Chicago Housing Market Update

Buyer demand combined with lower construction output are helping to raise prices in the Chicago real estate market. Prices rose steeply in March 2021, as did the number of home sales.

Similar to most housing markets across the country, housing supply and big demand from millennials wanting to buy at low mortgage rates helped fuel a very strong January to March period. The last half and next years predictions are higher prices for sellers and more new housing stock is being delivered.

The cost of lumber and other materials and a backlogged supply chain are hampering output and homeowners are not putting their homes up for sale as hoped for, as the pandemic comes to a close.

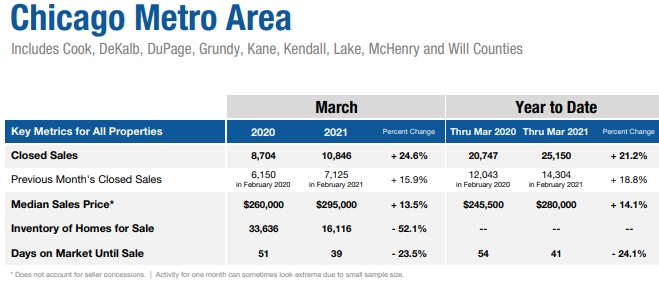

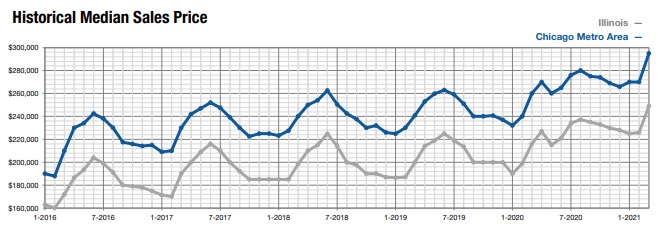

In the Chicago PMSA, 10,846 houses were sold, changing by 52.2% from a month ago and 24.6% from a year ago. The median price rose 15.3% year over year to $249,000 in the state of Illinois, and in the Chicago PMSA the median price rose 13.5% versus one year ago to $295,000. In the Chicago PMSA, 10,846 houses were sold, rising 52.2% from the previous month and up 24.6% from a year ago.

“The housing sector recorded strong month-to-month and year-over-year changes in March in both sales and prices,” The main concern in the coming months will be the low inventory levels, currently 1.5 and 1.3 months at current sales rates in Illinois and Chicago respectively.” said Geoffrey J.D. Hewings, emeritus director of the Regional Economics Applications Laboratory at the University of Illinois.

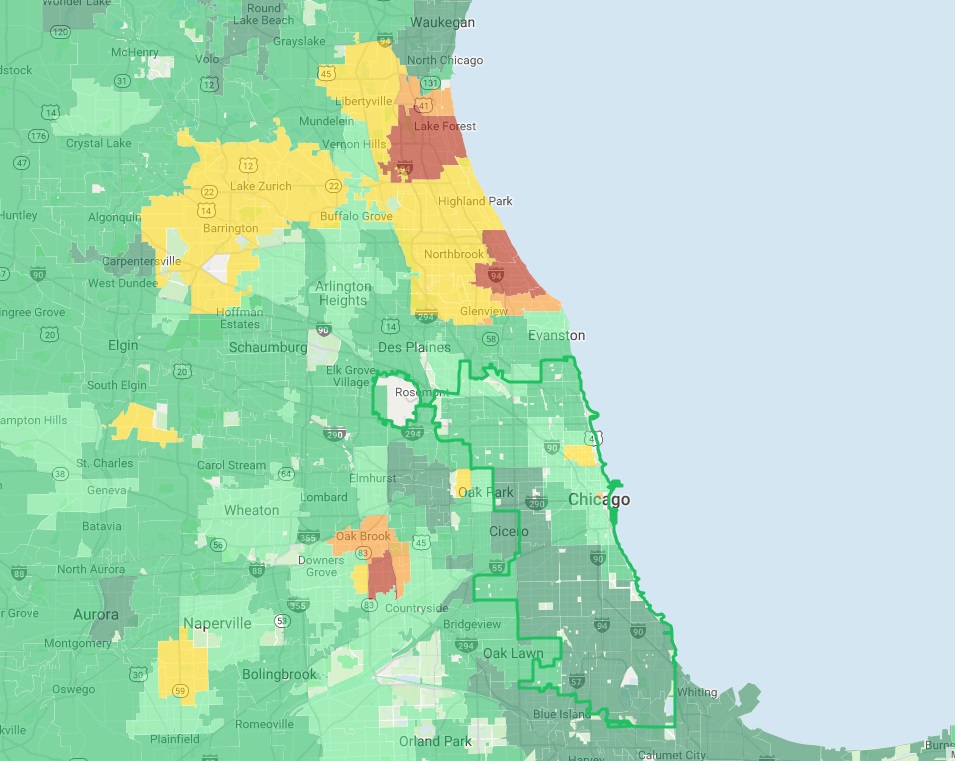

This graphic shows home prices rising fast beyond greater Chicago reflecting the migration of buyers to markets where they can buy single detached homes.

3 Month Forecast (Apil, June, July)

On a three month basis, Chicago PMSA home sales are expected to rise from 27.9% to 37.7% (according to heartlandro.realtor). For the Chicago PMSA, the comparable figures are 13.3% in April, 17.6% in May and 17.3% in June.

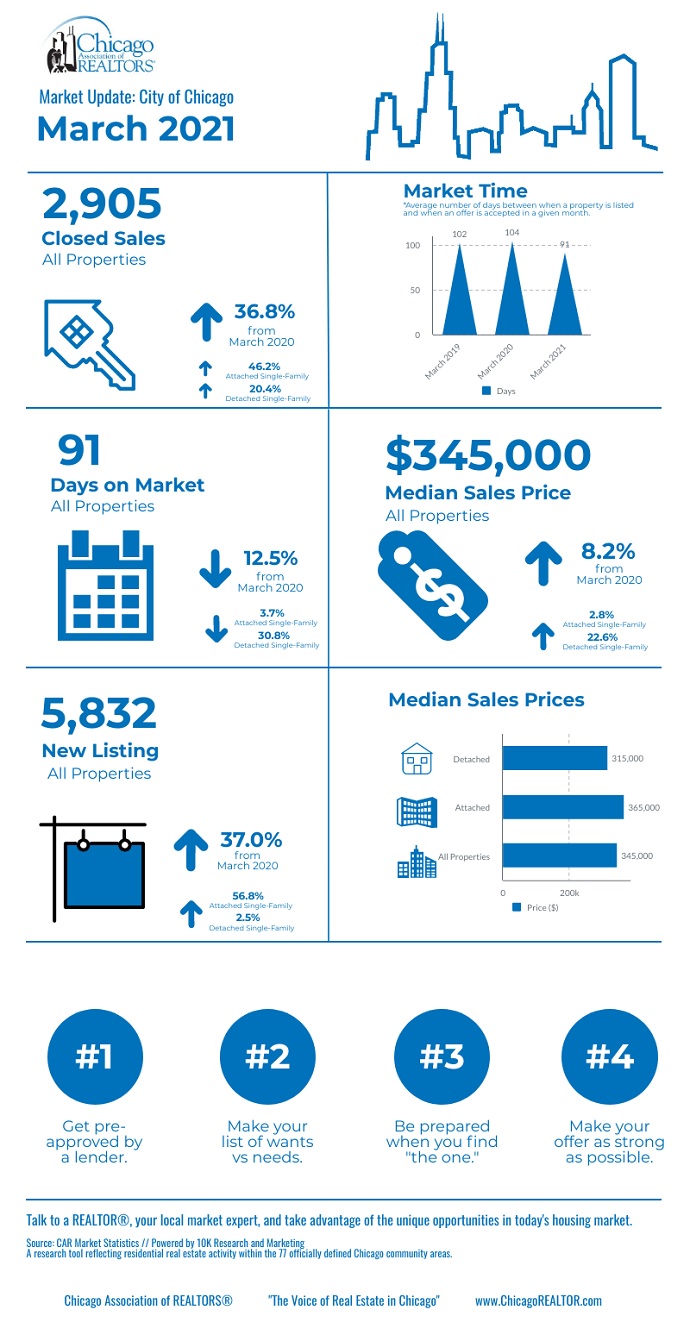

City of Chicago Real Estate Sales

Chicago Association of Realtors reports:

- 2,905 properties were sold in the City of Chicago in March 2021. This is a 36.8% increase from March 2020 and big jump 1300 units more than February.

- The median sales price in the City of Chicago for March 2021 was $345,000, up 8.2% from this time last year and up$25,000 from the previous month.

- The City of Chicago saw listings average 91 days on the market until contract, a 12.5% decrease from March 2020

- The City of Chicago’s inventory is down 11.6%, from 8,516 homes in March 2020 to 7,527 homes in March 2021.

- The month’s supply of inventory decreased 22.5%, from 4.0 in March 2020 to 3.1 in March 2021.

During February within the city of Chicago, home sales (single-family and condominiums) rose 8.8% to 1,628 homes sold. And median home prices rose 10.3% year over year to $320,000.

Geoffrey J.D. Hewings, emeritus director of the Regional Economics Applications Laboratory at the University of Illinois offers a rosy forecast for the markets, “Housing sales and prices are expected to continue their positive trends into the first quarter of 2021… continuing demand is likely to come from those seeking to relocate to accommodate opportunities to sustain the percentage of time spent working from home.”

Hottest Neighborhoods in Chicago

This chart from Trulia’s heatmaps show the highest listing prices in the coastal communities.

The graph below shows middle tier home prices were on the rise until recently.

Contrast with Other Housing Markets

Compare the price of homes and cost of living in Chicago to other US cities, and you’ll understand why Illinois might become a desired destination again. The work from home and small business growth trend changes the landscape. See the New York real estate, Boston Real estate, Philadelphia real estate, Atlanta real estate, Denver real estate and Dallas real estate scene for comparison. The spring housing market forecast is an exciting one for home owners.

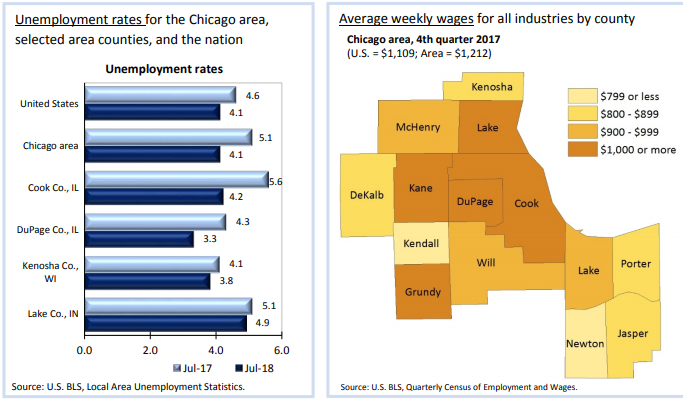

Up till now, the Chicago housing market has underperformed. Yet these graphs from BLS suggest wages are rising in the Chicago metro area, employment growing, and a lack of construction should push prices upward.

Longer Term Outlook Chicago Realtors

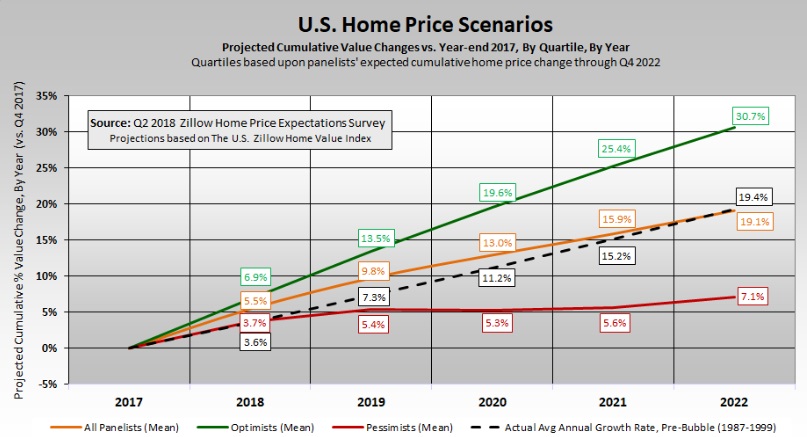

This long term projection of house prices by Realtors shows strong optimism about the housing market. In this chart, Realtors predict strong growth, with even the most pessimistic rosy about 2021 and beyond. And since Chicago is playing catch up economically and with manufacturing returning from China, Chicago has huge potential for growth.

New Home Construction in Chicago

Crain’s Chicago Business magazine reports that there are fewer new subdivision development projects underway in Chicago than in the past 20 years. Not welcome news for a city that desperately needs new housing. New home sales dropped in the first half of 2018, although recently an uptick has happened. New homes introduced are competitively priced, yet lack of reasonably priced land is thwarting new home construction.

Chicago Rental Market

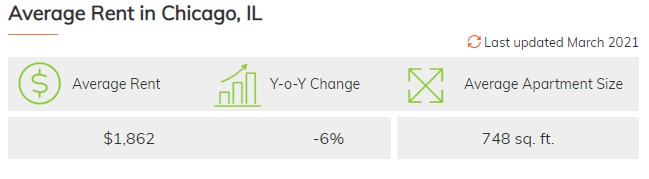

According to Rentcafe, the average rent for an apartment in Chicago is $1,862, a 6% decrease compared to the previous year.

More Insightful Posts on the Forecast for the Real Estate Housing Market , and teh Philadelphia Real Estate | Atlanta Real Estate | Boston Real Estate and the Florida Real Estate Market Outlook

Stock Market Forecast 2023 | Stock Market Crash 2023 |3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | Oil Price | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Prediction Software