Bitcoin Price Outlook

Bitcoin crashed suddenly and shockingly this weekend to $35,388, far below the big highs of last month. In some markets, it even it hit $28,000 so it appears cryptocurrency is in some hot water right now. However, for smart investors, this dumping is a buying the dip opportunity.

The BTC crash including an 18% plunge in one hour is being attributed to profit-taking and macroeconomic fears. Of course this coming Wednesday, executives from 8 major cryptocurrency firms are expected to testify before the U.S. House Financial Services Committee. They’re struggling and stumbling about how to regulate cryptocurrencies and this could be interpreted as a sabotage attempt by investors and Cryptocurrency companies.

This is nothing new since Bitcoin has been extremely volatile. As speculative stocks, bitcoin stocks are risky and investors are learning new respect for risk. Some however, see the volatility as ideal for trading and making some nice profits on the rise that’s no doubt ahead.

The Race for $100,000

The predictions for BTC price were to the extreme to $100,000 and up, and even $61,000 was thought to be outlandish. The belief was that long term, Bitcoin is going to be a core currency and store of value.

Crypto bulls always have a positive Bitcoin price forecast and even China’s rejection of Bitcoin and crypto doesn’t deter them. They believe that will only leave China out in the cold and the outlook for Bitcoin is upward. Those who support Bitcoin/Litecoin/Ethereum point out that it is a better store of value. That’s because, for instance, only 21 million Bitcoin can potentially exist (after they are all mined).

Contrast that with the US dollar or China Yuan, where they are devalued deliberately and more of it is printed. They don’t retain their value over time. A smart investment then is Bitcoin which is after all a currency and seemingly a good store of value. Of course, all currencies could be digitized, which means all the threats to crypto haven’t been uncovered.

Speculation Will Collide with Regulation

Cryptocurrency began to draw a lot of speculative investor attention beginning last year. Investors flooded in including Elon Musk and Cathie Woods. Prices have skyrocketed, but it’s still volatile. and ready to plummet. This week’s drop is perfect evidence. Yet that’s our buy the dip opportunity.

Bitcoin is all about speculation since it has no real asset value. And then there’s the adoption barriers including including governments, energy and climate change opposition, technology infrastructure issues, and competition amongst currencies. China is just the first major government to kick Bitcoin out the door. There will be more.

The biggest issue might be that no one knows what a world using Bitcoin looks like. Could it be a platform for complete economic meltdown. Enthusiasts don’t care, but the price plummets every time it hits an objection roadblock. And if economies stumble, investors will dump Bitcoin fast. There’s nothing to support its valuation.

Bitcoin, Ethereum, Litecoin and Dogecoin are also unregulated and speculative investments vulnerable to volatile price changes. Buyer beware of any investment that has no real asset backed value.

And on the road to legitimacy stands the mighty Elon Musk who supports and disclaims crypto on a monthly basis it seems. If crypto needs flakey billionaire support, we wonder if it’s legit, or a pump and dump scheme. Credibility is another issue crypto faces, especially with so many of them available.

Trading on Bitcoin Volatility

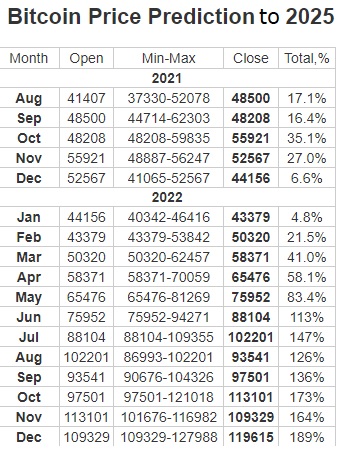

In my posts on Bitcoin volatility and buying the dip, I suggested a dip is coming in the markets. Now with President B stumbling and making horrible errors and potentially facing impeachment, the issue of a Bitcoin drop and 2023 stock market crash is upon us. The Bitcoin dip opportunity is coming, perhaps in December or January (according to longforecast). This week’s dip isn’t the big one.

Long run, many speculate Bitcoin is headed for dizzying heights, perhaps even $700,000 (euphoria outlook). Yet if the economy stumbles (interest rates will have to rise, wars will happen, corporate earnings might drop, inflation grows and oil prices rocket), it could fall. In fact, a big correction may be coming in 2023, accompanied by a crash of the housing market too. So when we talk rises, we’re really talking about one more year to make big money with Bitcoin.

Like clouds forming on a hot, muggy day, we’re not sure how the storm will play out. Each month it gets clearer, signals get stronger and the panic begins. Yet, right now investors are keen that Crypto will survive and thrive in the long run. They’re likely right.

Then, in 2023, we’ll see another dip buying opportunity before it races skyward. So there is a way to make money off of volatility if you’re very smart (and lucky).

Regardless, from day stock trading speculators to banks to self-directed stock enthusiasts, the demand for BitCoin, Ethereum, Dogecoin and other cryptos has been very brisk. Of course, the joke currency Dogecoin (Dog e Coin) got slapped on by Elon Musk.

Almost vertical on the charts and if more investors take the leap, the price might hit the heights forecasted below. Last week, the prices plunged, but they’re recovering and crypto investors are hoping they might hold their value going forward.

Buying cryptocurrencies such as Bitcoin, Dogecoin and Ethereum is so inviting, institutional investors are withdrawing funds from the stock market and moving them into the Cryptocurrency markets.

Should you invest in Cryptocurrencies such as Bitcoin, Dogecoin, or Ethereum? A lot of investors feel a fear of missing out on the mighty climb of prices, but are they more likely to lose their shirts than make money?

The banks and Billionaires are buying Bitcoin, so they’re hopping on board. There are thousands of cryptocurrencies, and in a crash, they will likely succumb, but Bitcoin and Ethereum may be okay.

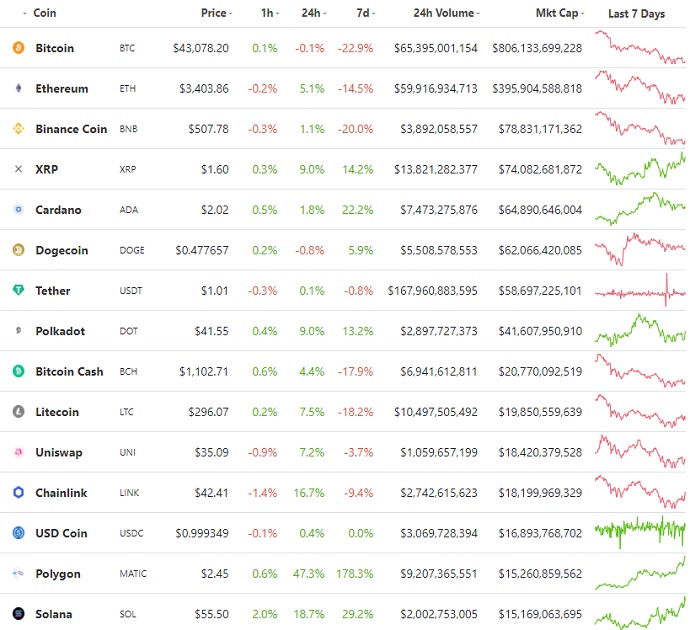

Yet, crypto is insecure and speculative so investors need stomachs of steel to endure the journey coming. Bitcoin was cheap before, but it isn’t now. Interestingly it’s the lesser lights such as XRP, Polygon and Solana that are attracting buyers. Some critics have said Bitcoin will never be accepted, which turns our eyes to technologies that might work. And what’s at issue isn’t how much electricity the systems use but rather how currency manipulating governments will live with it.

The Bitcoin forecast is bright but it’s mostly speculation that’s made it jump 8 times it’s value for Ethereum to jump 500%. One thing for sure, Crypto and Bitcoin have been a hot price pace since last November.

What’s Driving Bitcoin and Etherium Valuations?

- desire to evade banking system regulations

- desire to eliminate fiat currency exchange fees

- desire to end international money laundering

- desire to speed up international trade payments thus improving trade

- even if the US, Japan or Europe reject Bitcoin and crypto, there are plenty of countries who will embrace it

Yet Bitcoin may have plenty of negative side effects such as lack of regulations, criminal hacking, lack of ability to fix errors, no customer service, rising service fees, lost financial sovereignty, lost keys, etc.

Those diving into cryptocurrency might be idealistic and care not to see the downside which is certain to show up at the worst time. They haven’t stopped to consider how something could jump 8 times its value with no earnings statement to back it up.

Speculative Currencies

The astonishing rise of the price of Bitcoin this past year has shocked a lot of investors, economists and government leaders. Is the rise of Bitcoin cryptocurrency a serious opportunity for investors, or is a fool’s paradise?

Currency traders lose millions in forex trades and they have to write off the losses. The CEO of a crypto company in Turkey left the country with it’s $2 Billion after Turkey banned cryptocurrency. They haven’t found him yet.

Some forecasters predict Bitcoin will hit $100,000 in future and one prognosticator believes it will reach $500,000 in 2030. Another says $1,000,000 by 2037. See what a host of experts on BitCoinprice.com are predicting.

Only 21 Million Were Sold Originally

Only 21 million Bitcoins were produced. It’s hit $60,000 per coin already out of thin air, 8 times its value of recent, so $100k is hardly impossible. How can you limit forecasts of such speculative assets in a euphoric era? These people making predictions never explain why they believe in these lofty prices.

But the higher it goes, the more risk is presented, especially to the shaky overindebted US economy and an army of small retail investors. But if Bitcoin (and Etherium) do become the defacto international currency, will there be a fire sale on US Dollars?

Honestly, the downside during this market bubble is so scary, it’s difficult to understand why government officials aren’t warning investors about Bitcoin. India has applied an emphatic ban, obviously wise in a developing country where catastrophic losses would hurt.

Have the global stimulus payments simply transitioned into cryptocurrencies? Are they a safe haven once stimulus ends?

By 2023, when stimulus fades, taxes rise, interest rates grow, and foreclosures on million dollar homes begin, investors will sell their cheapening US dollars, but will they gamble on cryptocurrency? How would a forecaster know the outcome?

There’s a lot of investor psychology and euphoria involved in Bitcoin valuation. But when bubble’s burst, all assets have traditionally crashed too. And gold is no haven but then perhaps this is where everyone is headed.

One expert says cryptos are most in trouble after a very steep price climb. Of course, there’s nothing to levitate its price. Etherium’s Joseph Lubin, co-founder of Ethereum pointed out that fraud is rampant in development with grab and cancel outcomes on projects. Several years ago, $300 million in Etherium as apparently deleted by mistake. And the creator of Etherium, Vitalik Buterin, the creator of Ethers was only 19 when he invented this system, and government regulators and investigators haven’t scrutinized the security of Etherium.

Elon Musk and Cathi Woods Purchases

Both Elon Musk of Tesla and Cathie Wood of Ark Investments have wholeheartedly given Bitcoin a vote of confidence. You can buy a Tesla with Bitcoin now. Wood has purchased half a billion of Bitcoin and Musk/Tesla bought about 1.5 billion of Bitcoin.

Despite their exuberance about Bitcoin, too many financial people are overlooking the potential risk of full adoption of Bitcoin and reliance on it within the business and investment community. This has to be researched more thoroughly.

Experts need to clarify the outcomes. Governments will have to regulate cryptocurrency, and that rumor is what sent Bitcoin crashing yesterday.

Bitcoin Valuation

The valuation of Bitcoin is so ethereal and speculative, that it seems impossible that anyone could put forth a Bitcoin price forecast. But you’re bound to find a few predictions. In the short term, they may be relevant, and at worst insightful. Every speck of insight helps but there’s big picture factors that actually dictate where Bitcoin will be in the next 5 years.

This crypto enthusiast (CryptosRUs) talks about CNBC’s chart master gaff where he suggests to sell during a big breakout of Bitcoin last fall, at $20,000. Of course, it kept rising to $60,000 per bitcoin! History tells us nothing other than the folly of trying to predict Bitcoin’s price without more data, and without knowing when the US President might put the Kibosh on it.

Cryptocurrency models suggest that Bitcoin is finite, and the 21 million bitcoins that exist are simply priced upward due to supply and demand mechanics. Yet, there are other cryptocurrencies, flooding the market with currency. What if they surge or fail? Does this change the Bitcoin price valuation outlook?

What Will Governments and the Big Banks Do?

Do the big banks like Crypto? Do they care which type of currency account holders and mortgagees use? Would they accept payment in Bitcoin? Reports are that banks around the world are considering supporting cryptocurrency payments and buying Bitcoin.

Back in January, the U.S. Office of the Comptroller of the Currency (OCC) issued a letter approving U.S. banks to use public blockchain networks. And that sent many of cryptos soaring in price. So government action when it happens can significantly affect price valuations and have to be considered in Bitcoin forecasts.

Globalist investors don’t care about the survival of a US, Japanese or European economy, but those respective governments and their citizens do care. The uncontrollability of cryptocurrency is a big negative that isn’t factored into Bitcoin’s price yet.

