Florida Real Estate Market

It’s a wonderful time in the Florida real estate market this spring. Sales are growing and buyers are returning.

And this state offers unparalleled variety in locations, from quaint villages and small cities to ultramodern big city living.

There has been plenty of new construction here, but most buy in Florida to acquire beautiful single-family homes in beautiful cities such as Naples, Boca Raton, Fort Lauderdale, Sarasota, Tampa, Miami, Punta Gorda, Venice, Pensacola, St Petes and so many more. The lifestyle is desirable as taxes are low, climate and recreation are nation leading, safety, and prosperity are second to none.

Given Florida’s lower state debt, it’s attracting investors, businesses and others fleeing states with massive debt and tax problems that make business difficult there. It is perhaps the most attractive, vibrant and growing housing markets in the nation. While the rest of the US suffers from a suppressed economy, Florida marches forward. It is a clearly distinct State and housing market.

Will demand for Florida homes ever cease? Will prices plummet? There is no recession foreseen, and given taxes are lower in the Sunshine State, the positives override any negatives. And Florida is a dream home state.

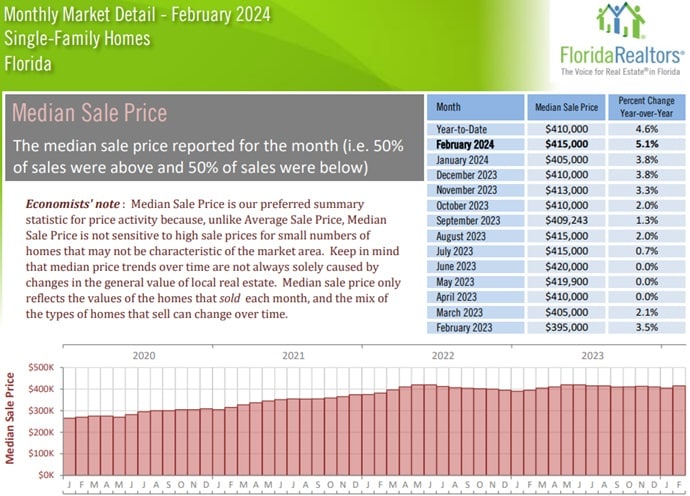

Florida Home Prices Rising

In February, home prices rose again nearing records with the median price up 5.1% year over year. If mortgage rates begin to decline in summer, we could see an extended buying season and more inventory becoming available. Given rates would fall minimally, it wouldn’t create a flood of new listings however.

Buyers are seeing inventory levels move back up to pre-pandemic levels and sellers are enjoying continuous price rises. Florida Realtor’s new report released today, show a new inventory level of 84,943 listings are available on the MLS. That’s a big rise of nearly 5% over January, and up 36.5% vs 12 months ago.

Buyers of course are waiting for mortgage rates to decrease as are sellers locked into ultralow mortgage rates. The market is still frozen, even though sales are increasing again.

Florida Realtor’s Brad O’Connor explains how prices are up 5% with a 2% increase in listings. But not surprising given how many homeowners are locked into their low-rate mortgages. However, new listings did rise (to a new record for February’s) so we know sellers are strongly motivated.

New Listings in Florida

New home listings climbed by 3.8% nationally, yet in Florida new listings are up 28.3% year over year, and up 2.5% vs January so the market is recovering from the devastation of 2023. Some of the rise might be in condos in Miami being dumped on the market. In January, a massive increase in listings occurred, so last month’s increase has to be viewed in context of January’s sudden wave of listings.

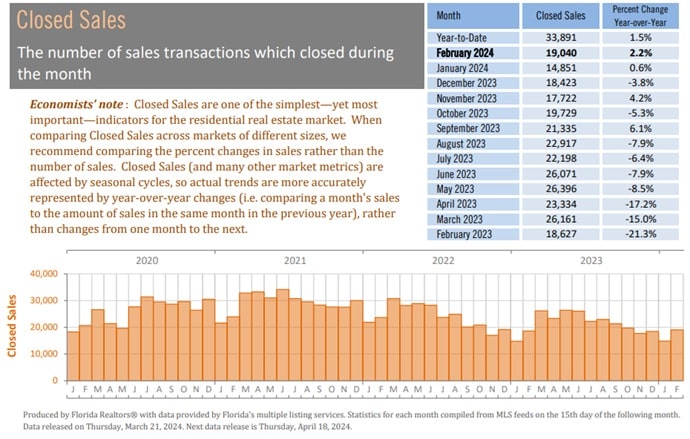

Homes Sales

After a slow month of January, home sales grew again by 2.2% last month. That is a 28% increase over January’s sales. New pending sales are up approx 2% from January. This is well up from last year’s severe downward trend. It shows the market is recovering from the high rate era.

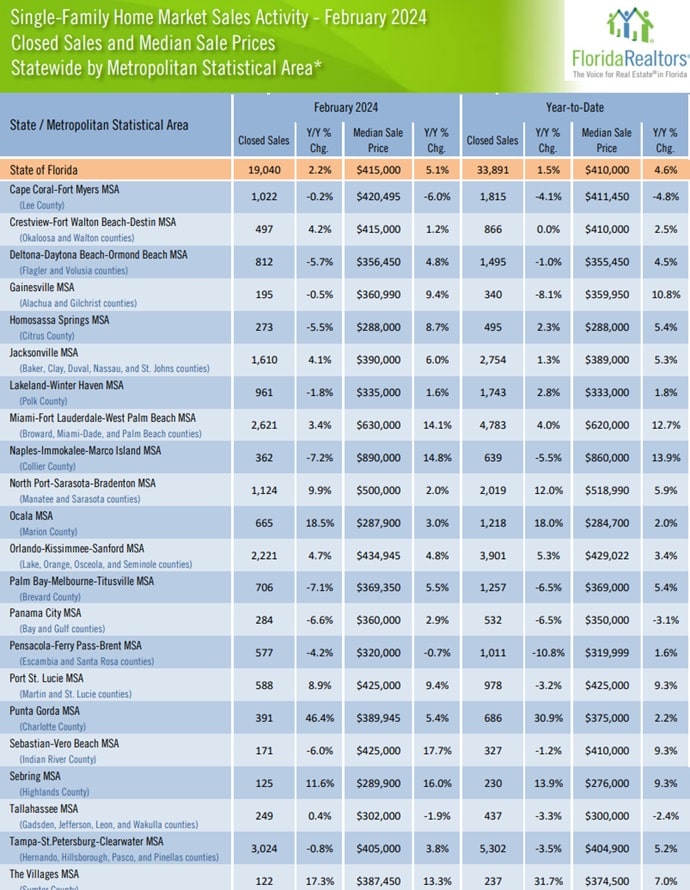

Florida Home Prices City By City

Sebastian Vero Beach, Sebring, Port St Lucie, Gainesville and The Villages led the way in February with the highest price gains. Ocala, Punta Gorda, Sebring and North Port-Sarasota-Bradenton area enjoyed the largest gain in single family home sales.

March of course, is the high point in the market as tourists and snowbirds add to the buyer pool. And as buyer interest dwindles in April, there’s a better opportunity for others to find and compete for homes for sale. If you’re looking for a place, to live in or as a rental investment, the 2024 summer season might be a great time to come down to Florida and take a good look.

And why not take a vacation and enjoy the warmth and a dip in the pool, and absorb the Florida culture?

Hundreds of small, medium, and large businesses are relocating to Florida, Texas and Tennessee as the economy cools. And Florida house prices have become more unaffordable for the majority of buyers.

Refin’s February Report

Redfin reports similar growth in prices, listings and sales across Florida.

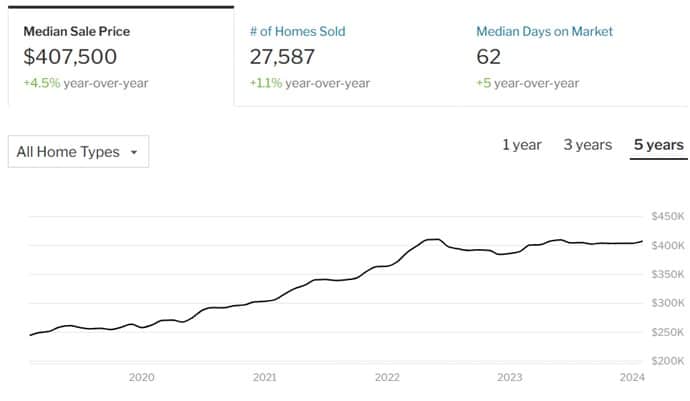

Zillow Home Values: Florida

Zillow gives us a longer term view of the Florida housing market where we see the huge increase in price beginning in 2022. Higher FED rates did slow the economy and rush to Florida, however prices really didn’t retreat. With a coming lowering of rates in 2025, Florida’s market could boom once more.

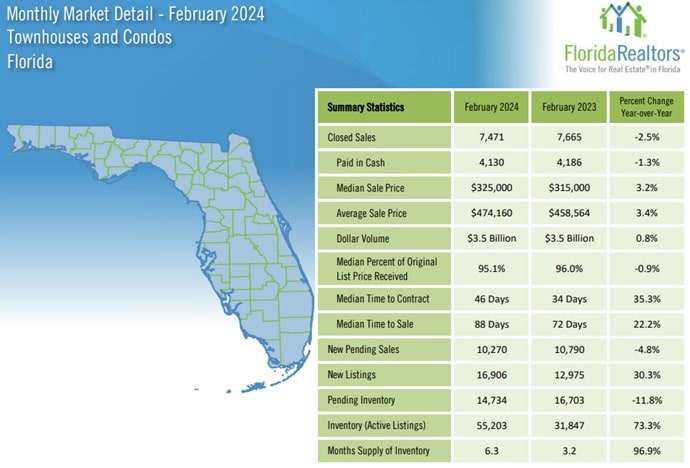

Florida Condominium Sales and Prices

The condo market thrives in Florida given the massive development taking place in Miami given it is an international transportation and business hub and a rising star in the tech space. The Florida condo market is more accessible and preferable to many types of buyers including foreign buyers.

Sales and pending sales in February were down 2.5% and 4.8% respectively. Sales by price category finds lower priced, affordable home sales are down significantly (9 to 17%). As Brad O’Connor states in the video, insurance rates and condo fees are resulting in a wave of condos put on the market. The greater volume of new listings occurred on the west coast.

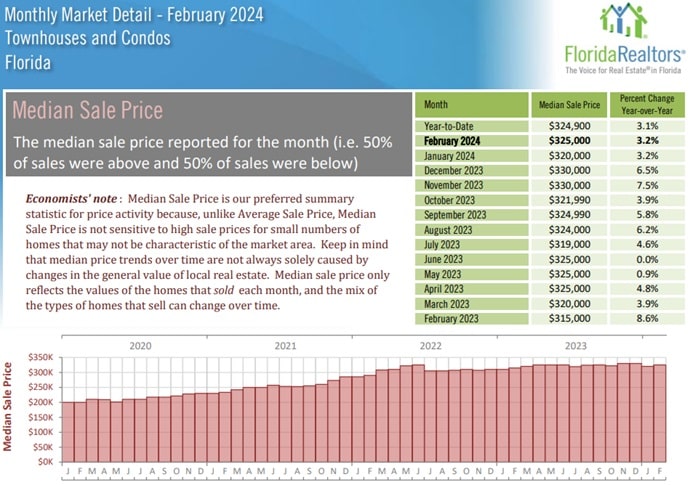

Florida Condo Prices

Despite the flood of condos put up for sale, prices are on the rise, and up 3.2% vs 12 months ago.

Florida HomeBuyer Profile

- First-time buyers comprise 21% vs 34% in the rest of the country.

- Average age of buyers was 57 years with average income of $95,900.

- 65% of recent buyers were married , 18% single females, 8% single males, and 7% unmarried couples.

- 24% purchased because they wanted to own a home of their own.

- 80% of buyers in Florida financed their home purchase (for 85% of value).

- 55% of buyers, used their savings while 42% used the proceeds from selling their primary residence.

- the typical Florida home seller was 63 years old who lived in their home for eight years before selling.

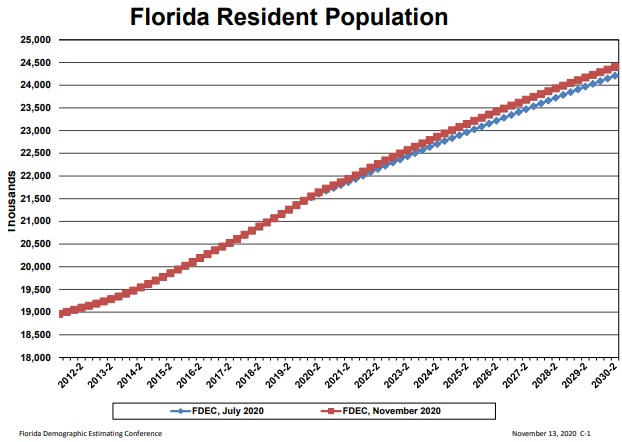

During the July 2021 to July 2022 time period, Florida’s population rose above 22 million people. That 1.9% increase was the largest of any US state. Today the migration to Florida continues. The climate, low taxes, and job market make it very attractive, especially to the 55+ buyer who sees Florida as a good retirement destination and a good prospect for rental property income.

Although the demand is always there, the mortgage payments and US government strife are making buyers hold off on purchasing. And homeowners are staying put as they are across the entire US housing market.

Compare Florida house prices in Los Angeles, New York, Los Angeles, Dallas, Denver, Atlanta, Vancouver or Toronto, and Florida real estate remains a bargain with a strong demand profile for the next 5 years at least.

More Cities to Review

See more on the Tampa housing market, Fort Lauderdale, Miami housing market, Boca Raton housing market, Orlando, Fort Myers, Jacksonville, Panama City and other beautiful Florida locations.

Buyers and sellers, find out more about conditions in the New York housing market, Boston housing market, Philadelphia housing market, Toronto housing market, Atlanta housing market and Chicago housing market.

More retirees who have cash may appreciate being able to buy in the Sunshine state at a more affordable price, but that lower-priced real estate is drying up fast. There are plenty of demographic, tax and economic reasons that Florida’s market may be the most resilient. See more on the US housing market forecast.

The forecast for the next 3 months is stronger than normal, leading into a 6 month growth period of unusual intensity. The 5 year real estate market outlook for Florida looks promising. This should encourage buyers to pay more and sellers to demand more for hard to find houses.

Florida Population Growth Outlook

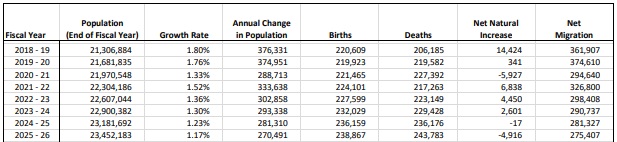

A study/prediction by http://edr.state.fl.us/ suggests Florida’s population will grow by 60,000 over the next 3 years ( a compound growth rate of 1.53%).

The edr.state study also shows further that population growth may begin to decline, death rate to climb, and household size begin to shrink after 2023. Overall, net migration is predicted to remain high which supports long term house prices.

Fewer listings is typical of the national housing market, or housing markets in Boston, Tampa, Miami, New York, California, Dallas , Denver, or San Diego. Homeowners are very reluctant to sell in this economic climate. More stats on Florida homes for sale below.

Why the Demand for Florida Real Estate?

Here’s a few good reasons why the brisk search for Florida homes for sale:

- one of the strongest state economies

- business-friendly state with fewer crippling regulations

- low Florida income taxes and business taxes

- greater square footage living

- economic concerns and debt in California, Illinois and Northeastern blue states

- buyers thinking ahead to new winter with the Florida warmth, sunshine, beaches and water, and year-round activity; no -40 or shoveling snow in Florida

- economic diversity increasing in the Sunshine state

- growing boom of recreation and travel

These and more might be the key factors driving the relentless growth of the Florida housing market. It should keep Florida Realtors busy and happier.

The Much Desired Florida Real Estate Market

Florida has a lot going for it. Lower-income and property taxes, warm weather, no estate taxes, and incredible recreation and beaches make this state the most desirable place (i.e, for New Yorkers and Manhattanites) to buy a home. While California cities are in freefall from evaders, Florida cities including Boca Raton, Miami and Tampa, are often among the best cities to buy real estate. Compare to home prices in Texas, Georgia, Colorado, or California.

The key stats below might be active listings and initial listing prices. They show a severe downward trend in homes for sale available, particularly at cheaper prices, and that listings are still growing in the upper price tiers.

Florida Realtors did a good job of keeping the market thriving. From Boca Raton, to Miami to Tampa, as in all US housing markets, the forecast is looking good for 2024.

Luxury Homes in South Florida

See more on the Miami real estate market and Tampa real estate market.

Real Estate Housing Market | Florida Dream Homes | Dream Homes | Real Estate Forecast | Housing Market Predictions for Next 5 years | Will Home Prices Fall? | Housing Marketing Forecast 2023 | California Housing Market | Sell House Now | Travel Marketing Tips | Bleisure Travel Marketing | Travel Company Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel | Author Gord Collins