Car and Truck Insurance Quote Comparisons

Searching for the cheapest car insurance quotes is the best way to find a better/lower monthly premium. I did a thorough search for a lower auto premium, and I saved about $80 per month.

I’d encourage you to do the same for your auto policies, or for home insurance or home mortgages. Active searching and comparison shopping works. You do it on Amazon, so do it with your auto insurance too.

Google’s AI search system knows you’re looking for auto insurance, and it will present you with ads, local brokers, search results and videos related to auto insurance quotes.

These are companies and opportunities you won’t find unless you start seriously searching. And by visiting more sites, the opportunities for a better quote multiply — Google’s system learns what you really want — lower rates and the right policy coverage.

You’ve likely been to Geico, Allstate, or Nationwide via Google, but to get better auto insurance quotes, you need to go deeper to find sites like this which you have. Congrats, because the big money savings and discounts increase as you go deeper.

Your Online Search will stimulate:

- more advertisers (car insurance companies) knowing you’re looking

- more frequent presentation of insurance quotes and insurance websites you’re not aware of

- exposure to broker’s ad campaigns

- more exposure to auto insurance stats, discounts, tips, and techniques

- visits to more auto insurance company and broker websites

You’ll gain insight into what to look for and encourage companies and insurance sales reps to give you what you need at the right price.

Most people won’t hunt for lower car insurance rates or mortgage rates until they get this gut feeling that they deserve it. They don’t have the hunger, but it looks like you’re entering that zone. Until then, it’s just an idea that most never act on. Every year you wait is a painful loss.

Apply this same search technique when house hunting, mortgage hunting, car hunting, and vacation hunting, and the savings are incredible!

I Saved a Thousand Dollars per Year

Most car owners are only looking for lower premiums yet many do insist on the right coverage. If you’re a student with a low-value vehicle, you’ll only need liability really. If you drive a luxury car, then specialized luxury car insurance is the route to get coverage that protects your very costly asset.

Unfortunately, car insurance companies are not keen on giving their current insured clients a price break. This is why you need to check out the info below and compare rates from all the top auto insurance companies.

Car insurance brokers and websites conduct surveys on how offers the lowest car insurance rates in each US state. However, these are just generalizations. Out of 100 million insured customers, the variations are immense.

I saved $960 per year on a new policy with a new insurance company by searching and comparing prices. Over 6 years, that is the full cost of my Hyundai Sonata, or about $6000 to put into my retirement savings or invest in the stock market or put toward a purchase of a TESLA or other EV.

Each Driver is Unique

Your insured record and profile is much different than standard policyholders. The only way to find the best auto insurance rates for trucks, cars, motorcycles or boats is to search. And searching on Google for instance, brings up insurance brokers (secondary market) who have access to companies who are ready to offer lower rates.

You’ll only discover a few of these on any one site, which means visiting several insurance-related sites is a must. I did recently, and I saved 45% on my monthly auto policy premiums. And that’s only because of a secondary driver who had a moving violation ticket charged (illegal left turn). That put my rate up more than $40 per month. Ouch!

So, in total I could have saved $130 per month x 12 months = $1560 per year.

It Was Still a Huge Success

But that’s okay, I searched hard and I’m still saving myself about $1000 a year. That’s right, one thousand dollars per year over the next 6 years, which was near the price of my car when I bought it. My car is good on gas too, so I’ve removed a big cost burden this year. It makes me feel good.

If you’re a student or young driver with ultra-high premiums, or you’re a parent who is about to put a young driver on your policy, the difference is immense.

If you’ve suffered an accident, your premiums can be very high. Not all insurers view your accident claim the same way. Some offer a free claim.

You need to find the very best among them, as I did. Again, we’re back to searching to get a lower auto insurance quote.

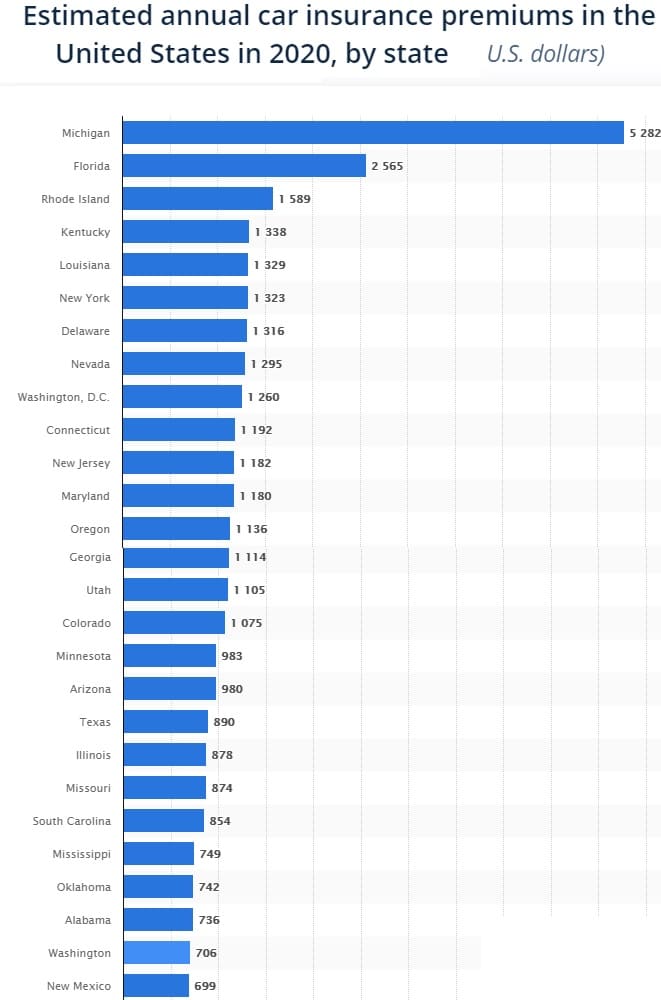

What are drivers paying on average in each US state? Here’s a stat from Statista:

Car insurance is an important way to protect your financial well being.

Stock Market Forecast | Stock Market Today |FAANG stocks | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2024 | Travel Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO | Advanced SEO