New TREB Report Shows Foreign Buyers Have Minimal Effect on Toronto Housing Market

Foreign Buyers Not Driving Up Prices in Toronto

A Toronto Real Estate Board investigation concluded that foreign buyers play a minimal role in Toronto house prices and availability. 3 key findings counter the Wynne government’s insistence that Foreign buyers and house flippers are ruining the housing market.

The report may indicate how government officials haven’t been honest to the public about the cause of high home prices in Toronto — government tax greed and ideology of privilege.

April TREB market report: a growth of 33.6% in home listings in the TREB’s MLS® System in April 2017, at 21,630. Prices rose too.

Buyers Tax a Regrettable Tactic

This new finding shows the Foreign Buyers Tax in Toronto (an old school knuckle dragging approach) was a knee jerk reaction by desperate politicians. The sad part is that it did cripple the development of new homes and condos in 2018 and 2019 which would have eased the housing crisis.

As we now know, housing availability has not grown adequately resulting in overbidding on the limited selection available.

It remains to be seen how Toronto condominium developers will react to the Ontario government buyers tax. Currently, the Toronto condo market is alive and healthy. But the housing crisis is unfortunately a sad reality for many Ontarians.

What happened in April 2017?

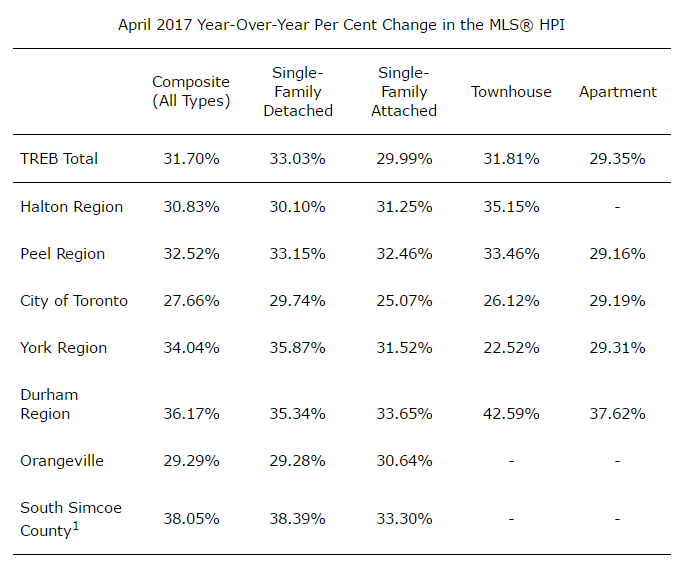

The MLS® Home Price Index (HPI) Composite Benchmark Price was up by 31.7 per cent year-over-year in April 2017. Similarly, the average selling price for all home types combined was up by 24.5 per cent to $920,791. — from report from TREBhome.com

Homeowners are Finally Selling!

On a positive note, and further to the real point of the study, TREB reported that home sellers appear to be loosening their grip on their homes and are putting them up for sale. The long awaited “Great Home Release” is happening now this spring 2017 in a Toronto neighbourhood near you. tTREB’s Jason Mercer added in the published statement that it will take a long time for the pent up demand to be fulfilled in the GTA area. from the new May report from TREB.

“It was encouraging to see a very strong year-over-year increase in new listings. If new listings growth continues to outpace sales growth moving forward, we will start to see more balanced market conditions. It will likely take a number of months to unwind the substantial pent-up demand that has built over the past two years. Expect annual rates of price growth to remain well-above the rate of inflation as we move through the spring and summer months,” said Jason Mercer, TREB’s Director of Market Analysis.

“TREB strongly believes that public policy decisions with regard to the housing market should be evidence-based and supported by empirical data.”

3 Key Findings that Debunk the Foreign Influence Myth

TREB’s Report summarized these 3 key findings, that debunk the Ontario government’s insistence that foreign buyers and quick investment flips are driving the Toronto housing crisis:

- The number of buyers with a mailing address outside of Canada is well-below 1%

- Between 2008 and April 2017, the average share of foreign buyers in the Golden Horseshoe area was 2.3%

- The majority of foreign buyers – 87% to 90%– purchased their home as a place to live, not as a tax evasion or speculative venture (homes that were bought/sold within a short period of time – within one year of the original transaction by domestic or foreign buyers accounted for a very small share — less than 5% in 2016 and 7% between January and April 2017) of total transactions).

With the above information in hand, what is your opinion of the Ontario government and Mayor John Tory’s stated preference for the Toronto Foreign Buyers Tax? What do you believe is the real purpose of the tax? Will the incoming Ontario government simply get rid of it? Do you consider the Toronto land transfer tax a fair tax? Do you feel the government is creating the problem with one hand and justifying its role with the other?

Get the full view of the Toronto Real Estate market, along with the Newmarket housing report, and Mississauga housing market report and forecasts.

Should you sell your house fast or for a high price? In the past 3 months Americans have been selling their home for an average $336,000 more than they paid for it. It’s one more reminder that real estate is where the real money is. And if you’ve been reading my posts, you’ll see that government red tape and land restriction is the real driver of high real estate prices. So if you’re renting, gaining no equity, while your life passes, and can’t come up with hundreds of thousands for a down payment, now you know why. It’s time to speak with your local government representatives about opening up land for development. The alternative is pay the future home prices which could rise another 30% in 2018 (depending on the economy and how well J Trudeau gets along with you know who).

Latest year over year Toronto region home prices (April 2016 to 2017):