US Economy Outlook 2024

Are we to believe the weak GDP and economic forecasts for 2023? And how about 2024?

The reason forecasts and predictions miss so often, is that forecasters don’t consider politics and news media manipulation. The macroeconomic outlook is colored by politics — China, Saudis and Biden.

Know one talked about the debt ceiling/national debt crisis, and I felt my coverage was not a popular topic, but here we are at a breaking point (McCarthy has announced a tentative deal, which will send the markets soaring this week. It’s suppressed stock markets around the world temporarily, but it looks like they’re going to work out a deal to kick the can down the road two years to 2025. A two year reprieve when the next payment due will be above $1 Trillion.

The bet today is that AI and automation will be the savior. And is AI ever being hyped right now.

Powerful, Tech Enabled, Resourceful Economy Looking to Grow

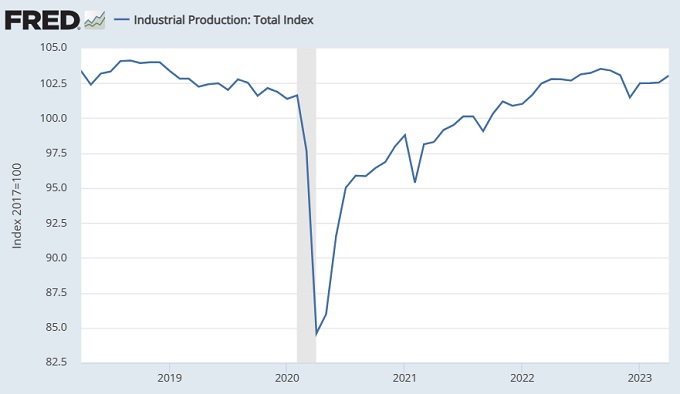

The US economy has huge potential and really, more stimulus is not needed. It would worsen inflation and cripple the economy for the next 5 years. Inflation has been beaten and after the summer rush, it will fall in late 2023. Core (PCE) Inflation jumped back up to 4.7% growth year over year. Industrial production is particularly strong after the pandemic and there’s plenty of financial resources in the system to power it up for 5 years.

Bankers are calling for more rises in the FED rate in response, so it’s proof that government spending needs to return to prepandemic levels. The pandemic is over, so spending suggests ulterior motives of the Biden regime.

Can an economy bursting with millennial/Gen Z demand, high immigration, and still rich corporations be contained? If high Fed rates are killing the economy, can the rates keep consumer and business optimism crushed for long? With lower interest rates ahead, the outlook for the US economy has to be positive.

Consider the euphoria over AI which the US is excelling in due to OpenAI’s ChatGPT solution which developers are building new plugins and software using the new API. NVidia and other US chipmakers are soaring in value, and those stocks likely will continue to grow.

2024 is the Year of the Upward Launch

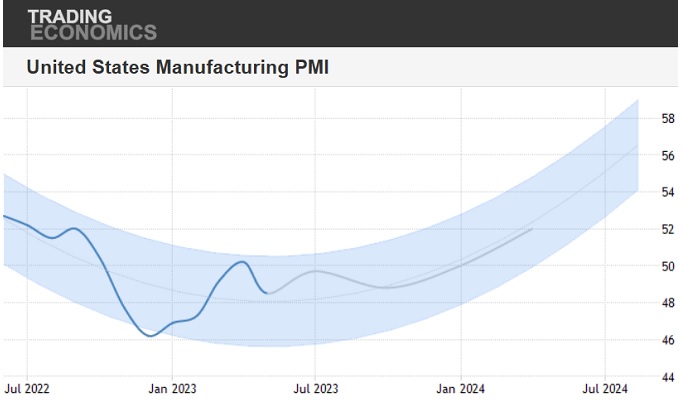

As Trading Economic’s Forecast for 2024 reveals, manufacturing must recover. Supply is strong right now, with retailers beginning to discount, but those supplies will diminish and need to be replaced. Manufacturing will have its own stimulus.

China Manufacturing and Investment Brought Back to America

The biggest single factor in a recovery is in onshoring investment/manufacturing that China has taken for the last 20 years.

This represents trillions in future value for US companies and the American economy. Truly astonishing numbers. The Republicans realize this and it will be part of Florida Governor Ron Desantis’ election bid. Any win by a Republican would be a big spark for the economy.

Although President Biden says he wants to continue an intertwined, dependence on China, relations with the communists grow more sour every month. China’s behavior shows a lack of appreciation of the trillions of trade they benefit from. The communists simply are not trustworthy and decoupling is a wise move.

So improving the trade deficit with that one single country alone is like pouring gas on a fire — igniting big growth for US companies. The stock market would enjoy easing interest rates, lower taxes, rising tax revenue without hurting American families, funds for government social programs and exciting new demand for US products simultaneously.

This would suggest the small caps on the S&P and Russell 2000 are worth a look. US small business might come back.

That’s the macro picture. China too is looking inward while they weakly try to expand militarily and threaten trading partners. They’re destroying their export markets.

The United States however could be entering a very high growth period that will have everyone forgetting the pandemic and high rate recession. For 2023, the higher rates are beginning to exert some pain. But with the 2024 being a Presidential election year, it is typically a good year, and both parties cannot talk down the economy. That means 2025 could be excellent.

Of course if you’re thinking of buying a house or other real estate, it will be tough. Much like oil and gasoline, housing will be short supply with raging price growth in homes and rentals.

While the media have everyone focused on details of slowing demand and an oppressive FED, the world is ready to grow. Despite lower cash savings, consumers keep spending, as discretionary spend has been strong. With jobs and wages okay, it will take something drastic to dampen their spirits. Investors have to look deeper to see the truth about the expert’s forecasts.

Global growth will make it challenging for the US not to participate. So far in 2023, stock market investors are beginning to breathe after a depressing 2022. January was a good month. Investors have been looking beyond the 3 month and 6 month periods to where we’ll be in 5 years. A big rally could happen.

And will rising interest rates here be able to control inflation anyway? Will the US administration be forced to let supply grow and allow the economy to improve?

Politicians of course are directed by party policies and theories they believe in, some of which are economically unsound.

For instance, which direction the Fed rate goes is a political decision, and a growing number of Americans feel increasing interest rates and going into recession is not a good idea. Some politicians want to print more stimulus money, and others want a hard ceiling for the debt limit. Not everyone’s going to be happy as the 2023 economy rolls out.

What are the Top Economic Indicators?

- GDP down to 1.3% growth in Q1 2023 (2.9% in the 4th quarter of 2022, )

- consumer confidence fell in April to 101.3 down from 104.0 in March.

- unemployment (down to 3.4%)

- industrial production (102.95 down 2 points since 2022)

- consumer spending (rose 0.8% in April, vs .1% in March)

- inflation (rose 4.6% in April vs 6.5% in December 2022)

- housing market (Sales rebounded 11.8% on a year-on-year basis in April while prices dropped 8.2%)

- new homes sales (rose 4.1% in April and is 11.8% vs April 2022)

- retail spending (rose 0.4 percent vs March is up 1.6% from April 2022)

- US Composite PMI has risen to 54.5 in May 2023, up from 53.4 in April

Those are some significant signs the economy isn’t doing so badly hence the belief that this is a soft landing from a wicked fast rise in interest rates. If rates were 10% instead of 5%, then the story would be different.

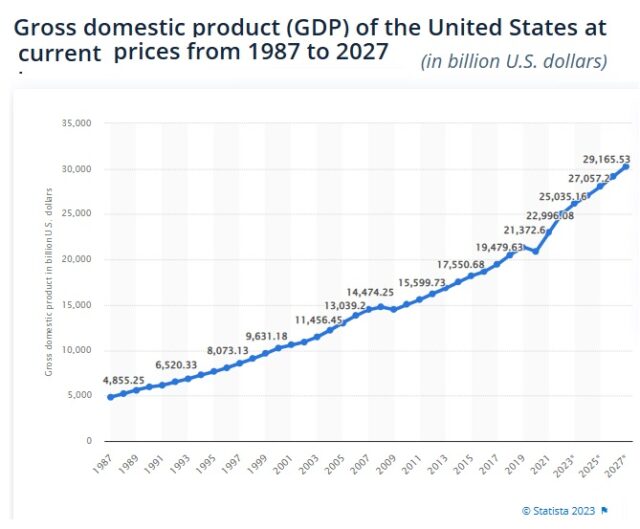

US GDP Rolls Along

The 5 year outlook for GDP is good despite warnings of a flat economy for the next decade. Where there’s money and spending, there is employment and GDP growth. Investment money will return to rebuild America.

Macro warnings: The end of US FED stimulus, a fast tightening M2 money supply, rising interest rates to fight high inflation, pandemic-weakened consumer demand and supply chains, along with being at the end of a long bull run, super high housing prices, and the debt limit crisis were macroeconomic warnings that until recently held weight.

Yet at this point, we can see the light at the end of the FED tunnel.

About Supply and Inflation

One point of contention is about supply to markets. Supply chains did finally become unblocked however regulations continue to suppress American freedom and productivity. This all based on ideological concepts with no regard to the political and economic long term consequences.

Oil, housing, copper, and other commodities are over regulated, thus artificially suppressing supply and raising prices. For example, raising the lending rate is forcing the cost of home ownership up, thus fueling more inflation — the kind that risk a housing market crash.

The FED is focusing on controlling demand for cars, furniture, credit, fuel, and discretionary goods. Yet demand for heating fuel, electricity, gasoline, food, and other staples are difficult to suppress. Rent prices for instance, in a market without vacancies is impossible to suppress. 12 month leases are signed, and even after expiring, renters have little room for negotiation with landlords.

Without a massive construction effort, housing is going to suffer for some time.

Rents have only fallen minimally, and in some cities are up strongly in the last year (34% in some cities). And with workers demanded to be back in office in crowded urban head offices, some cities won’t see a rent reprieve.

The key problem is too many people with too much stimulus money in bank accounts. That supports employment and thus spending. So lowering inflation is very difficult and takes 12 to 18 months on average, probably more this time around.

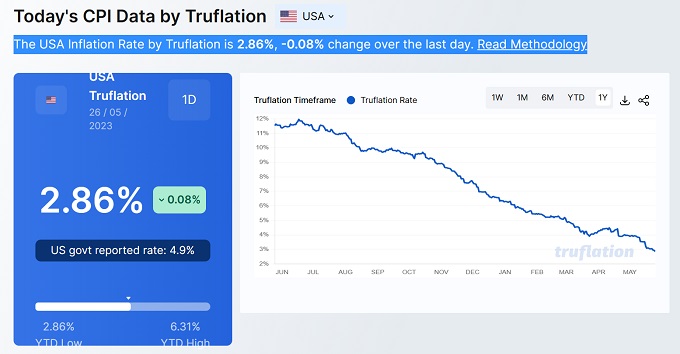

Inflation is receding, but it’s likely going to be a long time to reduce to a mere 2%. In fact, only a recession can get it down to 2%. Bankruptcies are rising, however, mortgage defaults are okay.

So far, in 2023, these issues look manageable, but many are casting a blind eye to government debt payments, rising interest rates, and trade deficits. These dark clouds trouble investors.

Inflation Has Fallen

Alan Blinder, a Princeton University economist said “The sooner the inflation rate falls, the sooner the Fed will ease up, and therefore the less the chance of a recession.”

An informal (sliding) consensus on a real recession you can feel (we’re in it now) is for a mid summer 2023 start. There is a long lag effect (12 to 18 months) before cutbacks actually hit consumers and businesses. Yet, there are forecasters, economists suggesting the economy will rebound in July 2023 due to the easing of interest rates.

However, inflation has been easing and most signs are of continued reduction, even if the January rate was a little high.

A key tool in fighting inflation would be to lift regulations on oil production. Lower oil prices would drag inflation down with them. Ideologically, the current US regime is opposed to doing so, and to stop hundreds of billions flowing into green fledgling energy projects.

A New President in 2024: A New Life for the American People

A new US President in 2024, and balance of power changes in the US Senate could result in a revival of US oil production, thus pushing oil prices well down. Cheap energy drives cheap business from micochips to transportation.

The US admin does have a “get out of jail” card they can play until the end of 2024. Then the matter comes to the voters who may not want a recession any longer.

In this way, we can see much of the recessionary pressures are politician made and undoable. If at any time, the Democrat media give up on the President, it could generate a wave of support for cheap energy.

Electricity too will only climb in price as more Americans plug in their EVs and as cryptocurrency and AI grow in usage. That adds inflationary costs for consumers.

Expect more volatility in the 2023/2024 markets. See more about the S&P, Dow Jones, and NASDAQ. Good luck picking the best stocks for the 2024 stock market surge.

The stock market predictions from the experts is mixed. Looking for the best tech stocks or best post covid stock picks? Independent investors should review the best stock market investing sites and self-directed investing website lists.

* the above post includes opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as general information only. For all your stock investment decisions please refer to your financial investment advisor.

Stock Market Today | Best S&P Sectors | Stock Market Forecast 2024 | Stock Market Crash 2024 | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ Forecast 2024 | Oil Price | S&P Foreast for 2024 | Stocks Next Week | 6 Month Outlook | Boston SEO | Los Angeles SEO | Stock Prediction Software