California Housing Market

Will home prices rise or fall in the Golden State this year? It’s a complex market with buyers across the country trying to understand the demand/supply factors that drive it.

Home prices have receded in many areas, but with FED rate cuts ahead and with more confidence in the US economy, it lead us to below California home prices will rise this year and next.

The key issues for the California real estate market this year revolve around the high home prices, cost of living, dependence on the tech sector, high taxation, and too high mortgage payments. Let’s take a look at all the factors driving the California housing market so you can decide whether this is the right year to buy or sell.

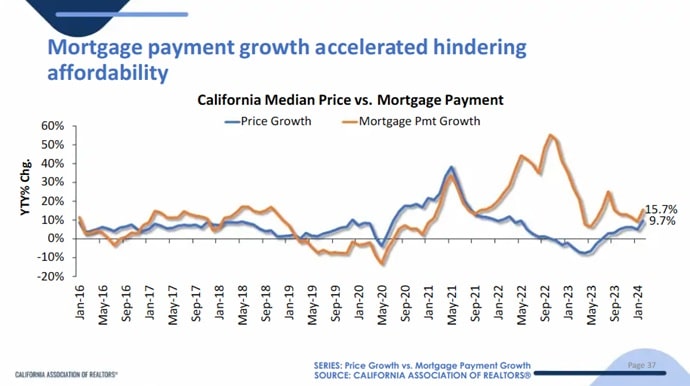

High Prices and Big Mortgage Payments

The high home prices make California sensitive to mortgage rates, tech sector pullbacks, as well as the tax change announcements pushed by the California governor, could scare off a lot of buyers.

Like most housing markets, California’s is paralyzed by locked-in buyers. Yet listings are rising which means some might sell without expectation of refinancing. Because if they refinance within two years, they’re going to find it unpleasant. Still, many can sell their million-dollar property and buy for cash in another state. And even buyers in California are cash buyers. 40% of buyers in Santa Cruz for instance buy with cash. So where sales can happen without high-rate financing, they might.

Like most housing markets, California’s is paralyzed by locked-in buyers. Yet listings are rising which means some might sell without expectation of refinancing. Because if they refinance within two years, they’re going to find it unpleasant. Still, many can sell their million-dollar property and buy for cash in another state. And even buyers in California are cash buyers. 40% of buyers in Santa Cruz for instance buy with cash. So where sales can happen without high-rate financing, they might.

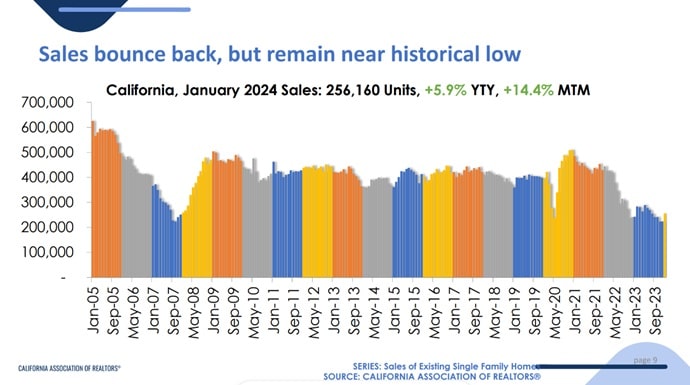

As the chart at right shows, listings and sales are up, and California Realtors polled in March believe home prices will rise. They’re optimistic about sales and listings, and that buyers will be facing higher prices.

CA’s high-priced housing market is a factor as high rates lagging effect erodes the economy. 4 of California’s counties rank at the top nationwide for home prices, with Santa Clara first at $1,583,000 average. This means affordability is an issue for out of state or foreign buyers as few can afford to buy at these prices. Yet California is never without buyers as it is the most amazing place to live. The climate, terrain, tech sector, and more continuous newcomers.

One note though is that the atmospheric rivers the last year, albeit damaging, have given new life to agriculture and tourism. This will draw potential buyers from across the country as they see the high Sierra, central valley and Yosemite Park come to life. It will be a special year and the travel market will be booming.

Sales Grow a little but 2024 Might not Be the Boom Expected

While many buyers and sellers were counting on fast-declining FED rates, it’s looking more like that won’t happen.

In fact, right now in March, the economy is in its best light with reasonable GDP growth, moderate price increases, and expectations for lowering interest rates.

C.A.R. Senior Vice President and Chief Economist Jordan Levine reflects on the rate troubles: “The increase in new active listings for the first time in 19 months was great news for the California housing market… With rates climbing back up to a two-month high earlier this week due to the latest inflation concerns, potential home sellers could hit the pause button on listing their house on the market and wait until rates begin to ease again. Or they might panic as others start thinking about unloading and moving on.”

As the realization of higher for longer sets in, buyers will be more cautious.

What’s driving CA Home sales Right Now?

It’s most likely the cost of living is simply too painful and Californians need to move out of state to get relief. Given California has the most pricey real estate, sellers are at least able to get more house for the dollar when they move to Arizona, Texas, Florida, Tennessee, or other low tax states.

Being free of California’s monster taxes is the passon of many sellers, and Realtors might be focusing on that end in their marketing campaigns to sellers. Being sympatico with sellers is the key to gaining their confidence.

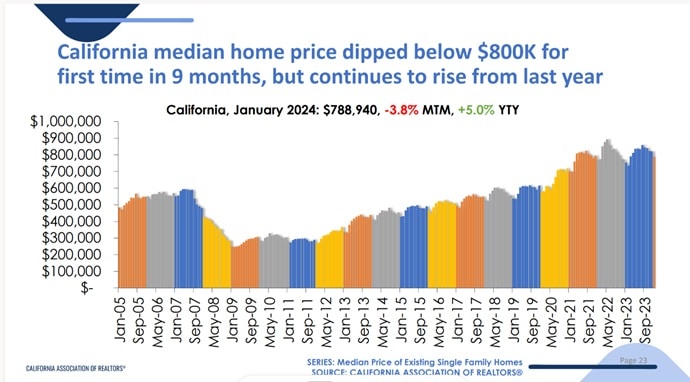

Current CA Home Prices

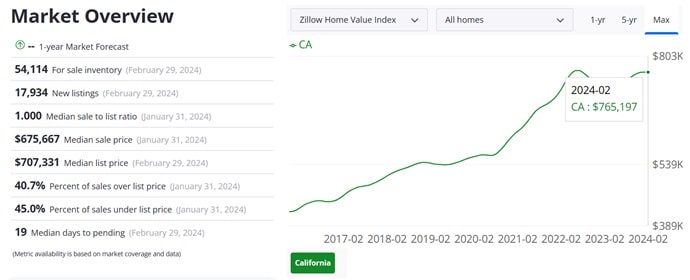

Zillow gives us the most updated price report so far this spring. The median price of a home, all types is up almost $50,000 vs February of last year. And for single family homes, price is up about $42,000 since last February. Home prices are flat of recent, perhaps reflecting the weakening confidence that mortgage rates will fall much this year.

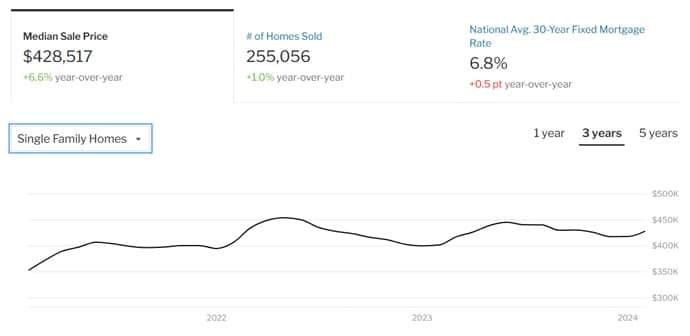

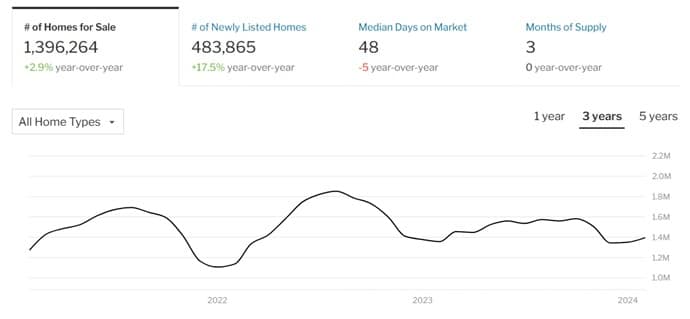

Redfin’s Price Report

Redfin’s most recent report show prices rising faster this year than last, with a price rise of 6.6% to a new median of $428,517.

Sales of homes in February were not much better than the pandemic era lockdown period. Home listings grew 2.9% YoY, while new newly listed homes rose 17.5%. Homes are selling faster.

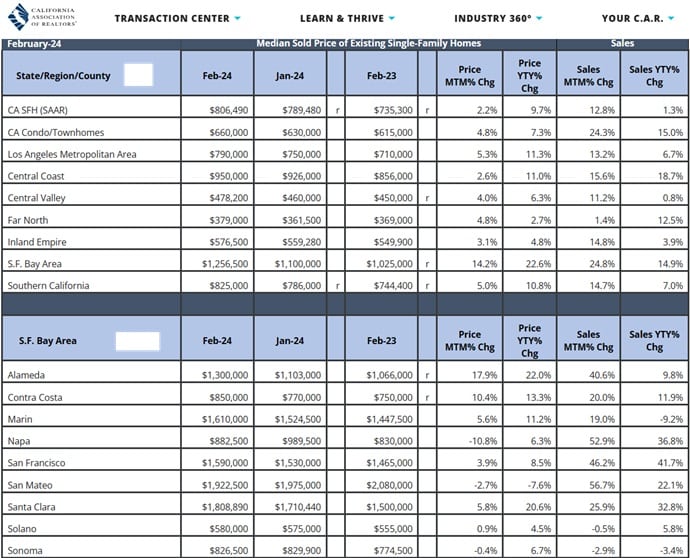

CAR’s Housing Market Report

The latest California home sales report from CAR.org shows prices are falling statewide month to month.

Beautiful California so Hard to Resist

Despite the disastrous situation in this state’s politics and governance, buyers still climb over themselves to get at whatever properties are listed for sale. If not for mortgage issues, home prices would be higher still, and there are indications this housing market is beginning to turn the corner to recovery.

In fact, no one believes the housing market is in store for a 2008 style crash. The banking system is better this time around and the US economy is is ready to spring back strongly. $5 trillion in money markets may not move to the stock market, but instead could move to the real estate market. And as interest rates recede, the tech sector will move into high gear.

Still, an agonizing period of suppression and pain for buyers and sellers remains for the next 12 months, until mortgage rates drop. This is when a housing boom is more likely. In CA, one major hurdle remains — anti-development real estate laws. What is being done to free up this state?

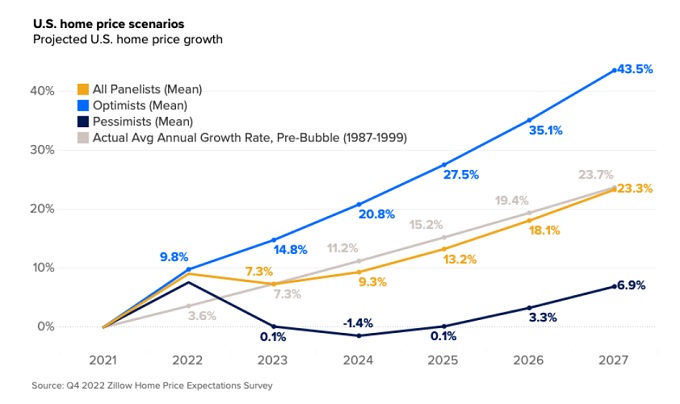

Before we dig into the less-than-optimal conditions in the CA markets, let’s see what Zillow’s experts say about the road ahead for the US housing market. The most optimistic are predicting average price hikes in the 30% range while the pessimists see only a 6.8% hike over the next 4 year period. The negative outlooks though don’t make sense. The US is positioned for tremendous growth with the repatriation of manufacturing to the US, the Chips Act, and interest rates will decline in 2024. California is over its painful, lengthy rain drought and the Silicon Valley tech sector should come back in the next few years.

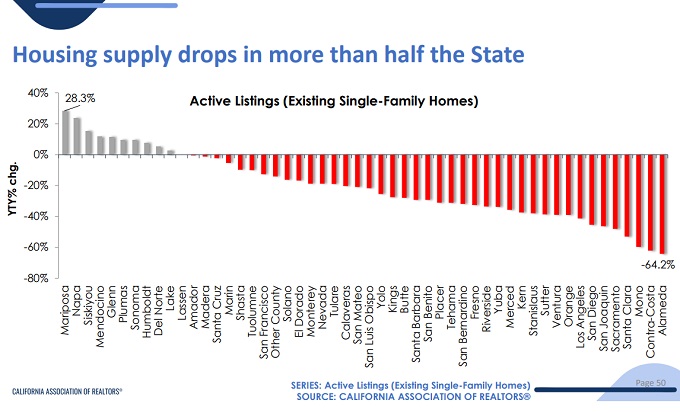

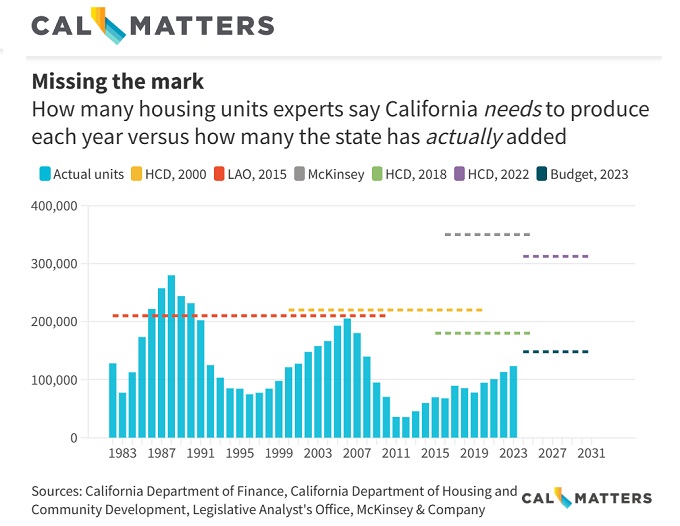

An unspoken problem by many about the California housing market, is a severe lack of housing which spawns additional problems and costs in the form of rampant crime and homelessness. It is no doubt reducing home prices, creating groundwater pollution (Santa Monica Beach), raising property taxes and creating significant social challenges in urban areas. It is a cause of people moving out of the state or moving inland.

A rising tide of pushback by Californians may help open up land for development and perhaps remove harmful taxes to get construction launched.

New Home Construction California 2023

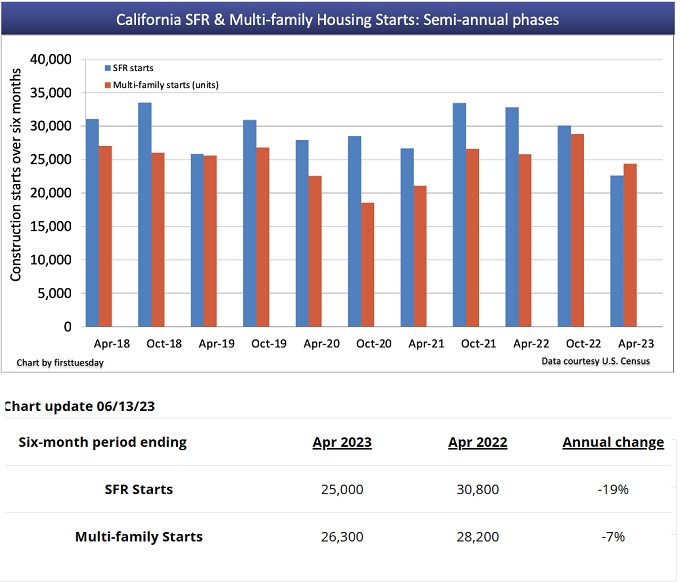

Despite claims, this chart from FirstTuesday using US Census data clearly shows decreasing new house and multifamily construction this year.

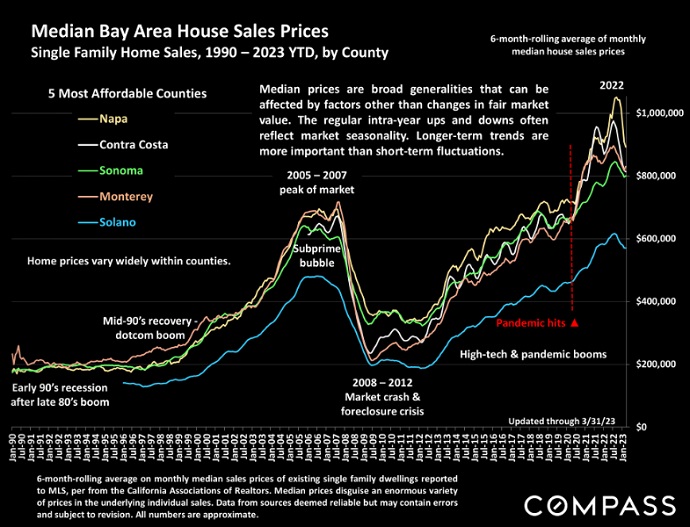

This Chart from Compass, shows the downward trend in Bay Area home prices this year clearly.

Positives and Negatives Driving CA Home Prices

There’s so much happening in the Golden State that even housing experts and economists can easily get lost in the details and lose sight of its true direction. This post might provide a more clear view for buyers trying to time a purchase and sellers wanting to sell at the right time in 2024.

The state’s faltering economy, high cost of living, and crippling taxes have made more Californians leave the state for greener pastures. And with all of that, the state reported it has created more homes than at any time since 2008. Yet times have changed with new types of buyers with different needs in 2023 especially an affordable price.

Besides its incomparable climate and geodiversity, what separates the Golden State from New York, Florida, Texas, Arizona, Georgia, Massachusetts, etc. is its onerous housing regulations and anti-housing development sentiment. The state keeps finding ways to create laws to make it worse (e.g. mansion taxes, exit taxes, proposition 13).

The housing shortage in CA continues causing massive increases in price and making any homes for sale, anywhere in the state, a holy grail for Californians. For buyers, almost nothing favors them in their quest to buy their dream home in California. Yet, if those who exited for Texas, Florida, Arizona, Oregon, Utah, etc. hadn’t left, this market would be unbearable.

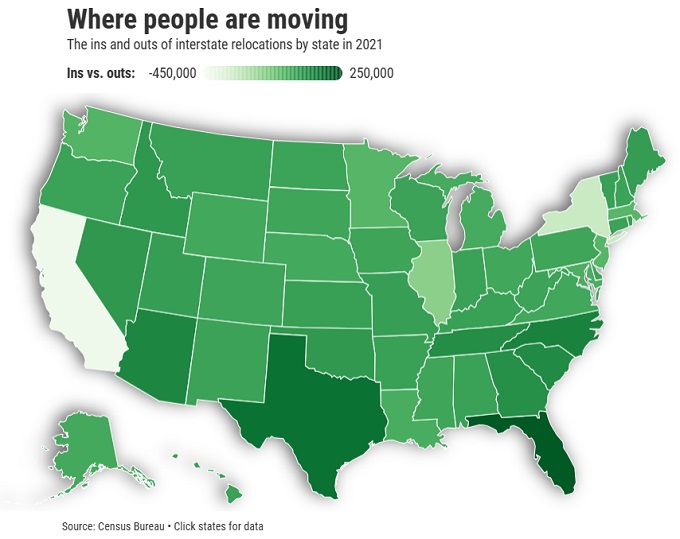

Where are Californians Moving To?

This chart from the Orange County Register where Californians are relocating to: Texas, New Mexico, Florida and North Carolina. There’s still that question though, that if you’re in technology, can you leave the Bay Area? It’s still the major center for software technology? Or is Texas zero tax culture just too much to ignore?

CalMatters on the Real State of Real Estate in CA

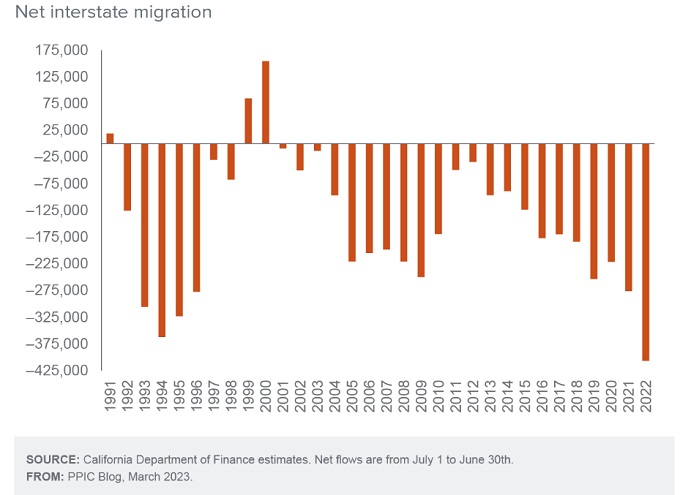

Calmatters interstate migration report shows a strong, growing trend of out-migration to 2022.

The June home resale report from CAR shows continued strength in home and condo prices, yet sliding sales. Sales are down due to prices, but also due to credit tightening and higher mortgage rates which are locking sellers into their homes.

Sellers Locked In, Buyers Locked Out

CAR’s sales chart shows it was bad as the Great Recession. Only 7 of 51 counties reported a growth in sales.

It’s a hint of madness in many levels of government who pride themselves on being progressive and innovative, when the miserable starkness of the truth in the 2024 real estate scene says otherwise. New construction permits are down with builders enjoying selling what they release at higher prices, yet finding land and financing if necessary is a big stopping point. The new construction market in California has bravely helped but likely can’t be counted on in 2024.

Macroeconomic fundamentals still drive housing markets from San Diego to Los Angeles to the Bay area. And the anti-housing lobby supercharges prices further higher as more buyers seek to avoid the risk of renting. And many more rental properties are being purchased by buyers thus diminishing the rental market.

Most expect mortgage rates will subside in 2024, and we’re wondering how that will impact transactions and prices next year. Who would argue that home prices will surge past records set in 2022? This year’s shocking rise makes little sense, but we might dub 2024 “buyers gone wild!”

And is the market in California one where buyers search and buy where there is inventory, not necessarily where they want to live? Who want to go somewhere they don’t live like way inland? Well, buyers and renters are heading inland for something, anything to rent or buy. Yet even there, prices are rising fast.

More buyers seem to be mortgage rate agnostic, desensitized to the 7% mortgages, which are still much lower than other overheated sales years. Rates are about at average for the last 40 years.

And the FED suggests they’re going to keep rates high for a while, even if inflation does fall. They believe the US economy is healthy and wants to roar. They want to put the kibosh on that.

Mortgage Rates and Trends

The Fannie Mae Home Purchase Sentiment Index® (HPSI) rose .4 points in June to 66.0. The overall sentiment of buyers is negative, that it’s the wrong time to buy a home. In California, this might be higher.

While mortgage rates likely aren’t going to drop, they will likely not go higher. That stability might help some buyers make their decision to buy this year.

Realtors will need better strategies on how to get homeowners to sell their homes.

California Home Price Growth 2017 to 2023 by County

Pandemic era boost in price has given Californian homeowners massive equity growth.

| Home Price Growth in California Counties | |||||

| California County | Median Price June 2023 | Median Price April 2023 | Median Price May 2020 | Median Price 2017 |

6 Year Price Change

|

| Alameda County | $1,305,000 | $1,230,000 | $955,000 | $834,500 | 56.38% |

| Butte County | $413,000 | $469,000 | $362,000 | $329,500 | 25.34% |

| Contra Costa County | $930,000 | $900,000 | $690,000 | $570,750 | 62.94% |

| Fresno County | $429,000 | $413,000 | $295,000 | $265,000 | 61.89% |

| Kern County | $380,000 | $375,000 | $270,000 | $220,000 | 72.73% |

| Los Angeles County | $832,000 | $738,520 | $546,930 | $581,000 | 43.20% |

| Madera County | $447,000 | $420,000 | $297,500 | $240,500 | 85.86% |

| Marin County | $1,700,000 | $1,790,000 | $1,500,000 | $1,015,000 | 67.49% |

| Merced County | $390,000 | $365,120 | $285,000 | $275,000 | 41.82% |

| Monterey County | $796,000 | $952,500 | $650,000 | $582,000 | 36.77% |

| Napa County | $840,000 | $815,000 | $672,500 | $635,000 | 32.28% |

| Nevada County | $574,000 | $550,000 | $410,000 | $400,000 | 43.50% |

| Orange County | $1,260,000 | $1,225,000 | $834,550 | $708,500 | 77.84% |

| Placer County | $680,000 | $650,000 | $515,000 | $485,000 | 40.21% |

| Riverside County | $628,000 | $615,000 | $434,480 | $380,000 | 65.26% |

| Sacramento County | $530,000 | $515,000 | $395,000 | $355,000 | 49.30% |

| San Bernardino | $470,000 | $450,000 | $320,000 | $329,750 | 42.53% |

| San Diego County | $960,000 | $930,000 | $655,000 | $550,000 | 74.55% |

| San Francisco County | $1,600,000 | $1,587,500 | $1,627,500 | $1,325,000 | 20.75% |

| San Joaquin County | $530,000 | $520,000 | $415,000 | $386,500 | 37.13% |

| San Luis Obispo County | $865,000 | $925,000 | $632,500 | $599,000 | 44.41% |

| San Mateo County | $2,040,000 | $1,970,000 | $1,650,000 | $1,250,000 | 63.20% |

| Santa Barbara County | $1,200,000 | $1,080,500 | $637,500 | $545,000 | 120.18% |

| Santa Clara County | $1,800,000 | $1,800,000 | $1,365,000 | $1,000,000 | 80.00% |

| Santa Cruz County | $1,200,000 | $1,349,500 | $850,000 | $727,000 | 65.06% |

| Shasta County | $385,000 | $390,000 | $297,000 | $244,500 | 57.46% |

| Solano County | $590,000 | $580,000 | $482,000 | $415,000 | 42.17% |

| Sonoma County | $850,000 | $840,000 | $675,000 | $595,000 | 42.86% |

| Stanislaus County | $460,000 | $455,000 | $350,000 | $300,000 | 53.33% |

| Tulare County | $375,000 | $357,000 | $255,250 | $230,000 | 63.04% |

| Ventura County | $930,000 | $885,500 | $681,250 | $575,000 | 61.74% |

| Yolo County | $620,000 | $610,000 | $443,000 | $447,500 | 38.55% |

| Yuba County | $445,000 | $447,450 | $320,000 | $298,250 | 49.20% |

| Stats courtesy of CAR. | |||||

See more on the Los Angeles housing report, San Francisco housing market report, San Diego housing market report and the Sacramento housing report.

Forecast for California 2024 to 2027

Zillow’s panel of experts predict falling prices for the rest of 2023, yet see price growth picking back up, at an average clip of 3.5% per year through 2027.

Please Do Share the California Housing Report on Facebook

View more forecasts on the real estate housing market |, and the latest home prices and sales trends for numerous major metros in California including San Diego, Los Angeles, San Francisco, and Sacramento. See stats on other cities, including Denver, Dallas, New York, Boston, Atlanta and in the Florida housing market in Miami and Tampa. Visit linkedin if you’re seeking advanced level SEO and real estate marketing services.

Rising mortgage rates, inflation, reduced housing supply and high home prices threaten the markets, it appears 2002’s real estate scene will stay strong. Realtors may want to build their presence this year as house prices decline in 2023. Lower prices will bring plenty of homes onto the market and boost your opportunities.

Real Estate Housing Market | Dream Homes California | Dream Homes Florida | Housing Market Predictions for Next 5 years | Will Home Prices Fall? | Will Housing Market Crash? | 6 Month Stock Market Forecast | Stock Market Predictions | Florida Housing Market | Travel Marketing Tips | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel | Silicon Valley SEO | Sacramento Housing Market | Malibu Housing Market | Why Are California Home Prices High? | SEO Expert