Where is Canada’s Economy Headed?

A new report on Canadian GDP has more people taking a closer look at the Canadian economy and perhaps reconsidering how they’ll vote in this coming snap Federal election.

StatsCan says Canada’s GDP shrank 1.1% in the 2nd quarter of 2021 and has dropped by .4% in July. According to a report, economic analysts expected a growth of 2.5% in Q2 and .7% for July.

This performance might be why housing market forecasts are sounding a little sour on this fall and winter. However, the news could improve regarding Canada’s GDP and housing markets with the right political choices. Also, long term threats that Canadians are barely aware of could dampen the country’s fortunes (Cryptocurrency, carbon tax, high taxes, poor export markets, lagging AI adoption, and a potential recession that would reduce demand for commodities).

Canadian Forecast

The Canadian GDP forecast to rise slightly to 6.1% (from 6.0% previously) in 2021, and to 4.4% (from 3.9%) in 2022. July’s stats don’t really support that however.

GDP had been growing strongly for the last decade, and of course it was derailed with the pandemic. Canada’s relationship with its major trading partner has changed, as the US has become more protectionist. At the same time, investment in Canada has not kept pace to compensate for the US loss. Questions surround Canadian politicians and whether they can improve the US Canada trade agreement. It could be the prime minister is hoping to benefit from the US Democrat’s $5 Trillion spending plan, but that appears to be in jeopardy now.

Solid leadership with a commitment to opening export markets fully, negotiating with the US Democrats, and helping small business, while cracking down on rich multinationals.

With the Republicans looking like they will take the US Senate back, we wonder if Prime Minister Trudeau will be the right choice for leadership.

Canada is now embroiled in a snap Federal election and the downward trend of GDP will likely impact the outcome.

StatsCan Reports on Economic Activity

What’s so important about the Q2 economic report from Stats Can is that business conditions were pretty good during the spring where Covid was weaker and the economy was waking from the winter and reopening from the pandemic shutdowns.

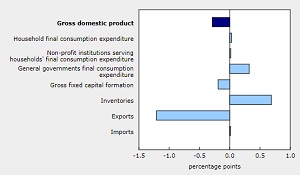

StatsCan reported substantial declines in home resale activities. Lower exports added to reduce Q2 GDP by 0.3%, quite the change from 3 consecutive quarterly GDP increases in the rebound from the -11.3% drop caused by pandemic-related business shutdowns and travel restrictions in Q2 2020.

StatsCan reported substantial declines in home resale activities. Lower exports added to reduce Q2 GDP by 0.3%, quite the change from 3 consecutive quarterly GDP increases in the rebound from the -11.3% drop caused by pandemic-related business shutdowns and travel restrictions in Q2 2020.

StatCan also said growth in investment in business inventories, government final consumption expenditures, business investment in machinery and equipment, and investment in new home construction and renovation couldn’t compensate for the strong declines in exports (-4.0%) and home ownership transfer costs (-17.7%). Reduced home sales meant significantly less tax revenue.

They report real gross national income rose 1.5%, and that is oddly enough from higher oil prices, a product the Trudeau government is trying to suppress and terminate. Domestic demand moved up only 0.2%, after growing 1.6% in the first quarter.

Canadian household spending, which rose 0.7% in the first quarter, edged up 0.1% in the second quarter due to less spending on goods — 32 out of 48 goods categories saw a drop. Investment in machinery and equipment rose 5.7% but most of that was imported into Canada, not manufactured here.

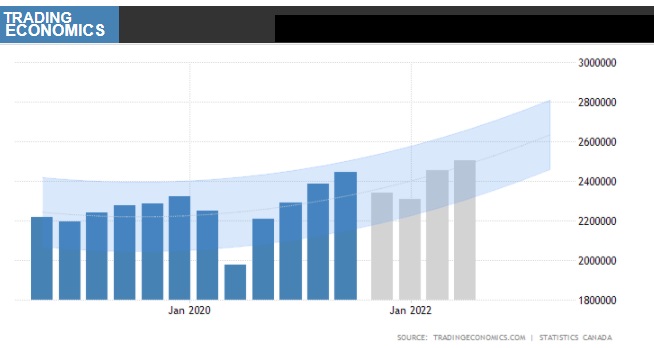

Canada GDP Forecast

Trading Economics forecasts a dip this fall with a strong recovery in the spring of 2022

Canadian Housing Market

Another oddity for the Canadian government is that the neglected housing market has been the major contributor to economic activity. Investment in housing was 17% higher than average over the last 5 years, yet sales are flattening as home prices have risen so highly in Toronto and Vancouver.

New home construction and home renovation spending have risen strongly since Q3 of 2020. Spending grew 3.2% on new housing and renovation spending rose 2.4%. The lower spending of Canadian was due to work from home, no commuting costs, reduced travel spending and reduced participation in other activities, and low mortgage rates.

Canadians took out $62.3 billion of residential mortgage debt in the last half of 2020, and they took on $84.2 billion more residential housing debt in the first half of 2021. The question is what will happen if Canadians stop using and leveraging their home equity going forward. The forecast for the housing market over the next 5 years is dependent on political parties managing smartly without sudden dangerous policies that might bring both a stock market crash and a housing market crash. The Toronto and Vancouver markets are artificially inflated, and those bubbles could burst.

See more about the Toronto real estate forecast and the Calgary housing market forecast. 2022 is coming soon and will be amazing if we have sensible leaders who believe in a real future.

3 to 6 month Market Projections | Stock Quotes | Stock Market Week | Alphabet Stock | Real Estate Market 2023 | 5 Year Stock Forecast | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO