Calgary Housing Market and Update

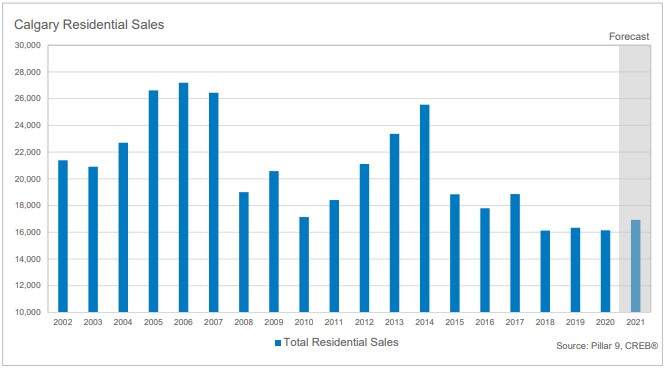

The residential real estate market across Calgary is similar to most housing markets including Toronto, Mississauga, Vancouver, Kelowna and Montreal. Housing sales in the last 13 months, and in particular the first half of this year were up sharply.

The question is whether sales and prices will continue rising or begin to languish. Contrast home prices in Calgary with home prices in Toronto, Vancouver, or Kelowna, and you have to think buyers will be happy to buy a house or condo in Calgary in the fall.

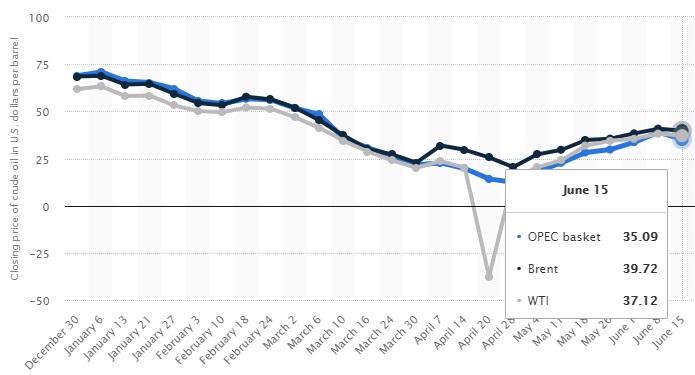

With strong energy prices of late, we’d expect Alberta’s housing markets to do well, and they have. And with Erin O’toole looking strong during this upcoming Federal Election, the outlook for Calgary and Edmonton might be very bright indeed. If Alberta can gets its oil products to markets in 2022, we might see a banner year for the province.

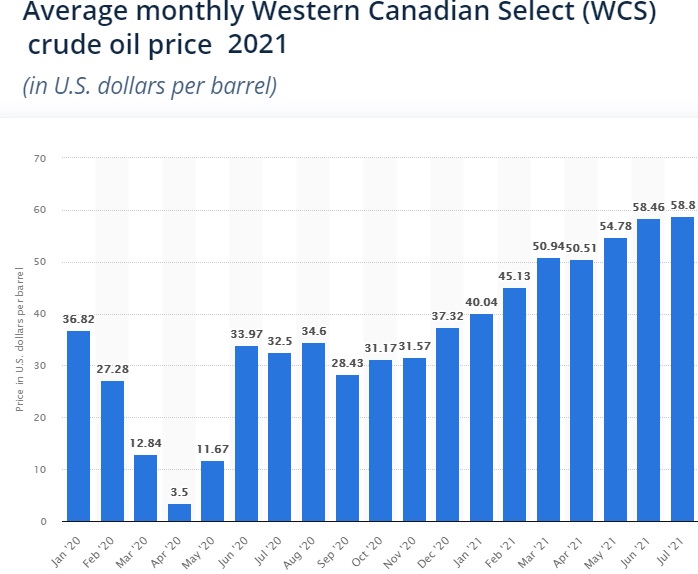

WCS Oil Price Driving Home Prices

With the price of oil reaching $71 today, and looking relatively strong for the next few years, we can forecast strong home sales in Calgary and Edmonton along with continuously rising prices. The economy has not fully reopened and immigration is still on hold for the most part. The province’s population has only grown by 27,000 in the last 12 months which is well down from the normal 73,000 migrants. A return to normal immigration and economy activity will likely push home price well up in Calgary and Edmonton in the next 12 months.

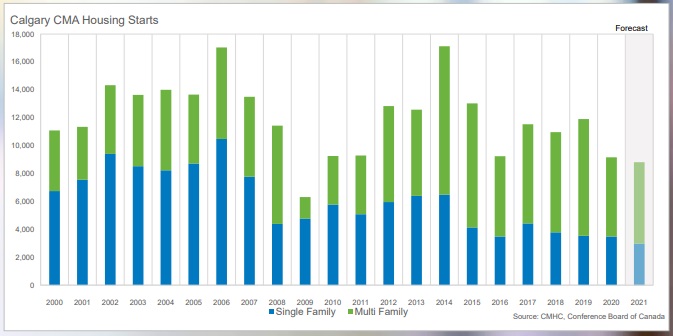

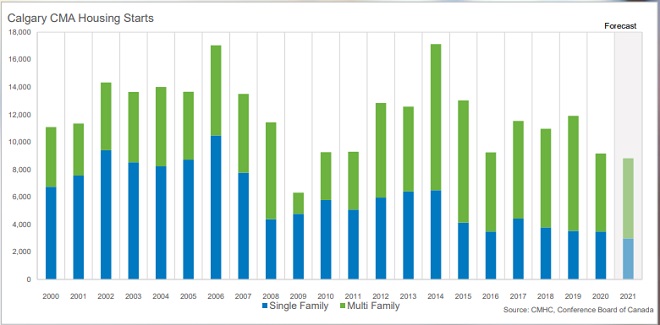

Construction of homes in the province was strongly up in 2021 vs 2020 and there are 2723 home starts in the province in July. Single detached home starts grew 85% in July. Year to date, home starts are up 42.6% which means home prices in the province could be much higher.

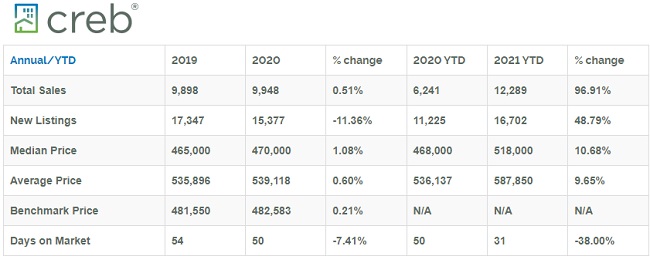

Home sales in both cities have been very strong this year, doubling versus 2020. While the pandemic has posed problems for workplace and retail reopenings, the energy prices are buoying Alberta tax revenues which really helps the province recover from a particularly awful time period.

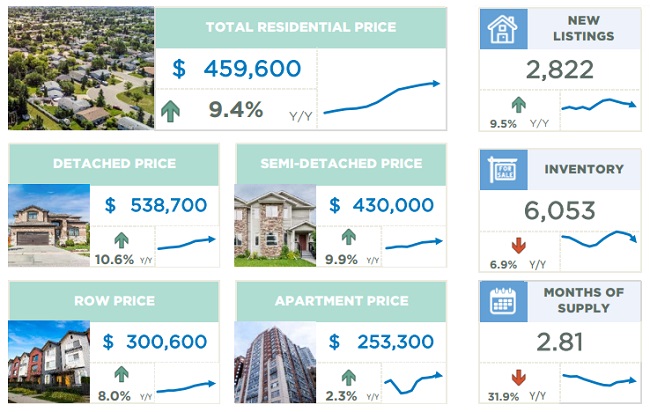

August Housing Market Stats for Calgary

Home sales in Calgary overall during August rose 37% vs last year to a new total of 2,151 units. More importantly, that sales level is 25% higher than long-term averages.

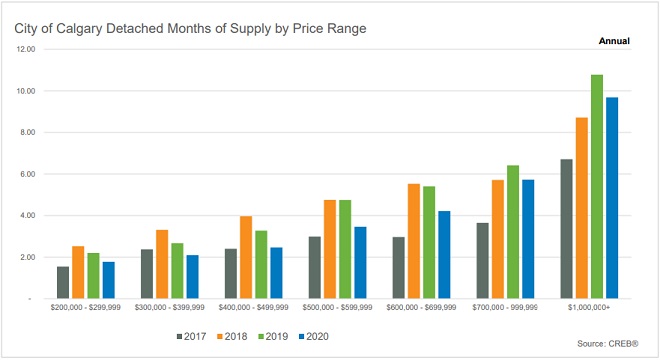

Condo sales activity in August was at its highest in over the past six years. This means the condo market is enjoying a bit of a boom as the pandemic (hopefully) eases across the province of Alberta. With continued gains in new listings, inventory levels are still elevated compared to last year and longer-term trends. There were 332 sales of condos in August. With 1,786 units in inventory, the months of supply remained above 5 months in August.

The average price of a condo apartments reached only $253,500, a bargain compared to Toronto or Vancouver.

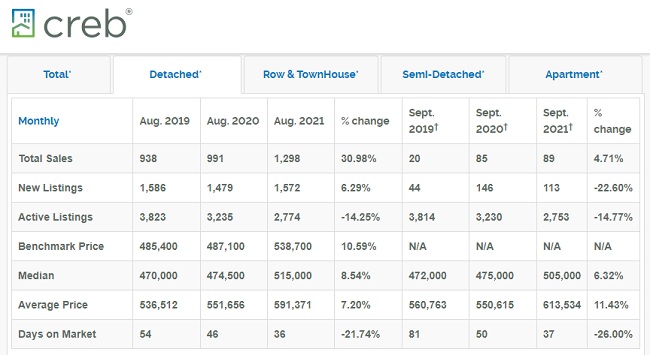

Sales of detached homes rose 31% year over year. A rise in new listings is helping the market grow allowing prices to rise only 8.5% YoY. Active listings however are down 14.25% which is going to force buyers to bid higher to win a home. CREB forecasts stats to remain consistent with August in September. The average price of a house in Calgary hit $538,700, up from $487,100 last August.

The fall season will likely bring higher oil prices and growing energy demand and that will create support for stronger home prices. The forecast for Calgary was based on mid $40 prices for oil, yet we’re consistently up to $US90 and to $80 for WCS. With production unlocked, the oil patch can generate more revenue.

One big factors is much higher actual prices for Alberta oil producers. Western Canadian Select oil prices have jumped 296% in comparison to last year. That makes Canadian oil companies a great buy for stock market investors. Alberta producers of oil, averaged US$50.94 a barrel in March 2021. Today, WCS stands at $78 a barrel. An excellent situation for the people of Alberta and Canada.

WCS Oil Prices History Timeline Chart. Screenshot courtesy of Statista.

As strong as the market is, it still lags behind the performance of Vancouver, Kelowna, Toronto, Mississauga, and Montreal. Calgary’s real estate market is regaining its health but it is far from the crisis you see in the Vancouver housing market or Toronto housing market.

Lower priced homes, low mortgage rates, zero income tax, and a more entrepreneurial spirit has also caught the attention of future buyers who may be on the fence about moving to Calgary. And as the price of oil is likely to rise (due to supply constraints in the US) and perhaps well above the forecasts for the price of oil.

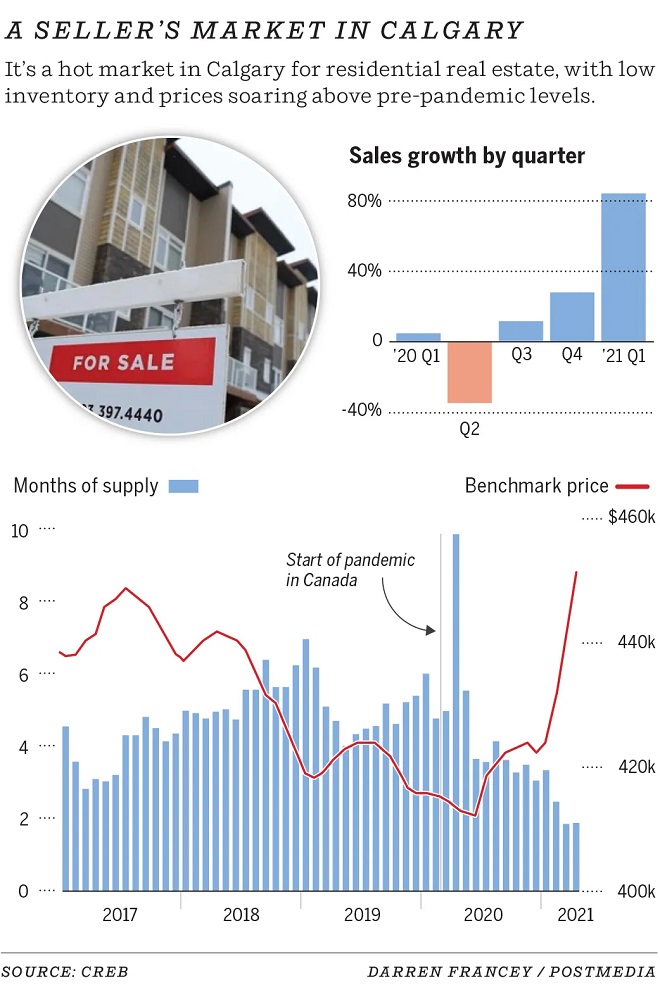

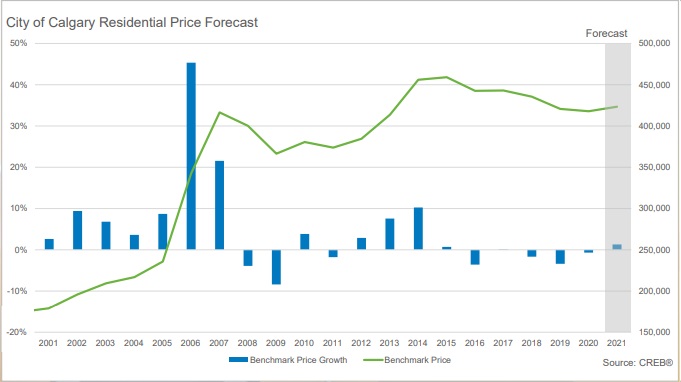

The Calgary Herald’s recent report on the market offers this graphic which really highlights the rise in sales and prices of recent.

The CMHC offer there dour outlook on the Calgary housing market again. 2 years ago they forecasted a bleak outlook for the Canadian housing market, which never materialized. It was so wrong, they had to retract the whole housing market forecast. This year, the CMHC says the hot market will cease in Calgary due to new construction and the market will flatten or slow in 2022.

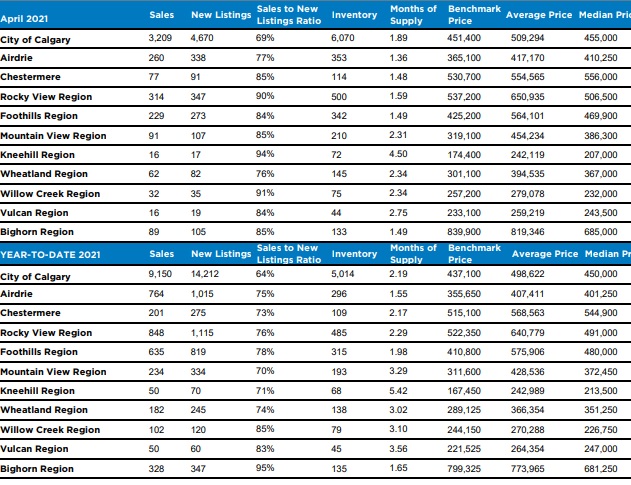

Calgary Region: Housing Sales and Prices

Finally after a tough 2020, we’re seeing Calgary beginning to follow the same path as Toronto, Vancouver, Kelowna Vernon, Montreal and Mississauga. Home prices are rocketing.

Housing Construction Starts Calgary

A study of the Canadian real estate market and forecast has offered no insight into the Calgary market. Both Calgary and Edmonton have suffered greatly during the pandemic as global oil demand has fallen. Travel, commuting to work, and manufacturing are expected to grow, but despite the vaccinations, progress is slower than most have hoped.

Some real estate observers believe Calgary real estate price rises will moderate in 2022 and 2023. Many economic and political factors will be in play.

In a post in Business in Calgary, CIR realtor Sarah Scott is seeing real growth in is investment real estate in the last few months. “I really first noticed it in October (2020), but it ramped up in my own business by the end of November and is still moving. These types of buyers are out looking to supplement income and they are taking advantage of the low mortgage rates.”

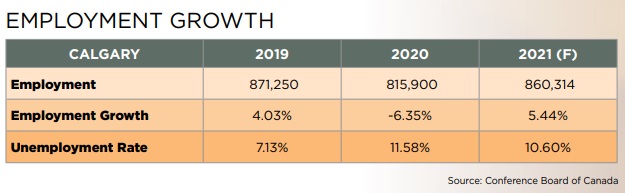

The economic forecasts for Alberta are quite rosy. RBC economics predicts Alberta’s GDP will grow 4.5% this year based on a $47 forecasted price for oil. Oil of course has been trading well about $60. It’s welcome boost and is energizing the Calgary real estate market. CREB expects job grow to improves 5.44%.

Alberta’s greatest asset is rising gasoline prices which Canadians will have to pay. That will ease their objection to allowing Alberta crude to flow. Once gasoline prices to unbearable levels in late summer, Alberta may see progress in pipeline development.

The Vancouver housing market, Kelowna Vernon housing market, and Toronto Housing market are in the same spot. However the rising price of oil, if it continues is a big break for Alberta. The development of the TransCanada pipeline could be an additional boost for the Western economy, yet the resistance to oil transit will become a bigger issue as oil demand increases.

Forecast for the Calgary Real Estate Market

CREB forecasts a 5% increase in Calgary home prices in 2021. They note that a reduction in supply kept prices moderate in 2020. They also mentioned lower unemployment rates as easing up buyer fears. CREB believes supply issues are important, and that is supply levels remain low, prices could head up.

This is all common sense forecasting. If we want to forecast correctly, we have to be a little bolder and consider some likely scenarios. The pandemic isn’t over and most provinces are seeing a Covid 19 variant outbreak mar the expected spring surge.

Housing construction will likely lag because builders aren’t certain that oil prices will rise much even if demand increases. Fracking oil producers are increasing their rig counts so supply will grow too. Oil producing nations are experiencing extreme financial problems (Russia) and will under pressure to let oil flow.

THERE IS SIGNIFICANT UNCERTAINTY surrounding how long it will take for the economy to fully reopen, the pace of economic recovery, and the long-term impacts of the pandemic in relation to business bankruptcies and job losses. This could result in both slower-than-expected sales and stronger-than-expected supply gains, impacting the pace of price growth… THE HIGHER RATE OF MORTGAGE DEFERRALS in Alberta compared to other provinces could start to turn into supply pressure in the housing market. — from the CREB 2021 Calgary housing forecast report.

Home Construction Starts Outlook

For builders, it is a risky business environment. Housing starts in Calgary are expected to fall. Materials, financing and labor will all rise in price. New housing may not help to stop price rises in 2021.

Oil Price Discount Hurting Alberta

The WCS discount isn’t a problem anymore and the oil pipelines are looking like they’re more likely going to happen (President Trump). The BC transmountain pipeline is hampered by the fact the BC Premier is entrenched in a pride position and likely won’t let the pipeline happen. Gas prices in Vancouver however are climbing to ridiculous heights and Vancouver’s own housing market is hurting bad. Something will have to happen.

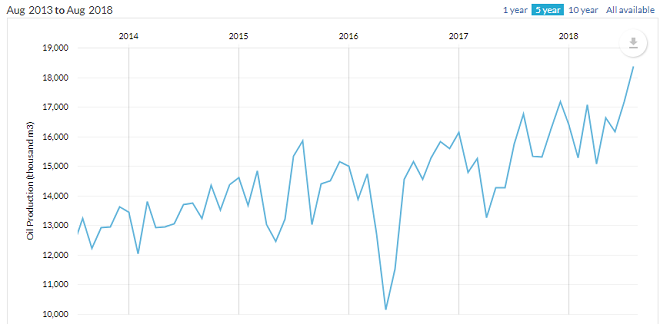

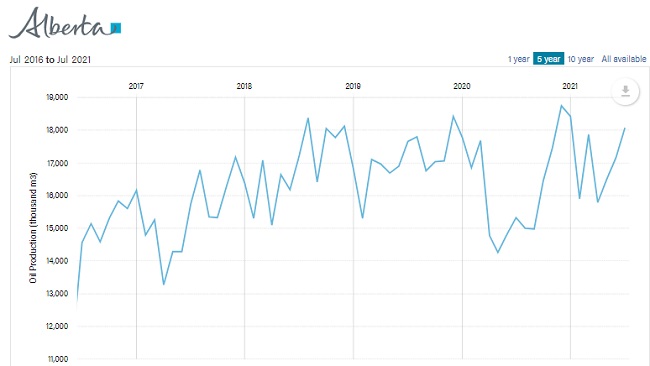

Oil production in Alberta is growing, however profit isn’t rising as much as people believe as this chart below reveals. The net effect is that there is growing revenue and it will lead to more activity in the Calgary housing market.

This forecast below from CREB doesn’t take into account the resurgence of the Alberta economy. With price stability, and a booming US economy, the picture for Calgary looks rosy.

Oil Prices and OPEC

Expert’s forecasts of oil prices and proving to be understated. Oil prices have far exceeded what most experts said would happen, now at an unexpected US $71 per barrel.

The Turnaround in Calgary Canada is Coming

The growth in the US oil wealth is obvious with Texas post hurricane development. And western shale oil producers are ramping up oil production which means they feel positive about demand and price. If the democrats gain increasing power, that could darken the picture for Alberta. They stopped pipelines before and would do again for powerful lobby groups in Washington.

The uncertainty of Calgary’s housing market makes it a gamble however buying in this vibrant young city is more preferable than rolling the dice in overregulated and overpriced Vancouver or Toronto.

Recent improvements: Unemployment has dropped in the last 2 years and many believe the recovery is well underway — powered up by rising oil prices in US dollars x rising production numbers. Calgary’s economic growth lead Canada at 6.9% and that’s when oil prices were lower.

The Conference Board of Canada predicted Calgary will lead the nation at 2.4% growth in 2019 however given recent developments, it’s unlikely. If Alberta oil is shut in, the CAD loonie should stay low. Some are still predicting a 70 cent loonie by the end of 2019. Toronto, Vancouver and Montreal are doing well, but not enough to raise the loonie.

OPEC Was Willing to Throttle Output to Raise Oil Prices

Yes, Calgary is more than oil, but oil money is hard to ignore. Alberta needs the investment funds that flow in when Oil prices rise.

With OPEC cutting oil production output, and oil prices jumped past $71 a barrel (WTI) it awakened the oil patch. Since then investment money is almost non-existent. Alberta can’t get its product to market and surrounding neighbors won’t let its products across their borders.

Some are still forecasting very high oil prices, yet Alberta may not get to enjoy the bounty until 2020. If prices fall, less political pressure and effort by oil producers in the province means the pipelines could be delayed indefinitely. At this point, we’d have to say house prices could fall much further. The carbon taxes are more nails in the coffin.

Even the experts are voicing caution, probably because they’re not sure themselves who has control of oil prices, and whether the BC pipeline issue will be solved. And BC doesn’t seem to be batting an eye, as gas prices there rose above $1.50 a litre.

Rachel Notley pointed out the BC premier’s ironic and hypocritical stance on Alberta oil with his new subsidies for LNG projects in BC.

And besides the BC carbon tax, and the investment killing removal of the corporate tax rate cut, there’s also the matter of how much Vancouver’s housing market and economy can take as interest rates rise too.

This is a text book test of the merit and wisdom of government regulation. BC’s government run auto insurance sector for instance, is already in deep trouble, rumoured to be on the verge of bankruptcy.

Not only does Alberta ease the prices BC drivers pay for gasoline, the Federal taxes on oil production are steep and distributed to the other provinces. Everyone benefits when Alberta’s energy sector thrives. It’s vital for Canada.

The WTI WCS price differential is a painful loss for Alberta Oil producers and of late it’s gotten worse due to pipeline bottlenecks. Will it get worse this year?

Alberta’s production capacity is impressive and has recovered by 7,000 m3 from 2 years ago. The issue is getting it to world markets.

International investors with a long term investment strategy should compare what you can buy in Calgary for $460,000 vs what you’ll get in the Vancouver market or Toronto market or Montreal housing market and you can see the long term investment advantages. Calgary is a much easier place to do business and buy real estate.

Which are The Best Neighbourhoods to Buy a Home in Calgary?

As a long time resident, I can tell you there are many excellent neighbourhoods, with great schools, shopping, and recreation. All of it is accessible.

If you enjoy exercise, you may find the communities along the Bow River best. There is a cycling/walking trail on both sides and the mountain biking park at Canada Olympic Park is on it too.

If you like beautiful views, Calgary has plenty. The northwest area of Calgary including those communities near Spy Hill, Coach Hill, and Nose Hill Park offer amazing views, some of the Rockies and foothills. Be ready for matching prices. The neighbourhoods on the northwest outskirts of the city offer unbelievable panoramic views of the Rocky Mountains to the west. Expect million dollar prices here. Homes on Spy Hill and Coach Hill offer incredible views of almost all of Calgary and the spectacular downtown skyline.

If water sports like sailing and windsurfing are important to you, Calgary has a number of man made lakes in the south end. The South has the largest selection of homes, with the Northwest next in number.

If you like cosmopolitan, the neighborhoods near downtown Calgary will appeal to you with the shops and walkability. And downtown’s plus 15 walkway system is close by too. Downtown city centre is where the condos are and virtually everything you need is here on 7th, 8th and 9th Avenue . The Bow River pathway is adjacent and Calgary’s convenient light rail transit can whisk you away to shopping in the south end of the city.

With the recession now largely in the rear view mirror, and with the price of oil rising steadily, homebuyers and property investors will be looking at Calgary homes differently.

With house prices so low, the expectation for buying residential properties in 2018 will improve. For speculators, the Calgary market is tantalizing, given that home prices in Toronto, Vancouver, Los Angeles, Bay Area, New York, and Miami have peaked.

In-migration to Calgary is rising and mortgage rates remain low. Although “made to depress” Canada housing policies will constrain the market, the outlook for Calgary real estate is for growth. The extent of that growth of course depends on the price of oil, incoming energy sector investment, and the value of the Canadian dollar vs the US dollar.

Economic Predictions for Calgary

If oil continues to rise steadily in price, Alberta stands to recover economically. Businesses have pared down their costs and are better able to profit from growth. Although not officially a big component of the rosy Canadian economic forecast, Alberta and Calgary are keys to the future.

Screen capture courtesy of CREB.com. Stats courtesy of CMHC.

Total house sales were precisely forecasted to be 600 higher in 2017 than 2016 with a price similar. Dead on accurate. New listings will total 32,731, 400 for the full year. Sales of apartment will rise slightly over last years numbers at about 2800 units.

The loonie remains around 78 cents CAD vs USD, maintaining an excellent premium on exports from Calgary, and exports of Alberta oil. Forex experts believe the US dollar forecast is upward, while the Canadian dollar forecast is downward.

If new construction starts are constrained, then the resale market may grow in the neighbourhood of 1% in 2018, 2% in 2019 and perhaps 3% in 2019. Of course, all predictions rest on the price of oil which as mentioned, the Saudis and OPEC control. And US shale production and drilling rig counts seem to moderate upward increases in oil prices.

The last word on Calgary and it’s oil-driven housing market is volatile. Statistical fundamentals are useless in predicting the movement of pricing and supply. Oil is a weapon, lever, and carrot used by politicians and sheiks, and they determine what prices will be.

Note: the preceding post is not meant as specific investment advice, but rather as a comparison of real estate investment or home buying opportunities. Please ensure you discuss all investments with a licensed professional.

Stock Market Projections | Stock Market Week | Alphabet Stock | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2024 | Vancouver Housing Prices | Kelowna Housing Prices | Toronto Housing Prices | Mississauga Housing Prices | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate