Vancouver Housing Market Update and Forecast

Vancouver has built its reputation as one of the most beautiful cities and locations in the world.

The modernization of the city, incredible mountain vistas, moderate climate with a surprising amount of yearly sunny days, high tech center growth, tourism and neighboring mountain recreation areas makes this area a paradise to travelers, home buyers and investors from around the world.

At this point, it is difficult to discourage “demand for homes” and even astronomical prices cannot stop buyers from wanting to live here and buy a home of some kind. It is simply a cultural and economic trend that can’t be stopped. of course, if homes were to be developed, there is conceivably some point where demand would be satiated. Politically, that rising supply will never be supported.

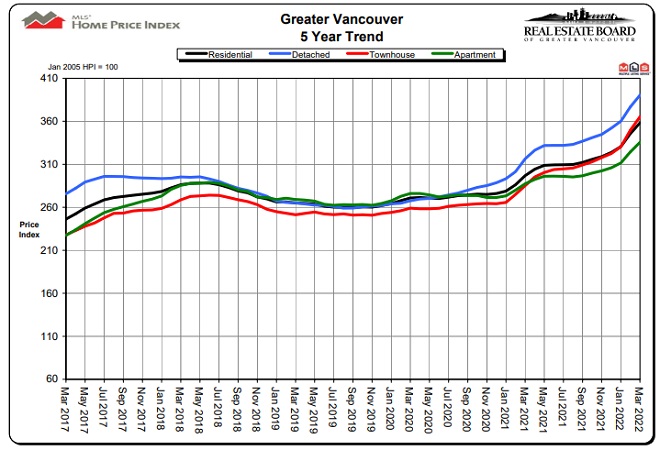

Fashioning a forecast for the Greater Vancouver housing market is no easy task. The volatility of the US economy, geopolitics, high inflation, rising interest rates and financing costs make it difficult to predict. The economy in the US and Canada appears to be picking up strongly. The US housing market is similarly hot and sales constrained.

This can only mean the Vancouver housing market, Toronto Housing market and Calgary housing market will continue red hot for 2022.

Economists are expecting a slowdown in 2023, due to rising interest rates. Yet the momentum of 2022 won’t be easy to crash or slow. Given the housing shortages in Vancouver, home prices should continue climbing at a good rate. If prices do begin to fall, it would only flood some homes onto the market which would mean buyers, mortgage agents and Realtors will be busy.

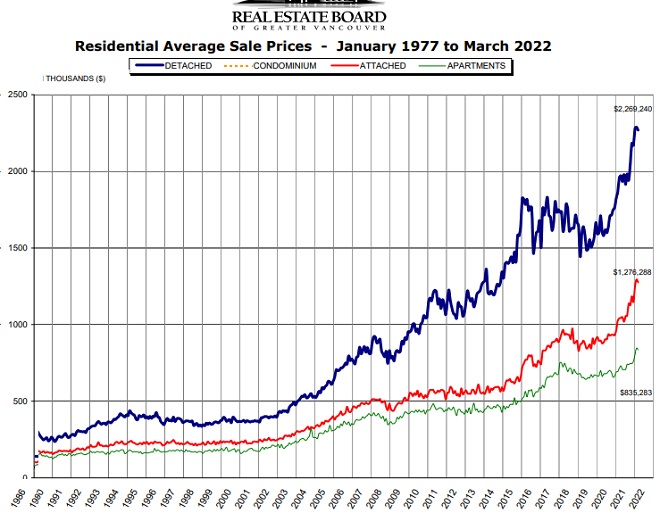

Vancouver home prices have doubled on average in the last 10 years, which may be a meagre growth compared to gains in the stock market in the same period. Yet anyone putting their Vancouver home for sale will be earning a shocking return on that sale. This is an ideal time to call a Vancouver Realtor and get the process started.

Real Estate Marketing Packages: Realtors, are you looking to successfully launch your digital marketing campaign for the new season? See the real estate marketing package page for comprehensive service to help you excel online.

Vancouver March Housing Market Stats

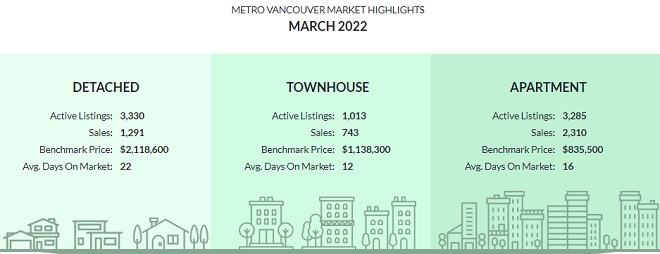

During March, 6,673 residential properties were newly listed for sale on the (MLS®) in Metro Vancouver which as down 19.5% from 12 months ago when 8287 homes were up for sale. That was a 22% however from February 2022 when 5,471 homes were listed for sale.

Vancouver home sales were well down from 12 months ago (down 23.9%) yet that month last year was a record setting one for the city. However, they took a big leap in March, as last month’s home sales rose 26.9% compared to February. That was 5708 sales.

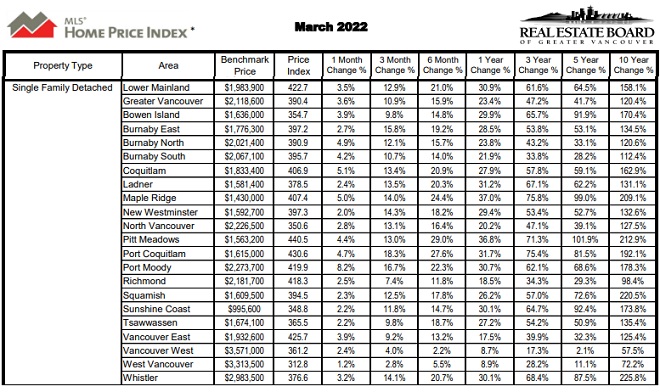

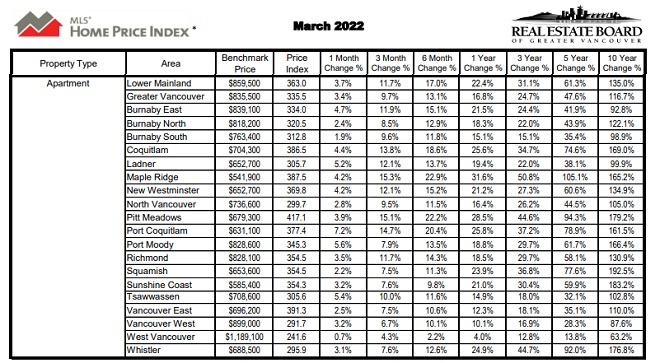

The benchmark price for a house in the city reached $2,118,600 and $835,500 for an apartment. The chronic issue for the greater Vancouver housing market is always supply. And as immigration picks up, new construction slows, and inflation rises, houses will become unaffordable for most homeowners.

Zolo lists the top cities ranked by home prices.

| City | Average Price | Median Price |

| #1 West Vancouver | $3.1M | $2.8M |

| #2 Lions Bay | $2.5M | $2.6M |

| #3 Bowen Island | $2.0M | $1.7M |

| #4 North Vancouver | $1.6M | $1.5M |

| #5 Delta | $1.5M | $1.6M |

| #6 Vancouver | $1.4M | $1.1M |

| #7 Port Moody | $1.4M | $1.2M |

| #8 Surrey | $1.3M | $1.1M |

| #9 Langley | $1.3M | $1.1M |

| #10 White Rock | $1.2M | $1.1M |

| #11 Maple Ridge | $1.2M | $1.3M |

| #12 Coquitlam | $1.2M | $925K |

| #13 Richmond | $1.2M | $890K |

| #14 Port Coquitlam | $1.1M | $1.0M |

| #15 Burnaby | $1.1M | $850K |

| #16 Pitt Meadows | $1.1M | $1.0M |

| #17 Tsawwassen | $987K | $775K |

| #18 New Westminster | $901K | $742K |

While the new tax on foreign buyers might ease the market a tiny bit, it’s not likely to have any effect on creating inventory at the lower price points where most buyers would hope to buy a home or condo. The tax might reduce prices for wealthy buyers.

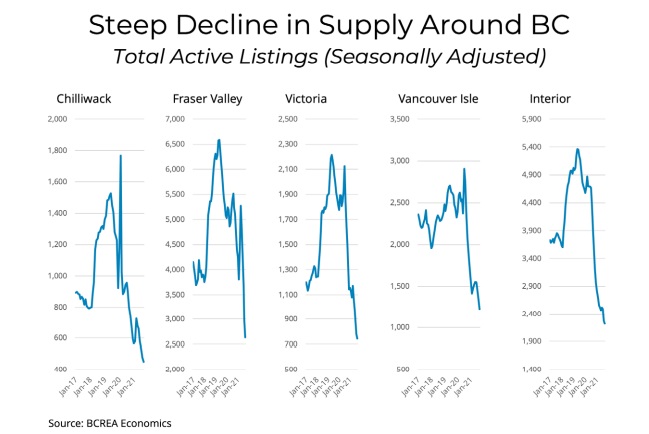

REBGV board chair said “We’re still seeing upward pressure on prices across all housing categories in the region. Lack of supply is driving this pressure. The number of homes listed for sale on our MLS® system today is less than half of what’s needed to shift the market into balanced territory. Home buyers are keeping a close eye on rising interest rates, hoping to make a move before their locked-in rates expire.”

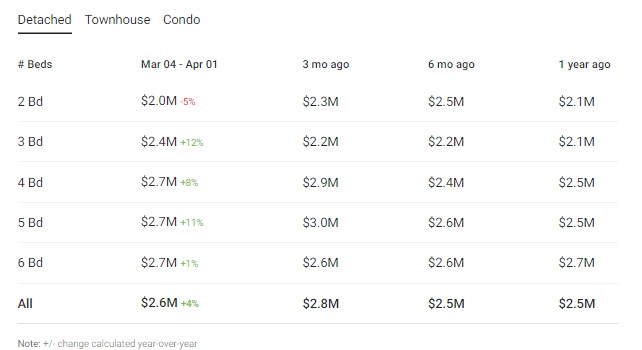

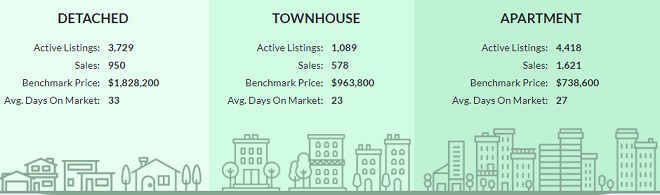

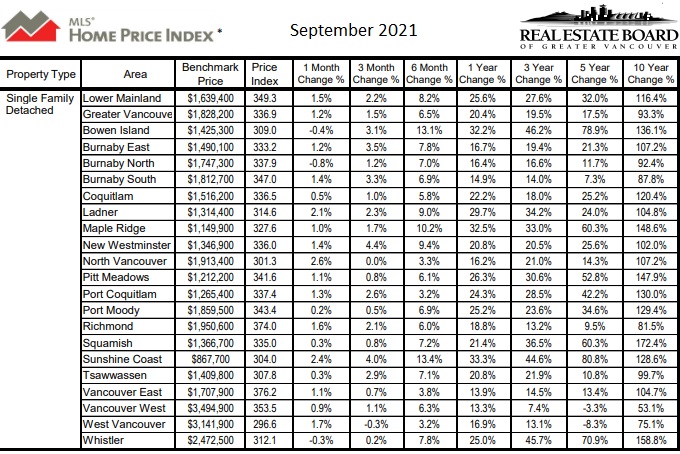

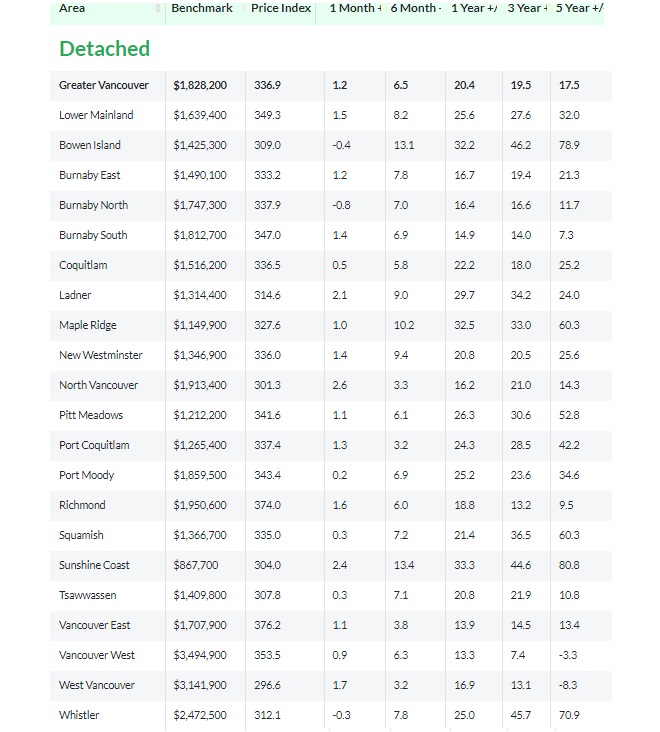

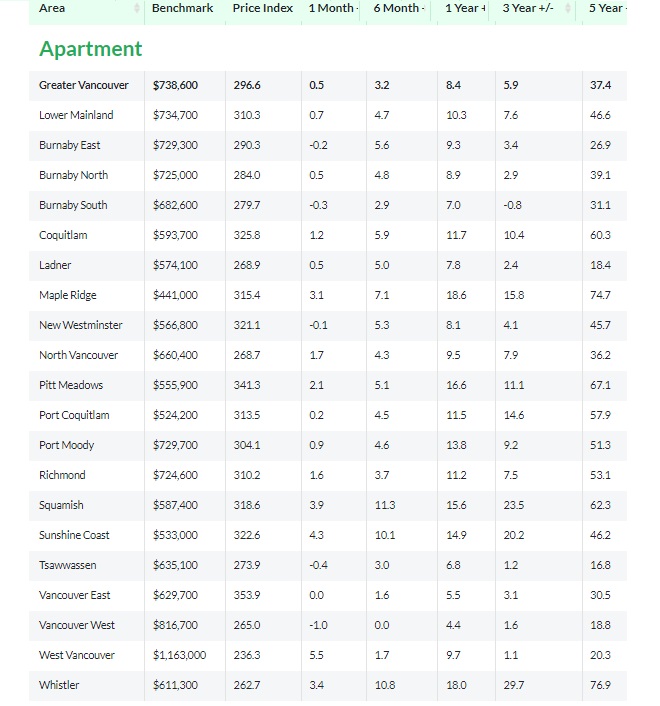

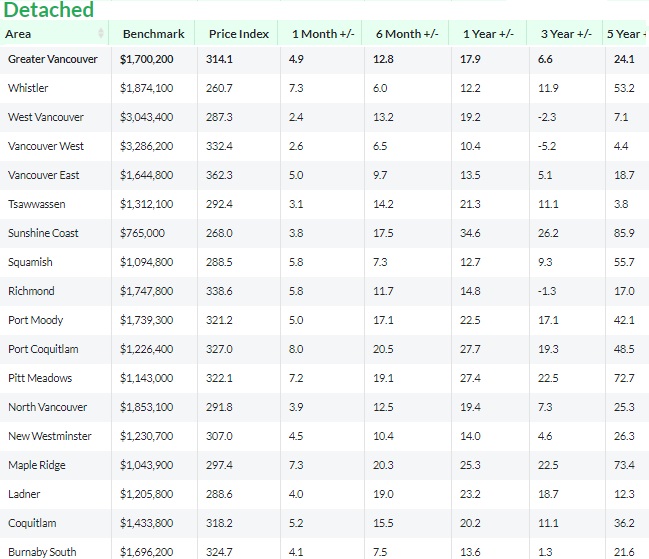

Median home prices for all types of residential properties in Metro Vancouver reached $1,360,500 in March, a 20.7% rise from 12 months ago and is up 3.6% from February 2022. Maple Ridge, Port Moody, and Coquitlam are the hottest cities for detached houses, while Port Coquitlam, Port Moody, and Ladner saw the largest price gains for apartments.

Single family house sales dropped 34.3% to 1,291, from 1,965 sales 12 months ago The median mls home sale price for a detached house rose 23.4% to $2,118,600 in March vs March 2021. That was also up 3.6% vs February 2022.

Apartment sales grew 14.3% to 2,310 in March 2022, vs the 2,697 apartments sold in March 2021. The median price of an apartment reached $835,500 which is up 16.8% from 12 months ago, and it’s up 3.4% as well, from the previous month.

Attached home sales amounted to 743 units, which was a 29% reduction vs the 1,046 sales that happened last month. The new median price of an attached home rose 28.1 % year over year to $1,138,300. And that was a growth of 4.4% compared to February.

The sales-to-active listings ratio in March 2022 reached 56.9% for all property types. For detached house, the ratio hit 38.8%, and was 73.3% townhouses and reached 70.3% for apartments. Anything above 10% is considered a sellers market.

New Housing Development in Vancouver

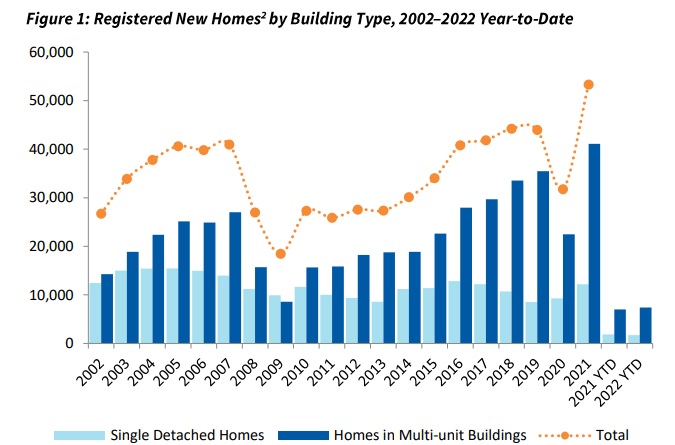

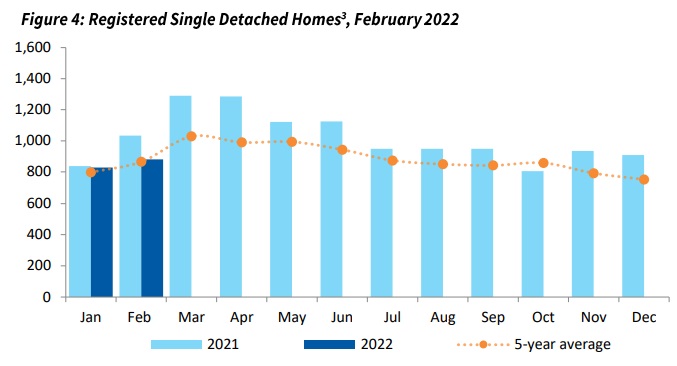

New stats from BChousing.org show construction activity is up in 2021, a very good trend.

The real story of the Vancouver real estate scene is purpose built built to rent units.

Home Prices by City

Home Sales in September

The Real Estate Board of Greater Vancouver (REBGV) stats show 3,149 home sales in September 2021, a 13.6% fall from the 3,643 sales recorded in September of 2020. It was just a 0.1 per cent decrease from the 3,152 homes sold in August 2021.

BC and Federal Governments have announced little in the way of additional support for construction and housing development. They’ll respond weakly with phoney speculation taxes to try to kill demand, but it won’t work. Speculation money is being used to build new housing including affordable rental housing too.

The forecast for the Vancouver real estate market just as with the Toronto real estate market and Calgary housing market is for higher prices and that includes rising prices for apartments and condos.

Vancouver’s housing market is as pressured as the Toronto housing market, Kelowna housing market, and Calgary housing market and we’ll see higher prices for the next year. With some political support for housing due to the election, we can predict that a housing market crash isn’t likely, until 2023 when mortgage rates rise.

An Angus Reid Institute survey showed that 28% of Vancouver buyers felt miserable about the housing market but this is below how buyers in Calgary, Edmonton and Halifax felt. It could be Vancouver buyers operate in their own world of expectations since clearly, prices, affordability and availability are much worse.

REBGV MLS market covers the communities of Vancouver, West Vancouver, Richmond, Surrey, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, South Delta, Squamish, the Sunshine Coast, and Whistler.

A Look Back at March of 2021 for comparison

Vancouver’s jump and in sales and price is a welcome event for sellers who may be considering a move to less densely populated regions of the province or even out of province.

Vancouver Real Estate Agents

Vancouver is an unusual real estate market which only the local Realtors fully understand. Homeowners here may see fewer options for moving or relocating and could hold onto their homes indefinitely. Only higher taxes, cost of living and lower quality of life might encourage them to put their home or apartment up for sale.

Those bad old memories of so few houses for sale and the wicked price rises when buyers have the resource to big come back to mind. BC’s Covid 19 cases have been rising, but don’t look serious enough to warrant a shutdown. Still, buyers will be shy about committing to buying a house or condo if they’re on the borderline for affordability.

And in eastern BC in the Okanagan, home prices in Kelowna Vernon and Penticton were on the rise, despite falling inventory and sales.

Please do Share on Facebook with your Friends!

Vancouver Home Price Predictions 2021

Adding to good outlooks for the Vancouver housing market is the post-pandemic euphoria. It will be strong, and immigration will return as will foreign students returning to study in lower BC. Students will help fill up those condo vacancies in Richmond, Surrey, Burnaby, Kitsilano, Point Grey and other neighborhoods.

The resumption of International trade and with foreign students and investors returning will give Vancouver’s economy a big boost. We should remember how good things were back in 2015 before the US presidential change. Some Realtors are comparing 2021 to 2015.

Capital Economics’ Stephen Brown offers his home price forecast of a 3% rise in 2021 and 5% in 2022. Prices did rise fast giving credence to Brown’s housing forecast.

BCREA Forecast

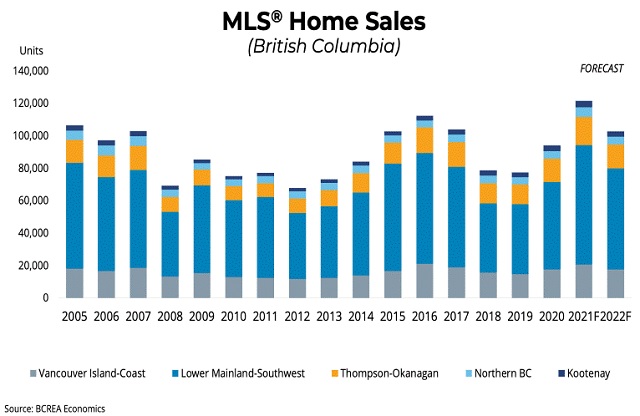

BCREA is its housing forecast is all onboard with a prediction of rising sales in 2021. Sales in 2021 has been brisk. Brendon Ogmundson, BCREA’s Chief Economist said in an earlier forecast that the BC residential sales would grow 9.7% to 99,240 units in 2021, however those estimates were crushed.

A recent BCREA report shows sales in B.C. will rise 29% to more than 120,000 units through 2021. That is up from 94,000 sales in 2020. They forecast sales to decline 15% to 102,000 units in 2022.

“While we do not anticipate a repeat of the record-setting market of 2021, we do expect housing market activity to remain vigorous in 2022,” added Ogmundson.

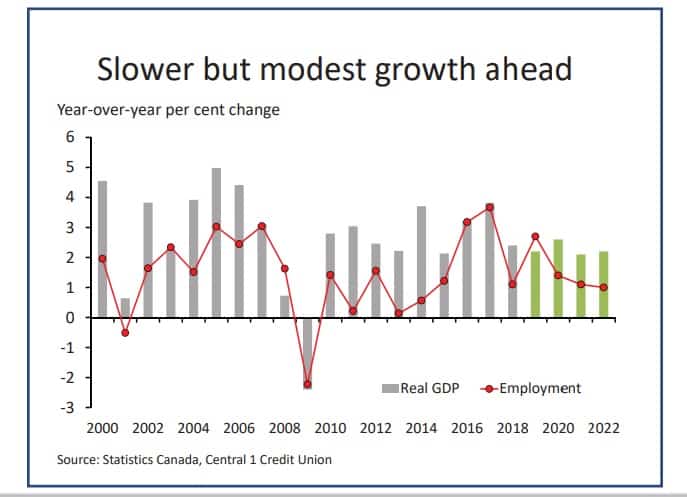

Central1’s Economic Outlook

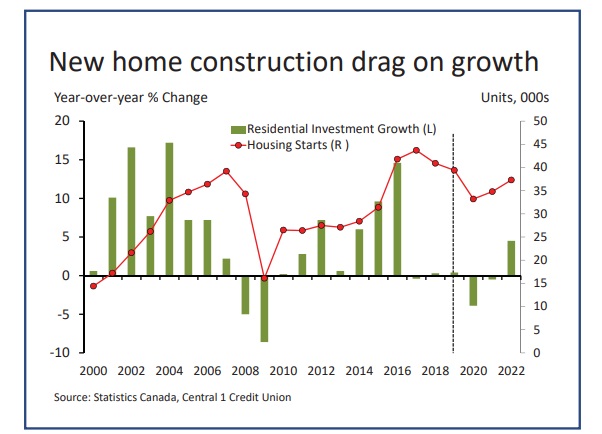

Did we see slower growth in 2021, as this prediction suggested?

Pessimists Point to Fiscal Problems that Suggest a Housing Crash

CMHC did boldly forecast a dour outlook for the next two years however they eventually retracted their prediction. That view had little support and sales stats in Vancouver, Okanagan, Toronto, Montreal, Calgary, Mississauga, York Region and the rest of the GTA continue to show big demand and rising prices.

Housing markets are so severely short of supply, it would take something very dramatic, like the pandemic to suppress sales. The pandemic in fact, is helping to accelerate sales that never would have happened (outflow from cities to suburbs and small towns).

Vancouver’s economy will certainly be challenged however with the positive outlook for vaccinations, we could see huge demand this summer as vaccinations grow.

The Canadian government just announced a $100 billion stimulus package beginning in 2021, which will give the BC an extra boost going forward. Natural gas, metals, and forestry products should all increase in price which further supports a good outlook for the Province of British Columbia.

Vancouver is still a key port for Canadian exports, and as imports grow the Vancouver terminal should be busy in 2022.

Home Sales Across BC

BCREA’s latest market report from May shows that a total of 4,518 residential home sales were recorded by the Multiple Listing Service® (MLS®) in May 2020. That is down 45.2% from May of last year. Not too much of a surprise. The average MLS® residential price in BC in May was $728,898, 3.2% higher than the $706,394 recorded in May 2019. Total sales dollar volume in May was down 43.5% to $3.3 billion, compared to 2019.

New Home Construction

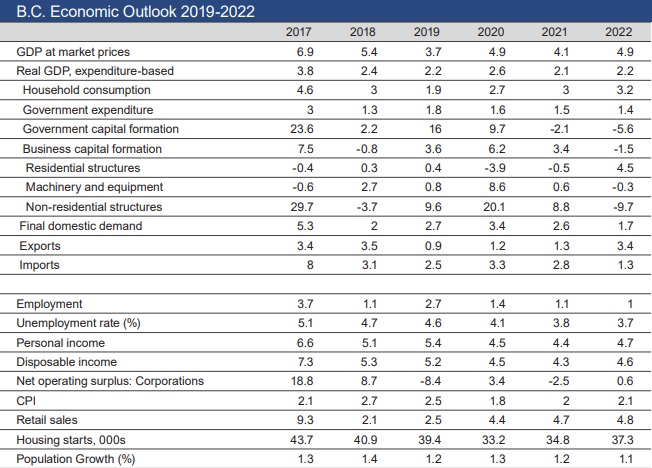

BC Economic Outlook

The pandemic, oil price shock, and more uncertainty about who will win the US Presidential election makes previous economic outlooks not very credible. However, for what it’s worth here is BC’s economic outlook for the next 2 years.

It’s a positive outlook for all Canadian housing markets at present. Toronto, Calgary , Okanagan, and Mississauga have all plunged. Montreal on the other hand, has done well without regulation.

It’s disgraceful what’s happening in BC, that new housing isn’t being built. NIMBY’s are making life really difficult and the government’s anti-development policies will ensure ultra high real estate prices. If demand hits as the experts say it will, Vancouver could be in for another period of deep suffering in high rent to income, and more homelessness issues.

Buying in Vancouver? Keep your eye on the big picture and key economic events and see which neighborhoods are going to drop in price the most. West Vancouver, North Vancouver, Burnaby, Port Moody, North and Port Coquitlam, appear to be the most vulnerable.

Certainty is Returning to Markets

With the exit of President Trump, the clock is turned back to 2015. This time, China is in the driver’s seat as they haven’t been ravaged by Covid 19, the disease they launched. They’re off to a roaring start, but goods being imported into Canada and then sent to the US should help support Vancouver’s real estate market.

A return of tourists will have a dramatically positive economy impact. From downtown Vancouver and Stanley Park to the Airport, up to Squamish and Whistler, the resumption of visitors in will be great.

Just as in the Toronto real estate market, the condo market should be revived once Covid 19 is tamed. Yet demand for life in BC is so strong, even the new condo developments will see lots of offers in late 2021.

The Real Estate Board of Greater Vancouver include: Vancouver, Burnaby, New Westminster, Richmond, Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta. Burnaby, Squamish, and West Vancouver suffered the largest monthly drops in house prices.

Vancouver remains perhaps the most unaffordable city in North America based on home price vs income. And with new mortgage rules Vancouverites have found themselves not much better off. Ask any post secondary student about housing. However, it’s expected that new investment will pour into student hotel housing projects.

Share the Joy about British Columbia and Vancouver

Please Mention this post on your blog!

Here’s a look at the historical price trends in Vancouver contrasted with Toronto and Calgary prices. You can see the Toronto real estate forecast and the Calgary housing market forecast here.

Real Estate Housing Market Forecast | Housing Bubble | Toronto Housing Market Forecast | Forecast for Toronto Condo Market | Visit Vancouver | Vancouver Condos | Calgary Housing Market Outlook 2022 | Kelowna Vernon Penticton Housing Market | Mississauga Real Estate Forecast | York Region Housing Market | Montreal Real Estate Forecast

REBGV is The Real Estate Board of Greater Vancouver, a member-based association of more than 14,000 REALTORS® who live and work in the Vancouver region.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single-industry trade Associations. It’s membership includes more than 125,000 real estate brokers, agents and salespeople, working through 90 real estate Boards and Associations across Canada.