Are we in a Housing Bubble?

The topic of a housing crash usually coincides with the topic of the housing bubble. Crash is too crass, arguable, and troubling a word. The bubble topic focuses on high prices, big mortgage debt and high flying lifestyles.

Are we within a housing bubble? Experts have said yes for many years now, but the housing market has rolled along on an upward path. And the 2022 housing market forecast was looking good until 2022 happened.

Are house prices in San Francisco, New York, San Jose, Los Angeles, and Miami, in the bubble zone?

A Different Way to Burst the Bubble?

President Trump wants to relax bank lending rules but this time the bubble bursting event might come from a different source.

A a housing crash might only need one small accelerant to make it real. Or, what if the crash threat is the same this time — rising interest rates and a lame duck government? What happens when you pour FED fire retardant on a bubble to extinguish it fast?

What if Democrat leaders decide, even against Donald Trump’s big economic success and rising US GDP, good job outlook, that it’s time to kill this business cycle? Could the Democrats sabotage it? Supply is growing in Atlanta, Miami, Tampa, Houston, Philadelphia and out in California but no one is talking bubble too loudly right now.

At this point, not enough low income earners can actually buy a home. Although home ownership is rising.

What Could Cause A Bubble to Burst?

What are the 12 housing bubble factors? They’re listed below. They reveal how threat to a national housing market is complex and unique to each city housing market. Chicago is in trouble, yet are San Francisco and San Jose really any safer in an era of massive US debt, ridiculously high trade deficits, and big changes in trade barriers?

Remember when experts advised “sell your house before 2020?” Killing confidence is an emotional factor that adds to the crash forecast mix.

A housing bubble is a run-up in housing prices which are fueled by demand, rising interest rates, speculation and exuberance

There are lots of forecasts about a housing crash, including economic fallout from a China housing crash, yet the US Housing Market forecast looks strong through 2020. It’s a continuously robust US economy overall that drives healthy demand for residential property right across the country.

Rising interest rates, trade skirmishes, and rising oil prices have home buyers and mortgage holders nervous. And even more worrying would be the defeat of Donald Trump in 2020 leaving the US ship dead in the water. Let’s stop and consider what a successful anti-trump revolt would do. Can the US return to the Obama era debt gravy train?

12 Housing Bubble Symptoms

- excessively high home prices form a price bubble

- sudden underwater mortgages and subprime lending

- Fed raises interest rates too persistently and high leading to failure of banks and finance companies (loan forfeits) and discouraging people from buying homes (unsold inventory piles up)

- slowing economy and sudden rises in unemployment raise panic levels

- wage growth not keeping up with home prices

- geopolitical shifts – global slowdown

- trade deals fail out of control

- stock market bubble and volatility

- level of consumer debt, student loans, rising credit card rates

- inflation and cost of living rises

- risky low rate mortgages for new home buyers

- high oil and energy prices

Some believe the Fed causes burst bubbles and by raising interest rates they ensure the business cycle comes to an end and stock markets and housing markets will crash. Who can prevent this from happening this time?

That’s what happened between December 1986 and October 1987. A climb in the 10-year U.S. Treasury yields from 7.19% to 10.23% was followed by a 200-point drop in the S&P 500. — Forbes report

A similar pattern was repeated a decade later, when a climb in the 10-year U.S. Treasury yields from 4.70% to 6.20% was followed by a more than 1,000-point decline in the S&P 500. And more recently, in 2005-7, when the S&P 500 dropped 940 points following a climb in the 10-year Treasury bond yields from 4.24% to 5.17%. — Forbes report.

We may be in a mild bubble with prices definitely high, however with weak new construction numbers, high employment rate, rising wages, inflating consumer prices, strong growing GDP, and huge millennial population, how can demand disappear and deflate the bubble?

On January 1st, 2019, the 25% import tariffs come into effect. Few economists seem certain about its effect. US tax revenue will climb, and US business will definitely flourish and see their sales rocket. Prediction: This one factor may launch a bubble in spring 2019.

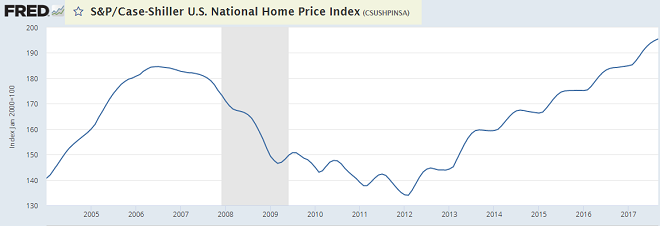

The Last Bubble Crash

Remember the worst financial mismanagement and calamity of our era? Subprime mortgages. 7.8 million foreclosures occurred during the 2008 housing crash and the country sunk into a severe recession.

Take another look at the US housing market factors and fundamentals and what are the latest home prices.

What is a ‘Housing Bubble’

According to investopedia, a housing bubble is a run-up in housing prices fueled by demand, speculation and exuberance. Housing bubbles grow with an increase in housing demand, pressured by limited supply. Then speculators enter the market to capitalize on capital gains and rental income property opportunities.

Supposedly, lessons were learned with controls on lending practices. Yet, could housing plunge for different reasons this time? Is a bubble a certain sign of a housing market crash? Experts think so.

Homeowners are wise to be wary. The last crash cost many their homes and savings. Billions wiped out. There were plenty of expert predictions about a crash in 2016 and 2017, but that didn’t happen. That’s because the US economy is too strong and frankly, it doesn’t look to be letting up for many years.

Money manager James Stack, 66, ($1.3 billion fund) predicted the last housing crash in 2005, just before prices peaked. He says his “Housing Bubble Bellwether Barometer” of homebuilder and mortgage company stocks is warning of another crash.

Stack’s emphasis on financial companies is interesting. He must feel that it’s this over-leveraged group, the ones we forgot about, that could be the weak link. If the Fed goes crazy with rises, it makes sense that homeowners would begin defaulting on their mortgages leading to finance company failures again.

The recent tax changes are powering up the economy fast but they’re cooling demand which could keep it from peaking further. But prices have raged forming one half of the bubble.

If we avoid a national housing crash, could individual markets in New York, Boston, San Francisco, Seattle, Miami or Houston see a rapid price drop?

Should you sell your house in 2019? or should you buy a house in 2019?

The problem comes when the bubble bursts and losses of 30%, 40% or more pile up quickly. Investors tell themselves they’ll be smart enough to get out in time, but that’s not true.” from a post on Bubble Dynamics by Jim Rickards.

With all the political strife in the US, there’s those who might think a housing market collapse is inevitable and could launch a stock market crash. Maybe a few will take pleasure from it. Wars, government incompetence, political interference, weak banking system, and a weakening economy brought everything down in 2008.

Some experts warn the conditions also exist for a crash in 2021/2022. Is this just anti-Trump lobby fear mongering or is there a factual basis for a housing crash? They point to heated up markets like Washington DC, Dallas, New York, Seattle and Denver and talk about bubbles.

They point to Presidential impeachment, trashed trade deals, global economic slides, and high consumer debt as sure signs the housing market bubble will burst.

But hold on, the stock markets are still strong with plenty of demand for housing. Houston, Miami, Los Angeles, Seattle, Denver, New York, and Boston are still showing strength during traditional weak seasons.

So is there really a US housing bubble and a tumble as early as 2018? Or will the year of the natural disaster be followed by a unusual good year for housing?

International economies play a big role now so perhaps domestic issues might not be enough to set off a housing landslide. But let’s take a closer look at all the fundamentals below.

The Last Housing Crash

Can history be a reliable guide to the 2018 to 2020 period? Looking back at the last housing crash 10 years ago, experts blamed it on everything from easy low mortgage rates to greed, house fippers, unregulated banks and lenders, mortgage underwriters and sub prime loans.

And when mortgage holders believe they will owe endlessly on a worthless high priced property, they’ll begin defaulting on their mortgages. If mortgage rates jump and they aren’t locked in at a low rate, that’s a factor.

If trade wars do begin, it could kill jobs, wage levels, and investment, resulting in a slide. The economy is the number one factor. And if foreign buyers want to sell because of currency worries, prices would fall.

It’s these worries that keep property investors up at night and a lot of people from buying.

Boston, Seattle, Denver, Atlanta, Portland, San Francisco Bay Area, Los Angeles and New York are cited as having the most likely conditions for a housing crash.

Those housing experts point to a number of things that exist now and could transpire in 2018 or 2019. So if the housing market was to burst, would that affect how much you should pay for a house? If you’re a seller, should you sell your house now?

If you’d like to put up your house for sale as the market is peaking, you might want to read these homeselling tips.

The US Economic Bubble

The US housing market has ridden the longest economic rally in US history. Is this an economic bubble too?

There is an economic bubble. We’re in it. It’s a period of intense optimism with lots of disposable income to throw at home purchases. And places like California is where the tech industry has done so well, bidding has been most intense. Yet, it’s not completely out of control (although anyone in the Bay Area would argue) as the points below suggest.

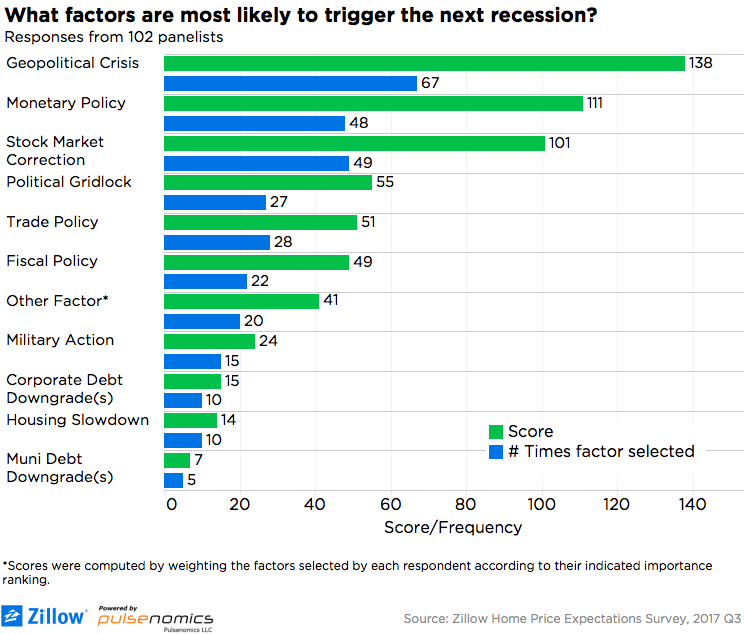

Graphic courtesy of Zillow.com

Graphic courtesy of Zillow.com

What happens if China calls in that debt? Interest rates would rise, layoffs would grow, mortgages would begin to default, and prices would plummet faster than they went up.

The Housing and Investment Market?

Experts say excessive risk isn’t present in the markets. They suggest few are overleveraged, financially stressed, and not threatened by increased interest rates.

Is Demand for Housing in the US exhausted?

It appears demand for housing is still strong and considerable building is taking place. However not enough housing is being built to satisfy current demand.

Is Debt a Problem?

US credit card debt is the highest in history and the US national debt is $20 Trillion. The US annual trade deficit is also in the trillions. The average US home buyers puts 5% down on a home whereas in the past it was 20%. There’s not a lot of new mortgage debt:

In 2016, new first lien mortgages topped $2 trillion for the first time since the end of the housing crisis, but mortgage originations were still 25 percent lower than their pre-recession average — from Magnify Money.

Average debt to income ratio is rising yet is way below what it was before the last housing bubble.

However, Equity is High

Homeownership is at its lowest level ever in the last 30 years. Most Americans make low wages and can’t afford to buy. And those who do own, have a lot of home equity

Big Demand so is a Bubble Collapse Possible?

It doesn’t look like the statistics support a housing bubble or a burst. The markets appear to be stable and those who are at risk of an economic downturn are renting and don’t hold mortgages.

We can say for sure that it is a good time for wealthy Americans and large multinational corporations. Record profits that they don’t appear to be willing to share with American workers. Without excessive demand from the working class, a housing bubble would have to happen from investors taking flight.

Perhaps the best way to prevent a housing bubble from happening and an economic catastrophe is to not allow half of Americans to participate in the housing markets. This is why the property rental market is piping hot. There may not be an end to demand for rentals.

Have a good look at the student housing investment opportunities. It seems students are starved for accommodation and new REITs are serving the market.

Stocks | Stock Market Today |FAANG stocks | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News