lots of stimulus and a population hungry for production, we shouldn’t underestimate the real estate housing market in the next 3 to 6 months and into 2024.