Those opinions of Bitcoin and the volume of stimulus money spilling out into markets at any one date, could be all you have reference to.

Bitcoin and other currencies are treated as a store of financial value in contrast to major currencies, stocks, gold, diamonds, commodities, etc. Some investors believe Bitcoin will replace the dollar, but can the US economy base itself on a currency it doesn’t control? That is really risky.

But while we understand the value of real, finite assets, Bitcoin is more of a digital world currency and it isn’t controlled by governments we elected, and who represent our best interests. Currencies are actually representations of their governments and economies so does cryptocurrency threaten these social and legal organizations?

The amount of electrical power and computing power needed to operate cryptocurrency storage and exchange is frightening. In an age of eco-sensitivity, it makes little sense to choose Bitcoin. If Bitcoin becomes the financial world’s currency, is there enough electricity to run the Bitcoin system?

It’s these issues that will persistently cloud the Bitcoin price forecast, among other issues.

International Risks

Although cryptocurrency is lauded as an Internet currency, investors have lost huge amounts when they lost their “key” an identifier for their coins. Cryptocurrencies may not have any advantage over traditional currencies in financial transactions or retail purchases. Although a few consumers have opened Bitcoin accounts, they are basically competing with dollars and lack a substantial benefit.

Could crytocurrency accelerate global inequities between trillionaires and growing hoards of penniless masses? This will be looked at shortly too and likely will send Bitcoin values downward. And do banks and governments really understand cryptocurrency? If a government were to suddenly lose all its cryptocurrency, how would that effect its economy and tax base?

I would classify Bitcoin as a competitor for the US dollar, Euro and Yen currencies. Who decides how much Bitcoin exists and is that amount in circulation sensible and sensitive to real world economic conditions?

We’ve seen two big pullback’s on Bitcoin’s price recently and we’re wondering if we’re about to see a bigger Bitcoin price crash? If the stock market crashes, will cryptocurrencies fall with it?

If institutional investors get the jitters and begin pulling out of the cryptocurrency, will we see it drop to $20k as Guggenheim’s advisor believes it will. If governments come to the conclusion that cryptocurrencies are a threat to country’s currency valuations and that reliance on cryptocurrency is extremely risky, will that bring an axe down on Bitcoin, Coinbase and Dogecoin.

Bitcoin Price Momentum?

What is the reason Ethereum’s price is rising while other coins are falling? There’s a lot going in on cryptocurrency markets and investors are keenly interested in the Bitcoin price forecast and the outlook for cryptocurrency.

After his Bitcoin price prediction of $146,000, JPMorgan Managing Director Nikolaos Panigirtzoglou noted the falling price for and he feels concern. Experts feel the momentum that drove the price to $60,000 might end and thus send it back the other way.

If Bitcoin’s price is all about momentum, then certainly any cessation of investor demand and price growth would be concerning. What is the core reason investors have bought Bitcoin? If it’s pure speculation, then a crash has to be imminent. There is so much liquidity in the economy and markets, and cryptocurrency is part of it.

Is cryptocurrency as desirable or secure as the US dollar or Japanese Yen? What will the battle between the currency formats be like? If the stock market and housing market should crash in the next 24 months, will Bitcoin keep its value, or will it be the first asset to be sold?

As you can see Bitcoin’s recent huge price started during the pandemic. Is this due to government stimulus efforts and retail investors enjoying a speculative opportunity? Or is there a significant purpose for cryptocurrency in our modern economy?

Now that investors have sunk $2 trillion into cryptocurrencies and much of that total in Bitcoin itself, it has to be taken seriously. If Bitcoin collapses, where will those funds head to next?

If you want to invest in the Cryptocurrency craze, you can avoid Bitcoin and instead buy into Cryptocurrency ETFs. And you can buy Coinbase stock as it’s simply a transaction vehicle and a wallet to store your cryptocurrency.

Note: The statements and information presented in this post is not intended as professional investment advice. It is solely an exploration of Cryptocurrency investing and the risks, perils, and behavior of stock markets and the economy. No one should rely on a single source of information or investing professional’s advice. The overall message of the post might be to diversify stock, currencies, real estate, and cash/gold holdings as a hedge against stock market crashes. Investors should look into hedging strategies but be aware that even hedging may provide limited protection from a crash.

Stock Market Predictions | Best 5G Stocks to Buy | Stock Market Today | 6 Month Stock Forecast | 5 Year Stock Market Forecast | Best Oil Stocks | Best Recession Stocks | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates