Google Anti-Trust Charges Soon?

The US department of justice continues to research and push forward on anti-trust investigation. It’s been delayed by the Corona Virus pandemic, yet the DOJ would be prepared to lay charges against Google Alphabet this fall.

Google’s stock price dropped about 3% on the news, but the DOJ’s determination could result in bigger price drops as the intent sinks in with investors. Although the charges mention android and adwords, the real issue is whether Google’s cash cow search engine, with 90% market share is the real culprit.

The small drop in Google’s price might reflect a disbelieve that any US entity would dare charge Google, much less lay fines and break the tech giant up. It’s been over 20 years since the much hated Microsoft Corporation faced similar anti-monopoly charges. The result of that suit opened up a vast set of business opportunities for tech companies.

What Will a Conviction Mean?

Generally speaking, what does an anti trust conviction really mean? It means Google has a monopoly position in the market and is using it to block competition, raise prices, and squeeze money unfairly from consumers, who have few other options.

It would lead to a more competitive situation for small businesses and a new boom in the marketplace. This means new tech jobs across the country and new startup companies actually succeeding. Investment in small tech companies would boom.

In the market of search engine results, Google is absolutely a monopoly. Something should have been done about it before, but no one stood up to them. Now with impending disaster for small business, something must be done immediately about all the mega monopolies — Facebook, Amazon, and Google.

“U.S. Senators Josh Hawley (R-Mo.) and Richard Blumenthal (D-Conn.) sent a letter to Attorney General William Barr asking the Department of Justice (DOJ) to ensure that its antitrust investigation into Google includes the company’s search operations. In the letter, the Senators point to the European Union fining Google $2.7 billion for manipulating search results as well as the Federal Trade Commission (FTC) finding evidence that Google engaged in similar search manipulation as early as 2012” — from Senate.gov.

What Good Will Come of the Court Action?

Google will likely have to be broken up into pieces, as this may be the only solution that will solve the situation. It’s various departments and subsidiaries will be identified and divided up to unassociated buyers. This will stop Google from using its financial might to stop competition, buy threatening competitors entering the “kill zone.”

It will force Google to compete with new search engines and advertising bringing the advertising and online communications world back into competitive balance.

Some believe competition solves all evils and that markets must be competitive. It’s every company’s goal to become a monopoly where they can dictate terms, processes, products and services, take advantage of data, and charge too high prices.

Some might say that if Google sold gasoline, the price would $20 per gallon

The day of monopoly judgement for Google (and Amazon too) was always looming like a trip to the dentist.

How Might Google be Broken Up?

Looking ahead at a potential break up of Google, experts are wondering which relevant parts of the company (related to the monopoly charges) would be sold off to satisfy the DOJ and US attorneys? Youtube, Google Cloud, Search, Google Play, Google Shopping, etc.

The competitive environment has changed considerably since the Microsoft monopoly times, and most markets are are now dominated by a few major companies. The trend is worsening. These companies have much more financial power and data resources allowing them to venture into virtual any line of business they find interesting, and then to dominate those markets. Add AI to the mix, and the future looks dim for their competitors.

Their control of big data is another key point of unfairness that Google, Facebook and Amazon (FANGS) will have difficulty defending in the courts. According to a Wall Street Journal, both the DOJ and the FTC have been examining competition concerns related to several companies including Facebook Inc, Amazon.com Inc and Apple Inc as well as Google.

There’s increasing serious talk about the case against Google, but we’re not hearing from any of the small businesses and competitors themselves who have been undermined by Google’s monopoly. If small tech businesses in particular begin making a lot of noise about this, it will hit the media, something Google, Facebook and Amazon must fear.

Most of the conversation is about tech consumers, advertisers, and Google solutions users but little about small tech companies trying to launch into an overly tough US marketplace.

US Attorney General Wants This Wrapped by Summer’s End

Attorney General William Barr wants to make a decision on Google this summer. And an investigation by US states and territories, which involves more than 50 attorney generals is in action too. Google is apparently complying with requests, however, Texas Attorney General Ken Paxton believes Google is dragging its feet and making filings of its own to slow proceedings.

State and Federal law enforcement are investigating Google separately which makes the outlook even dimmer for the search mega-monopoly.

In March, two months ago, Yelp, one of Google’s top critics, shared its grievances with senators on the Antitrust Subcommittee. Yelp produces local search results for consumers looking for restaurants or other local businesses. They have claimed that Google favors its own local search products and services in search, often at the expense to consumers in terms of quality.

Lowe said “Google grew on the promise of a web-shaped Google, but instead, we got a Google-shaped web, to everyone’s detriment.”

That is one issue not discussed frequently, that in some cases Google’s solution was not better than free market services.

Corona Virus the Last Nail for Google?

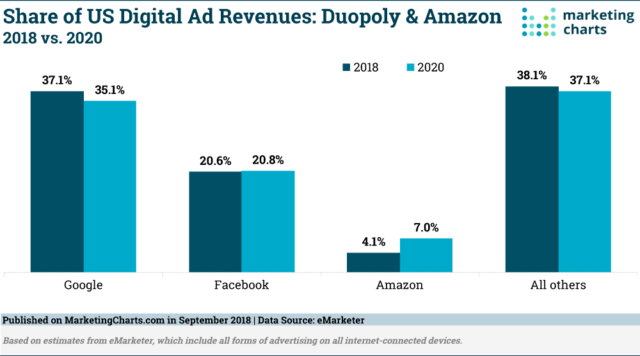

These DOJ and FTC investigations including the anti-trust law suits that may happen, reflect a focus on renewing entrepreneurialism, investment, and the American Dream. Google’s 90% share of search engine traffic and 60% share of online advertising are the focus for this round of potential charges.

Google spokesperson Julie Tarallo McAlister: “Our focus is firmly on providing services that help consumers, support thousands of businesses, and enable increased choice and competition.” from Politico report.

What’s happened during the long run of Free Trade is large cap, multinational corporations have thrived and gained unfair leverage over SMB businesses, online advertising, and tech investment. Only 3 years ago, new SMB formation hit an all time low. Unfair trade and corporate bullying in markets has made life miserable for small business who unlike Amazon and Jeff Bezos must pay dearly in taxes.

Particular points Google might struggle in defending are minimum price bids on keywords on the Adwords platform. Given the company makes trillions of dollars, forcing advertisers to pay high minimum bids for ads seems like highway robbery. This is not free market pricing.

Another point is the disappearance of small business websites from the search results. Google’s lack of transparency, withdrawal of some data, and virtually no customer service for search is a troubling aspect for most businesses who must try to compete on a search engine with 80% marketshare. This sounds a lot like a monopoly.

It’s uncertain as to how many complaints the FTC has received regarding Google, but we have to believe most don’t bother because of how difficult it is to even have your complain acknowledged. The FTC has been receiving complaints about Google for decades. There have been few reported actions taken against the company.

EU Has Previously Charged and Convicted Google

In the past 9 years, Google has been convicted by the European for monopolistic and trust offenses and fined 8 Billion Euros. The EU is basically saying Google has generated 8 Billion in damages to the European economy.

Now as US lawmakers scrutinize Google, the company could face charges of monopolizing or even attempt to monopolize under the Sherman Act. Some experts recently suggested Google could face a fine of up to $20 Billion.

Google’s development of Adsense, Google Search, Android are only a few departments that make it impossible for other businesses to operate. As positive as its contribution has been, Google has become insensitive to customers and competing businesses.

The end of the Google, Facebook, and Amazon triopoly could herald an era of entrepreneurialism, investment, and commerce. Yet for investors, the breakup could actually cause Google (and Facebook) to get rid of less profitable ventures, thus raising profits even more for shareholders. Some shareholders are advising Google to break up now.

Crushing Small Business

The trend towards large business domination has been going for many decades now, coinciding with globalism. Every sector has seen small businesses go out of business (e.g., real estate agents vs large brokerages). Is there a correlation between this and low wages, high housing prices, poverty growth, and lack of investment in manufacturing and research in the US?

The despotic control the big 3 have over business, advertising, commerce, and innovation is tangible. Try to advertise without paying a tidy sum to these 3. They grab the lions share of industry ad revenues. Facebook’s growth in advertising domination is now threatening Google (Facebook doesn’t share ad revenue with publishers), which FB will be facing their own monopoly charges.

Ask anyone who has lost their Google search engine rankings (black box) how unfair this monopoly is. Or those who won’t adopt the Google amp network or develop according to Android system specs. It usually means going out of business, and that’s simply not right. The sheer weight of Google’s wealth means competing with them is unwise.

Adsense and Google search will be the focus of prosecutors.

Optimism Growing for Startups and SMBs

Investor financed startups would live to see another day against giant, punishment meting monopolies who say their way is the gospel. For small business and tech startups the coming anti-trust charges and convictions are a fountain of life giving hope.

The defeat of US and foreign monopolies means the end of political tyranny that made living and doing business in the United States a painful situation. When the monopolies lose control, small business and individual citizen rights can return. There’s a lot on the line with this anti-trust case as Google stock price, Amazon stock price and Facebook stock price could all cascade downward.

Europe has been punishing US monopolies for years, so the precedent is well set. Check out this post by Marketwatch describing the risk the monopolies face.

Can Google Solve the Bay Area Housing Crisis?

Google just announced a billion dollar fund to assist with the Bay Area housing market squeeze. Coincidentally, the town of Mountainview voted on a bylaw to get rid of thousands of RV street residents camping within its town borders. The motion in council was defeated, yet it’s a warning of the stress and weakening tolerance about the housing crisis in the San Francisco Bay region.

It could also be a demand for Google and other Bay Area companies to take charge and help their workers buy homes or rent apartments. Many of Google’s cheap wage workers live on the streets whereas their India programmers/engineers likely live in homes.

Google says it will create 20,000 new housing units to resolve the Bay Area housing crisis that it’s contributing to by centralizing its workforce here, instead of spreading them out like a responsible company would.

The anti-monopoly charges are said to center around Google’s search engine and advertising habits. But the issue with Google goes much deeper and the focus will change. Google’s whole business model and system is choking business around the world.

The charges against the company are similar to those leveled against the oppressive Microsoft and its operating system decades ago. Yet strangely, this time, India is not complaining.

Seriously, More Threats?

Sundar Pichai is Google’s India born CEO. Like all Google employees, he poses the usual pro-big-tech progress juggernaut as fully justifiable. Google reiterates that its monopoly is preferential since it speeds up consumer tech solutions. Consumers and voters seem doubtful that the latest expensive smartphone is a life or death matter.

It’s the usual argument when monopolies have free reign and need to ward off threats. The usual corporate message is that success in certain tech product circles is more important than life itself. Pichai stays well away from topics related to the damage that big tech monopolies do to the rest of country, and the world.

In this video interview below, Poppy Harlow of CNN captures Google’s CEO in a spontaneous moment. How easy is it to get an interview with a Google CEO? Harlow asks about a rumored, maybe possible anti-trust probe.

During the intervew she diverts from her gently phrased question about the probe, to push the usual Democrat propaganda, where she suggests Google, just like other monopolies would not hesitate to push services and work outside of the US. I’m sure Pichai knows his situation. In response, the India born CEO actually fluffs off her threatening messenging, by stating Google’s usual message of universal good. CNN’s stance shows the democrats are uneasy about these events.

Pichai’s like the Ghandi of big tech. The problem is that Hitler used that same reasoning to support his political ambitions. The ideology demands it!

Global Politics is Changing

While America suffers through this transition, it’s struggle is awakening fairness politics around the globe. Countries are already adjusting to a life without American consumers. China is at a point where it is giving up on US consumer exploitation as a revenue source. China’s Xi won’t capitulate to Trump because he knows the cat’s out of the bag. Talks of trade are a farce. China will never agree to fair trade.

Fair Trade is the prime objective for most, and Americans aren’t interested in Trade revenge, just an amicable fairness.

You have to like Pichai for his poised, straightforward approach, however can we be sure this spontaneous event isn’t some sort of staged video, a prepared pro-monopoly/CNN alliance? Given the Democrat’s overpowered media propaganda machine, can we believe anything at all from multinational CEOs?

Please Explain Elizabeth Warren

The anti-trust movement is supported by Democrat Presidential hopeful Elizabeth Warren, who has spearheaded the anti-trust question. A Democrat move to alienate multinationals might seem outrageously bizarre, however the Dems may sense an opportunity to create volatility in the stock market. And that might send ripples through President Trump’s base support.

Warren’s quest for the White House must be a thorn in the side for Democrats who are fully supported by multinational advertising money.

Is she talking about Dems or Republicans?

“The problem is a government that won’t get in the fight on the side of the people.” — Elizabeth Warren, Democratic Party of the United States

Warren seems to be suggesting that Trump’s US economic stats are not happening. While there may be valid arguments that the average American worker is not gaining a lot, a persistent, record breaking 3.6% unemployment rate and roaring economy has to be mentioned.

That doesn’t mean the Dems have jumped off the carbon tax, “global warming” American manufacturing shutdown effort. It probably means they’re confused for the moment. If global warming isn’t enough, what’s next?

Will Trump Commit to Convicting the Multinationals Right Now?

The Republicans and Trump might be reluctant to get into this, but there is a way they can spin this to make it work for them.

These Trillion dollar monopolies generate a lot of dividend cash for investors (and big salary for their CEOs), yet their success comes at big cost to small and medium sized businesses. With Russell Index success, investors and everyone else are seeing living proof that small business was sacrificed and harmed. Small biz may be the ticket to big investment gains in 2020.

The growing sympathy for the revived small business sector is a huge issue for the multinationals. It will sway votes in the 2020 election.

Due to tariffs on multinational company imports, SMBs are gaining traction in the US. The result is a positive jobs report, startup company success, creativity, rising wages, and growth in the midwest, something the big coastal monopolies gravely fear.

The Anti-Trust Juggernaut

The reason this is the biggest new story of 2019 is that it reflects real political momentum. This isn’t the fake stuff you see on Democrat propaganda channels like NBC and CNN. This is Americans realizing they were getting trashed and awakening their desire to make things fair for themselves.

America First, not America Last

As mutual fund investors increasingly realize their investment portfolios and retirement payouts are fine, they’ll stop supporting the Democrat’s Fuhrer, whoever it is the Dems finally choose. The fact the Dems had no leader for 3 years is another sign to voters that they’re not a respectable party worth voting for.

Trump jumped on the America First bandwagon, and is making it look like it’s his platform. It isn’t his. The movement is a horse he threw a saddle on. While he’s not looking like the white knight to many Americans, his re-election is looking more certain.

America First is about returning a healthy, productive way of life to America free from joblessness, homelessness, low wages, high debt and the growing national despair. It will be a cultural renaissance as well, free from the tyranny of drugs, poverty, and hopelessness that’s gripped this country for the 30 years of free trade.

The anti-trust charges reflect a political movement towards making business fair in America.

* the above post includes opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as general information only. For all your stock investment decisions please refer to your financial investment advisor.

Travel Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO | Advanced SEO